Answered step by step

Verified Expert Solution

Question

1 Approved Answer

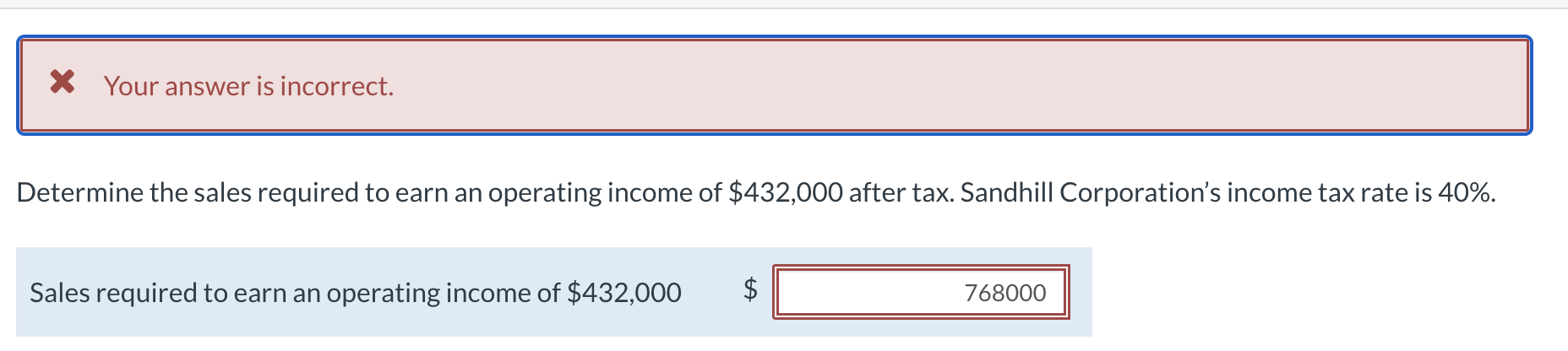

Determine the sales required to earn an operating income of 432000 after tax. Income tax rate 40% Sandhill Corporation sells a single product for $40.

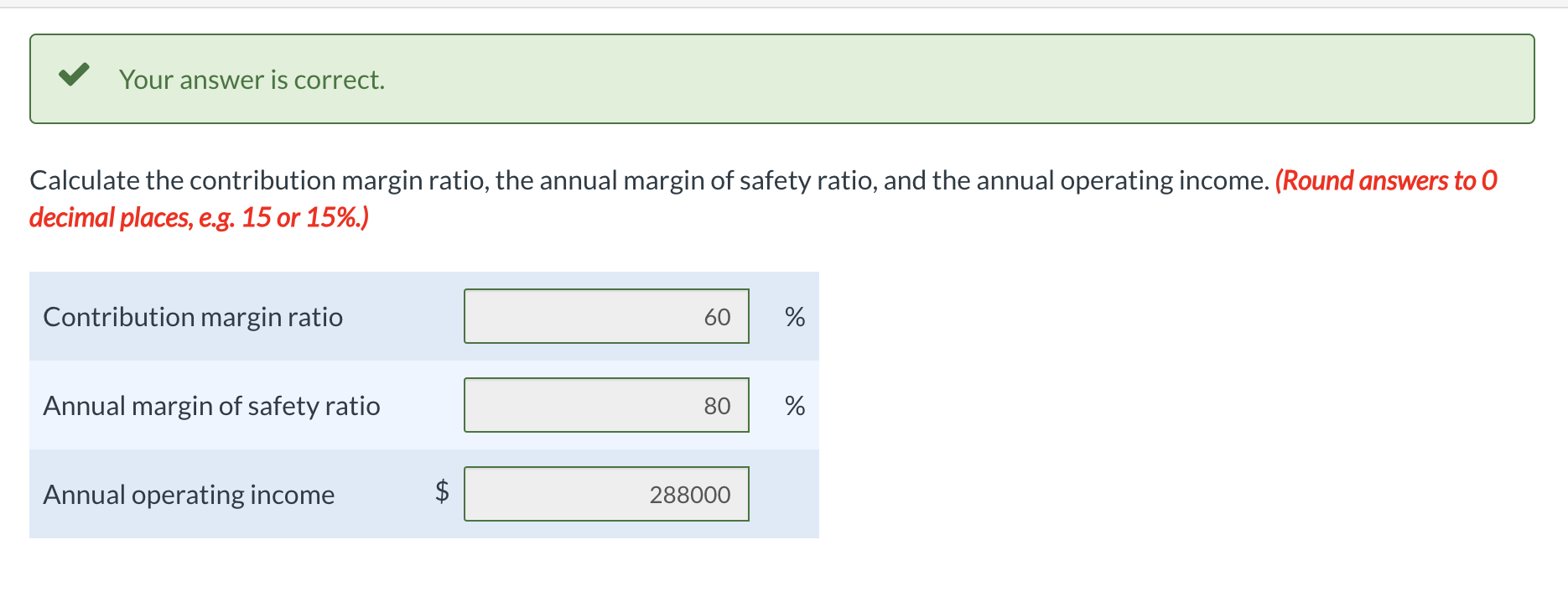

Determine the sales required to earn an operating income of 432000 after tax. Income tax rate 40%

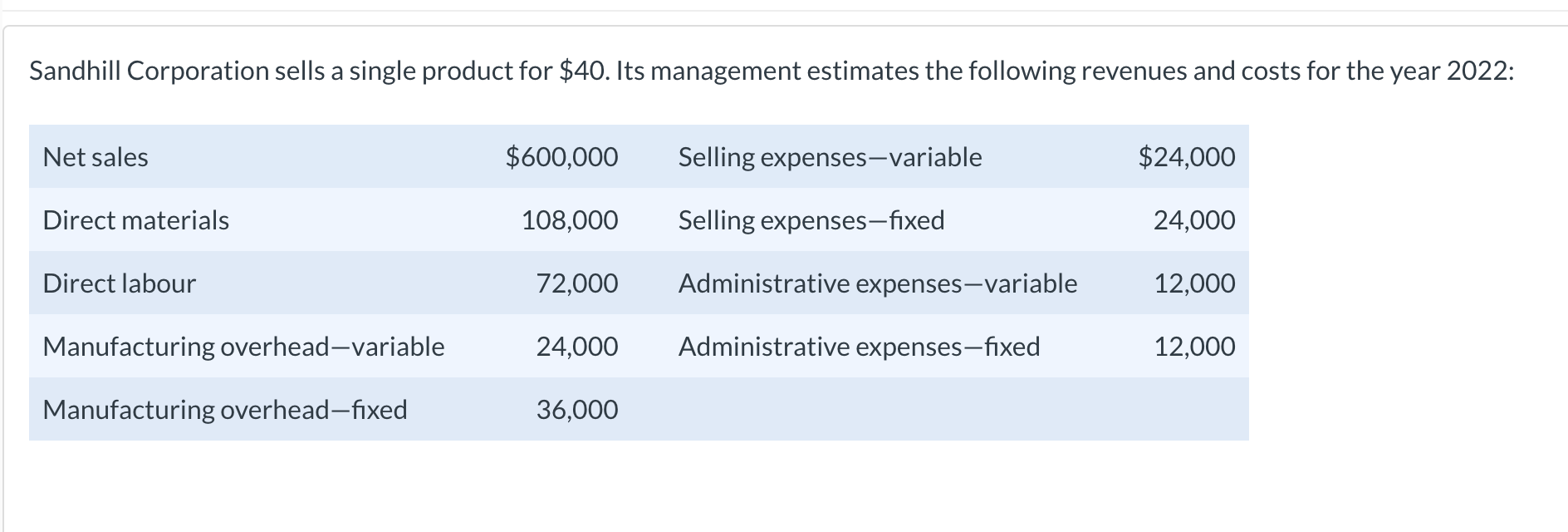

Sandhill Corporation sells a single product for $40. Its management estimates the following revenues and costs for the year 2022 : \begin{tabular}{lrlr} Net sales & $600,000 & Selling expenses-variable & $24,000 \\ Direct materials & 108,000 & Selling expenses-fixed & 24,000 \\ Direct labour & 72,000 & Administrative expenses-variable & 12,000 \\ Manufacturing overhead-variable & 24,000 & Administrative expenses-fixed & 12,000 \\ Manufacturing overhead-fixed & 36,000 & & \end{tabular} Your answer is correct. Calculate the contribution margin ratio, the annual margin of safety ratio, and the annual operating income. (Round answers to 0 decimal places, e.g. 15 or 15%.) Contribution margin ratio Annual margin of safety ratio Annual operating income $ Determine the sales required to earn an operating income of $432,000 after tax. Sandhill Corporation's income tax rate is 40%. Sales required to earn an operating income of $432,000 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started