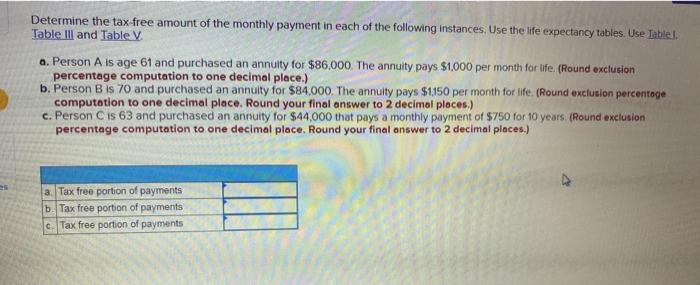

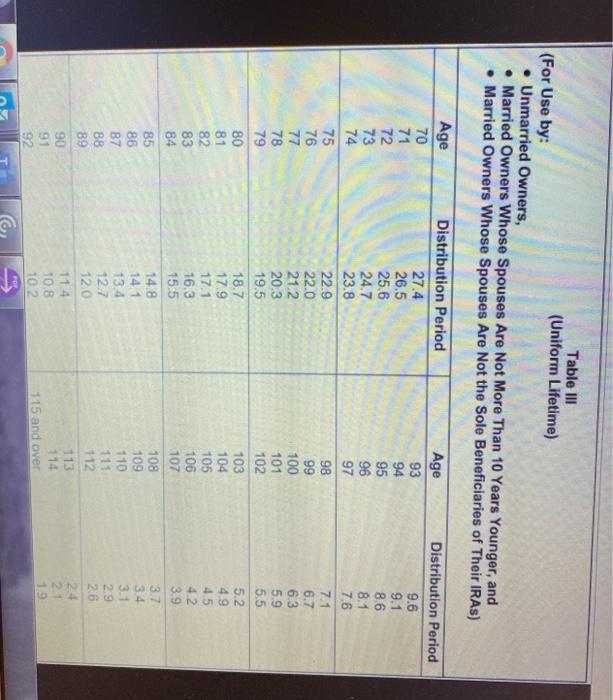

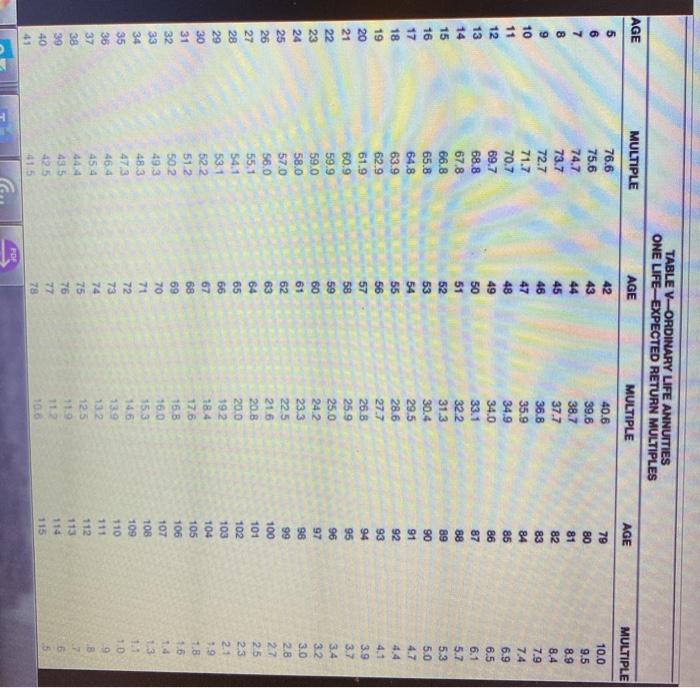

Determine the tax-free amount of the monthly payment in each of the following instances. Use the life expectancy tables. Use Tablel. Table III and Table V a. Person A is age 61 and purchased an annuity for $86,000. The annuity pays $1,000 per month for life. (Round exclusion percentage computation to one decimal place.) b. Person B is 70 and purchased an annuity for $84,000. The annuity pays $1,150 per month for life. (Round exclusion percentage computation to one decimal place. Round your final answer to 2 decimal places.) c. Person C is 63 and purchased an annuity for $44,000 that pays a monthly payment of $750 for 10 years. (Round exclusion percentage computation to one decimal place. Round your final answer to 2 decimal places.) a Tax free portion of payments b. Tax free portion of payments c. Tax free portion of payments Table III (Uniform Lifetime) (For Use by: Unmarried Owners, Married Owners Whose Spouses Are Not More Than 10 Years Younger, and Married Owners Whose Spouses Are Not the Sole Beneficiaries of Their IRAS) Age 70 71 72 Age 93 94 95 96 97 98 73 Distribution Period 9.6 9.1 8.6 8.1 7.6 7.1 6.7 6.3 5.9 5.5 5.2 4.9 99 Distribution Period 27.4 26.5 25.6 24.7 23.8 22.9 22.0 21.2 20.3 19.5 18.7 17.9 171 16.3 15.5 14.8 141 13.4 12:7 12.0 11.4 10.8 10.2 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 4.5 4.2 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 and over 3.9 3.7 3.4 3.1 2.9 2.6 24 2.1 1.9 T TABLE V-ORDINARY LIFE ANNUITIES ONE LIFE-EXPECTED RETURN MULTIPLES AGE MULTIPLE AGE MULTIPLE AGE MULTIPLE 42 43 44 45 46 47 48 10.0 9.5 8.9 8.4 7.9 7.4 6.9 6.5 6.1 5.7 5.3 5.0 4.7 49 3.9 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 76.6 75.6 74.7 73.7 72.7 71.7 70.7 69.7 68.8 67.8 66.8 65.8 64.8 63.9 62.9 51.9 50.9 59.9 59.0 58.0 57.0 56.0 55.1 54.1 53.1 52.2 512 50.2 49.3 48.3 473 46.4 45.4 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 40.6 39.6 38.7 37.7 36.8 35.9 34.9 34.0 33.1 322 31.3 30.4 29.5 28.6 27.7 26.8 25.9 25.0 242 23.3 225 21.6 20.8 2010 192 18.4 17.6 168 16.0 153 146 139 132 125 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 3.4 32 3.0 2.8 25 23 2.1 72 13 1.1 1.0 9 8 73 74 75 76 77 78 435 11 1010 41.5 [T FDF E