Answered step by step

Verified Expert Solution

Question

1 Approved Answer

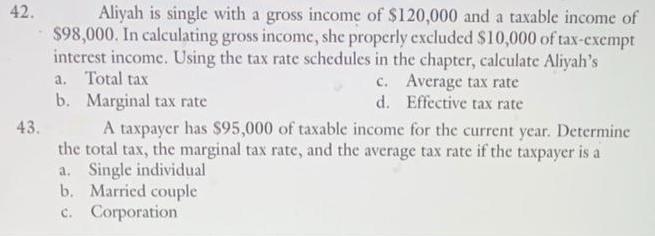

42. Aliyah is single with a gross income of $120,000 and a taxable income of $98,000. In calculating gross income, she properly excluded $10,000

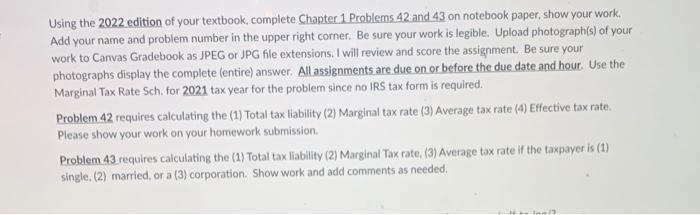

42. Aliyah is single with a gross income of $120,000 and a taxable income of $98,000. In calculating gross income, she properly excluded $10,000 of tax-exempt interest income. Using the tax rate schedules in the chapter, calculate Aliyah's Total tax b. Marginal tax rate c. Average tax rate d. Effective tax rate a. 43. A taxpayer has $95,000 of taxable income for the current year. Determine the total tax, the marginal tax rate, and the average tax rate if the taxpayer is a a. Single individual b. Married couple c. Corporation Using the 2022 edition of your textbook, complete Chapter 1 Problems 42 and 43 on notebook paper, show your work. Add your name and problem number in the upper right corner. Be sure your work is legible. Upload photograph(s) of your work to Canvas Gradebook as JPEG or JPG file extensions. I will review and score the assignment. Be sure your photographs display the complete (entire) answer. All assignments are due on or before the due date and hour. Use the Marginal Tax Rate Sch, for 2021 tax year for the problem since no IRS tax form is required. Problem 42 requires calculating the (1) Total tax liability (2) Marginal tax rate (3) Average tax rate (4) Effective tax rate. Please show your work on your homework submission. Problem 43 requires calculating the (1) Total tax liability (2) Marginal Tax rate, (3) Average tax rate if the taxpayer is (1) single, (2) married, or a (3) corporation. Show work and add comments as needed.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started