Question

DETERMINING THE CORRECT DISCOUNT RATE IN DCF-VALUATION FOR DU PONT Du Pont, a large chemical and paper conglomerate, is planning to sell its Paper division

DETERMINING THE CORRECT DISCOUNT RATE IN DCF-VALUATION FOR DU PONT

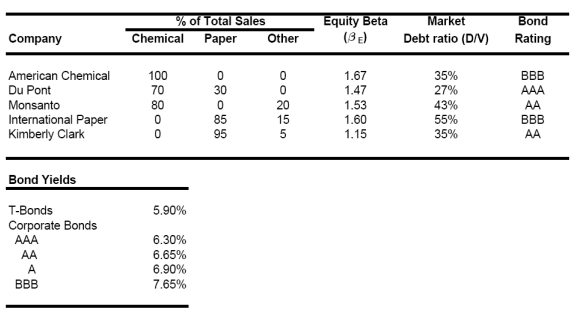

Du Pont, a large chemical and paper conglomerate, is planning to sell its Paper division to American Chemical. Suppose you have been asked to identify the cost of capital of Du Pont after the sale of the division and collected the following firm and financial market information. You have established that all firms in the table pay corporate taxes at a 35% rate, and estimated a market risk premium of 6%. Du Ponts target capital structure has 40% debt. American Chemicals target capital structure for the division has 25% debt. Describe clearly how you would proceed in estimating the correct discount rate and also lay out any additional assumptions you would make.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started