Question 3: Leicester Plc is currently preparing its budget for the year ending December 2022. The company manufactures and sells three products Queen, Bishop and

Question 3:

Question 3:

Leicester Plc is currently preparing its budget for the year ending December 2022. The company manufactures and sells three products Queen, Bishop and Pawn. The unit selling price and the variable cost structure of each product is budgeted as follows.

Queen | Bishop | Pawn | |

(£) | (£) | (£) | |

Selling price | 120 | 148 | 38 |

Variable costs | |||

Direct labour | 28 | 58 | 7 |

Direct materials | 30 | 9 | 8 |

Overheads | 10 | 5 | 6 |

68 | 72 | 21 |

Direct labour rate is budgeted at £6 per hour and direct material cost at £2 per kilogram, and fixed costs at £1,500,000 per annum. The production manager has estimated that the company will have a minimum production capacity of 280,000 direct labour hours and the direct material available will be restricted to 780,000 kilograms.

A meeting of the board of directors has been convened to discuss the budget and to resolve the problem as to the quantity of each product, which should be made and sold. The sales director presented a recent market survey, which reveals the market demand for the company’s products will be as follows.

Product | Units |

Queen | 28,000 |

Bishop | 14,000 |

Pawn | 72,000 |

The production director proposes that, since Pawn only contributes £17 per unit, the product should no longer be produced, and the surplus capacity transferred to produce additional quantity of Queen and Bishop. The sales director does not agree with the proposal. Pawn is considered to be necessary to complement the product range and to maintain customer goodwill. If Pawn is not offered, the sales manager believes that the sales of Queen and Bishop will be seriously affected. After further discussion, the board decided that a minimum of 5,000 units of each product should be produced. The remaining production capacity would then be allocated to achieve maximum profit possible.

Required:

- Determine the production plan that will optimise the contribution of Leicester Plc.

(12 marks)

- Prepare a profit statement that clearly shows the maximum profit that could be achieved in the year ending December 2022 based on the production plan you have finalised (question 1).

(03 marks)

- Critically discuss the advantages and disadvantages of using Limiting Factor Analysis as a tool for managerial decision making in companies.

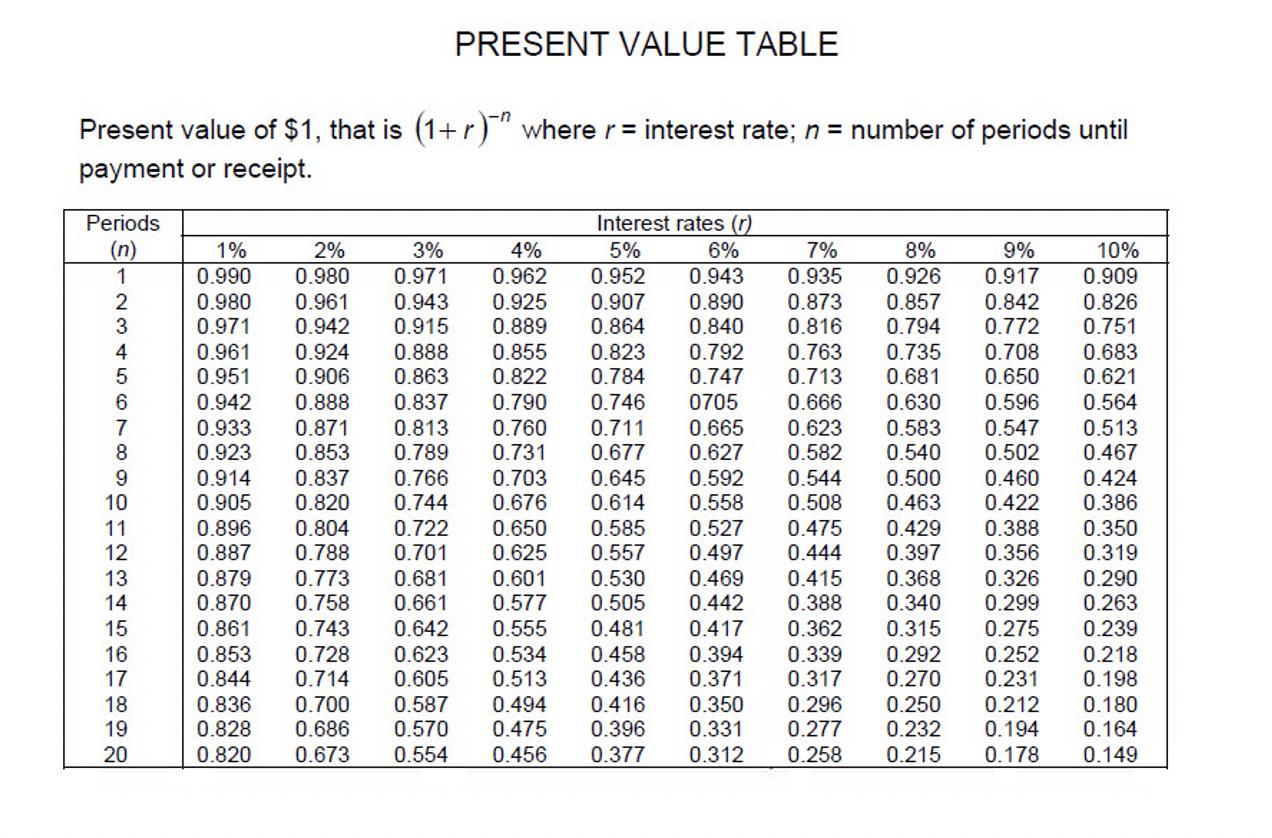

Present value of $1, that is (1+r) where r = interest rate; n = number of periods until payment or receipt. Periods (n) 1 234567 8 9 10 PRESENT VALUE TABLE 11 12 13 14 15 16 17 18 19 20 1% 6% 0.943 Interest rates (r) 2% 3% 4% 5% 0.990 0.980 0.971 0.962 0.952 0.980 0.961 0.943 0.925 0.907 0.890 0.971 0.942 0.915 0.889 0.864 0.840 0.961 0.924 0.888 0.855 0.823 0.792 0.951 0.906 0.863 0.822 0.735 0.708 0.747 0.681 0.650 0705 0.630 0.596 0.623 0.583 0.547 0.582 0.540 0.502 0.422 0.784 0.942 0.888 0.837 0.790 0.746 0.933 0.871 0.813 0.760 0.711 0.665 0.923 0.853 0.789 0.731 0.677 0.627 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.861 0.743 0.642 0.555 0.481 0.417 0.853 0.728 0.623 0.534 0.458 0.394 0.844 0.714 0.605 0.513 0.436 0.371 0.836 0.700 0.587 0.828 0.686 0.570 0.820 0.673 0.554 0.299 0.362 0.315 0.275 0.339 0.292 0.252 0.317 0.270 0.231 0.296 0.250 0.212 0.494 0.416 0.350 0.475 0.396 0.331 0.277 0.232 0.456 0.377 0.312 0.258 0.215 0.194 0.178 7% 0.935 0.873 0.816 0.763 0.713 0.666 8% 9% 0.926 0.917 0.857 0.842 0.794 0.772 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Determine the production plan that will optimise the contribution of Leicester Plc The production plan that will optimise the contribution of Leiceste...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started