Answered step by step

Verified Expert Solution

Question

1 Approved Answer

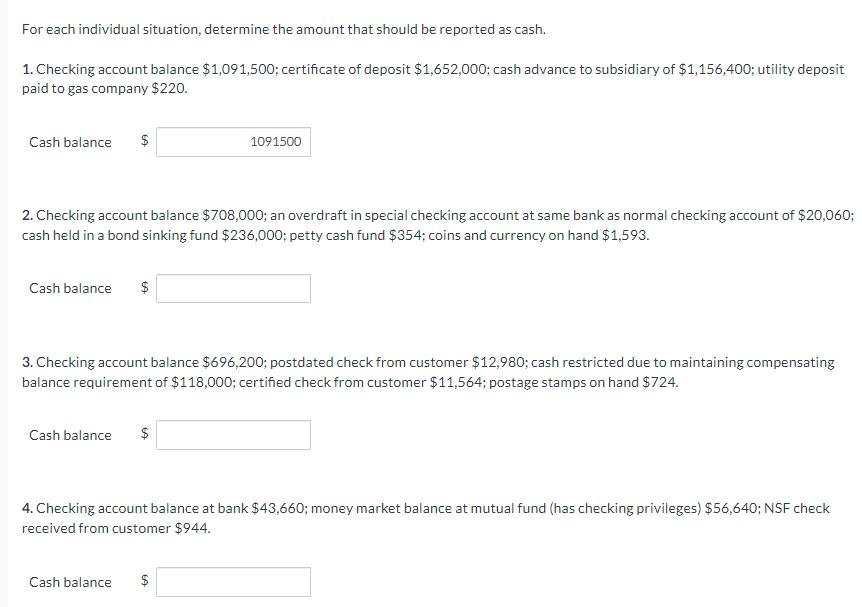

For each individual situation, determine the amount that should be reported as cash. 1. Checking account balance $1,091,500; certificate of deposit $1,652,000; cash advance

For each individual situation, determine the amount that should be reported as cash. 1. Checking account balance $1,091,500; certificate of deposit $1,652,000; cash advance to subsidiary of $1,156,400; utility deposit paid to gas company $220. Cash balance $ 2. Checking account balance $708,000; an overdraft in special checking account at same bank as normal checking account of $20,060; cash held in a bond sinking fund $236,000; petty cash fund $354; coins and currency on hand $1,593. Cash balance $ 3. Checking account balance $696,200; postdated check from customer $12,980; cash restricted due to maintaining compensating balance requirement of $118,000; certified check from customer $11,564; postage stamps on hand $724. Cash balance $ 1091500 4. Checking account balance at bank $43,660; money market balance at mutual fund (has checking privileges) $56,640; NSF check received from customer $944. 69 Cash balance $

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started