Determine What is the firms NOPAT? What is the firms NOWAC? What is the firms TNOC? What is the firms Net investment in TNOC? What

Determine

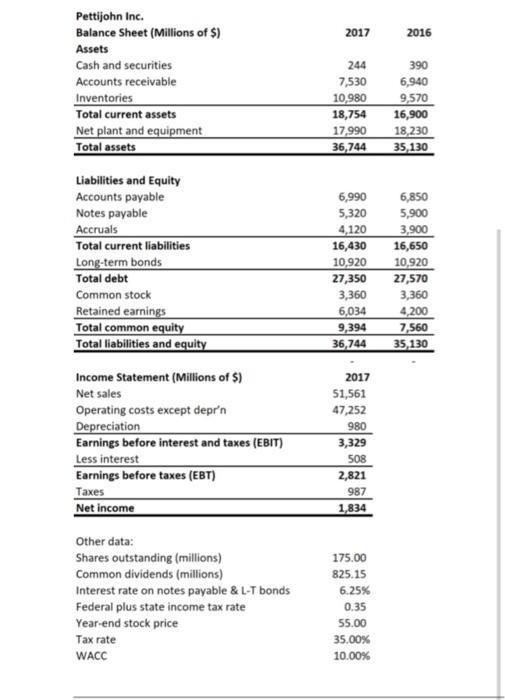

What is the firm’s NOPAT?

What is the firm’s NOWAC?

What is the firm’s TNOC?

What is the firm’s Net investment in TNOC?

What is the firm’s debt ratio?

What is the firm’s EPS?

What is the firm’s total assets turnover?

What is the firm’s dividends per share?

Pettijohn Inc. Balance Sheet (Millions of $) 2017 2016 Assets Cash and securities 244 390 Accounts receivable 7,530 6,940 Inventories 10,980 9,570 Total current assets 18,754 16,900 Net plant and equipment 17,990 18,230 Total assets 36,744 35,130 Liabilities and Equity Accounts payable 6,990 6,850 Notes payable 5,320 5,900 Accruals 4,120 3,900 Total current liabilities 16,430 16,650 Long-term bonds 10,920 10,920 Total debt 27,350 27,570 Common stock 3,360 3,360 Retained earnings 6,034 4,200 Total common equity 9,394 7,560 Total liabilities and equity 36,744 35,130 Income Statement (Millions of $) 2017 Net sales 51,561 Operating costs except depr'n 47,252 Depreciation 980 Earnings before interest and taxes (EBIT) 3,329 Less interest 508 Earnings before taxes (EBT) 2,821 Taxes 987 Net income 1,834 Other data: Shares outstanding (millions) 175.00 Common dividends (millions) 825.15 Interest rate on notes payable & L-T bonds 6.25% Federal plus state income tax rate 0.35 Year-end stock price 55.00 Tax rate 35.00% WACC 10.00%

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Based on the financial statement of Pettijohn Inc the following can be determined NOPAT Net Operatin...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started