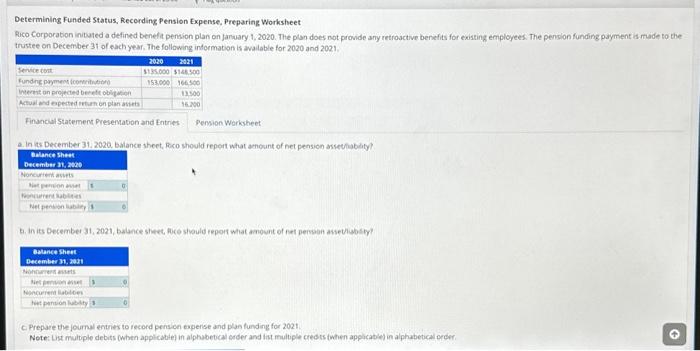

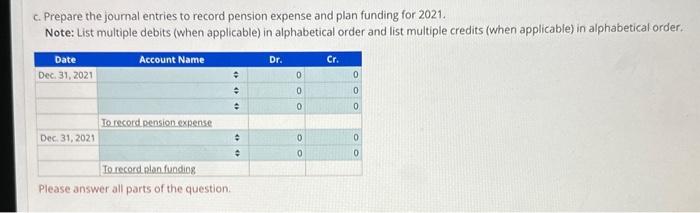

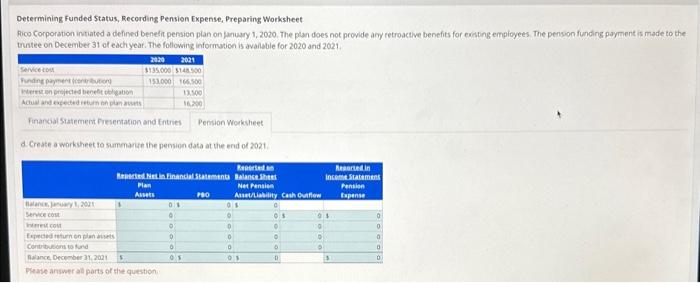

Determining Funded Status, Recording Pension Expense, Preparing Worksheet Rico Corporation inituted a defined beneft pension plan on jarsary 1, 2020. The plan does not prowide any retroactive benefits for existing employees. The pension funding payment is made to the trustee on December 31 of each year. The following information is available for 2020 and 2021. Financul Statement Presevabon and Entnes a. In its December 31. 202a balance sheet, Fro shovid repert what anount of net pension assethabity? th. In its December 31, 2021, balance sheet, foce should report what anount of net persabh assethisbsy? C. Prepare the journal entries to record pensicn experise and plan funding for 2021. Note: Ligt multiple debits (when applcoble) in alphabevical erder and ist multiple crests twhen applicable) in alphabetical order. c. Prepare the journal entries to record pension expense and plan funding for 2021. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Please answer all parts of the question. Determining Funded Status, Recording Pension Expense, Preparing Worksheet Poco Corporation intiated a defined beneft pension plan on Honury 1, 20z0. The plan does not provide any retroactive benefits for exating employees The penson funding payment is made to the trutre on December 31 of each year. The following informution is avaliable for 2020 and 2021. Finarial Statement Fiesentation and fintres a. Create a worksheet to summarke the pension data at the end of 2021. Determining Funded Status, Recording Pension Expense, Preparing Worksheet Rico Corporation inituted a defined beneft pension plan on jarsary 1, 2020. The plan does not prowide any retroactive benefits for existing employees. The pension funding payment is made to the trustee on December 31 of each year. The following information is available for 2020 and 2021. Financul Statement Presevabon and Entnes a. In its December 31. 202a balance sheet, Fro shovid repert what anount of net pension assethabity? th. In its December 31, 2021, balance sheet, foce should report what anount of net persabh assethisbsy? C. Prepare the journal entries to record pensicn experise and plan funding for 2021. Note: Ligt multiple debits (when applcoble) in alphabevical erder and ist multiple crests twhen applicable) in alphabetical order. c. Prepare the journal entries to record pension expense and plan funding for 2021. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Please answer all parts of the question. Determining Funded Status, Recording Pension Expense, Preparing Worksheet Poco Corporation intiated a defined beneft pension plan on Honury 1, 20z0. The plan does not provide any retroactive benefits for exating employees The penson funding payment is made to the trutre on December 31 of each year. The following informution is avaliable for 2020 and 2021. Finarial Statement Fiesentation and fintres a. Create a worksheet to summarke the pension data at the end of 2021