Answered step by step

Verified Expert Solution

Question

1 Approved Answer

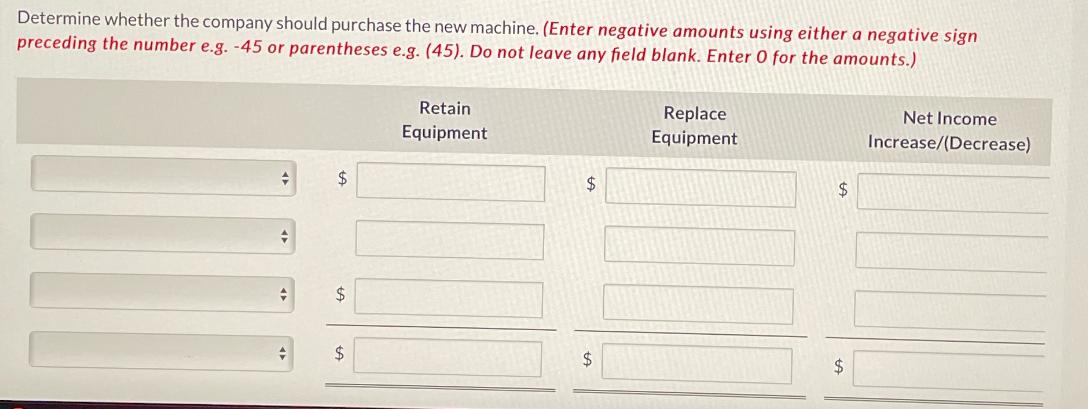

Determine whether the company should purchase the new machine. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses

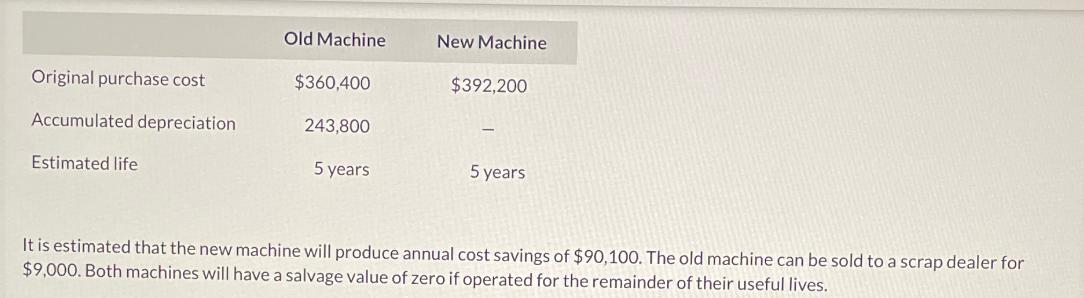

Determine whether the company should purchase the new machine. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not leave any field blank. Enter 0 for the amounts.) + + $ $ $ Retain Equipment $ $ Replace Equipment $ $ Net Income Increase/(Decrease) Original purchase cost Accumulated depreciation Estimated life Old Machine $360,400 243,800 5 years New Machine $392,200 5 years It is estimated that the new machine will produce annual cost savings of $90,100. The old machine can be sold to a scrap dealer for $9,000. Both machines will have a salvage value of zero if operated for the remainder of their useful lives.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of book value of the old machine Book value Original purchase cost Accumu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started