Answered step by step

Verified Expert Solution

Question

1 Approved Answer

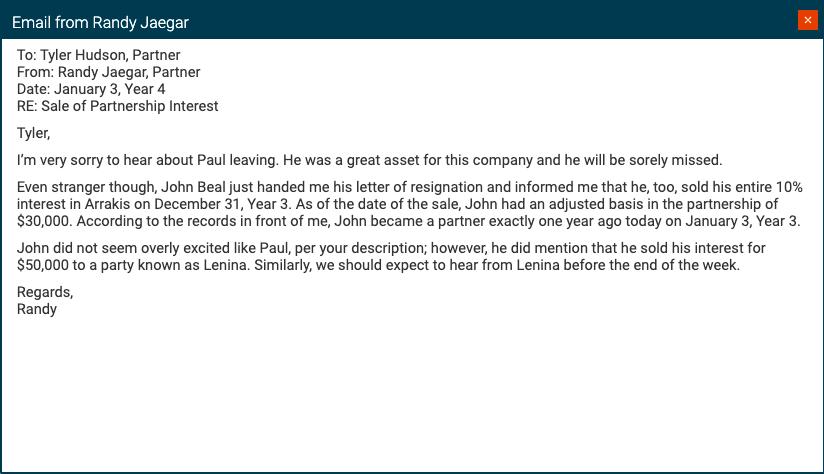

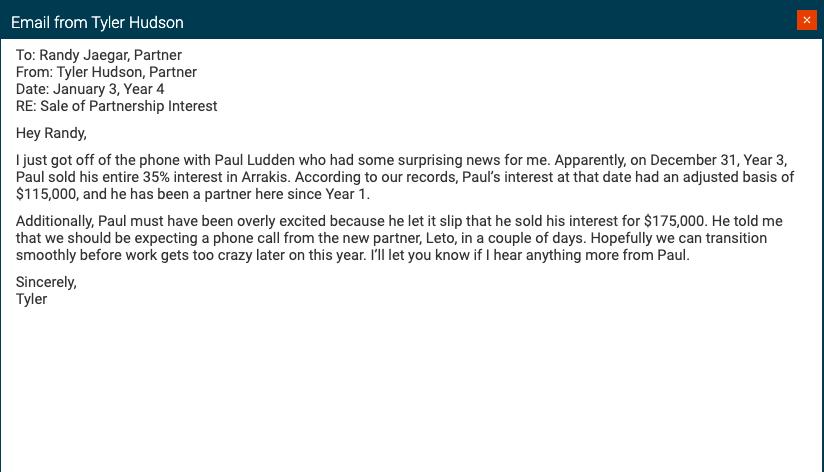

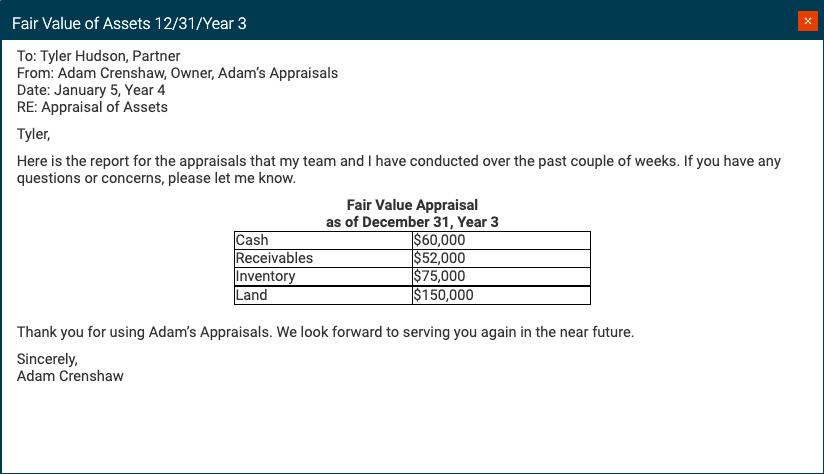

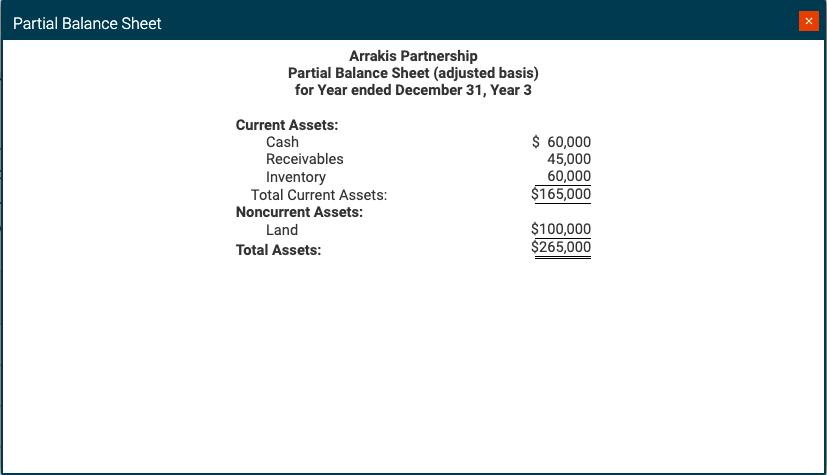

Determine the types and amounts of income that Paul and John must report as a result of the sales of partnership interest, based on information

Determine the types and amounts of income that Paul and John must report as a result of the sales of partnership interest, based on information included in the exhibits.

Select from the option list provided the type of income that Paul and John must report. Each choice may be used once, more than once, or not at all.

Then, enter the appropriate amount in the associated cell for each item. If the amount is zero, enter a zero (0). Round all amounts to the nearest whole dollar.

Type | Amount | |

| 1.-2. Paul | ||

| 3.-4. John | ||

Select an option below Short-term capital gain O Short-term capital loss O Long-term capital gain O Long-term capital loss O Ordinary income RESET CANCEL ACCEPT

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Determination of Johns Income It is found from the Email from Randy Jaegar that John acquired intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started