Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determining the Cost of Capital (WACC) Determining the Cost of Capital (WACC) a) Calculate Powerline Networks WACC. The target capital structure is 15% debt, 2%

Determining the Cost of Capital (WACC)

Determining the Cost of Capital (WACC) a) Calculate Powerline Networks WACC. The target capital structure is 15% debt, 2% preferred stock, and 83% common equity.

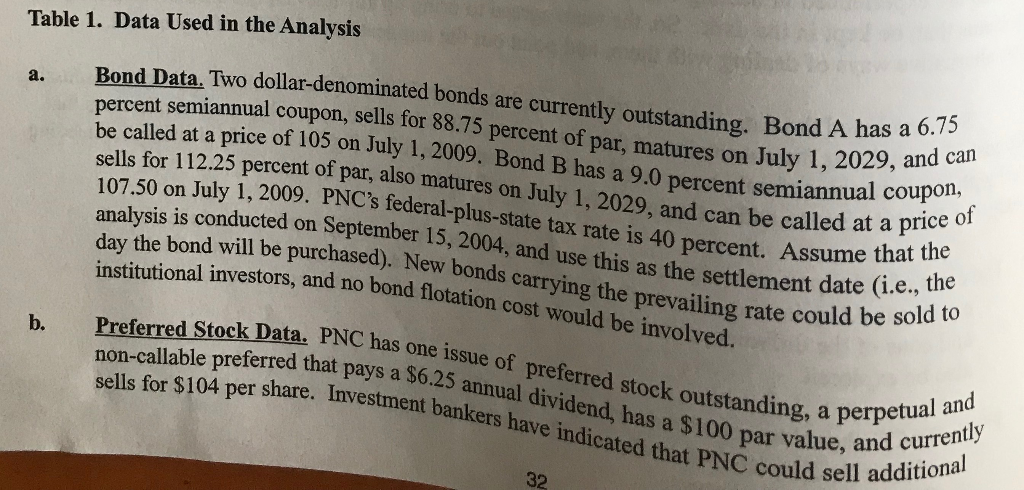

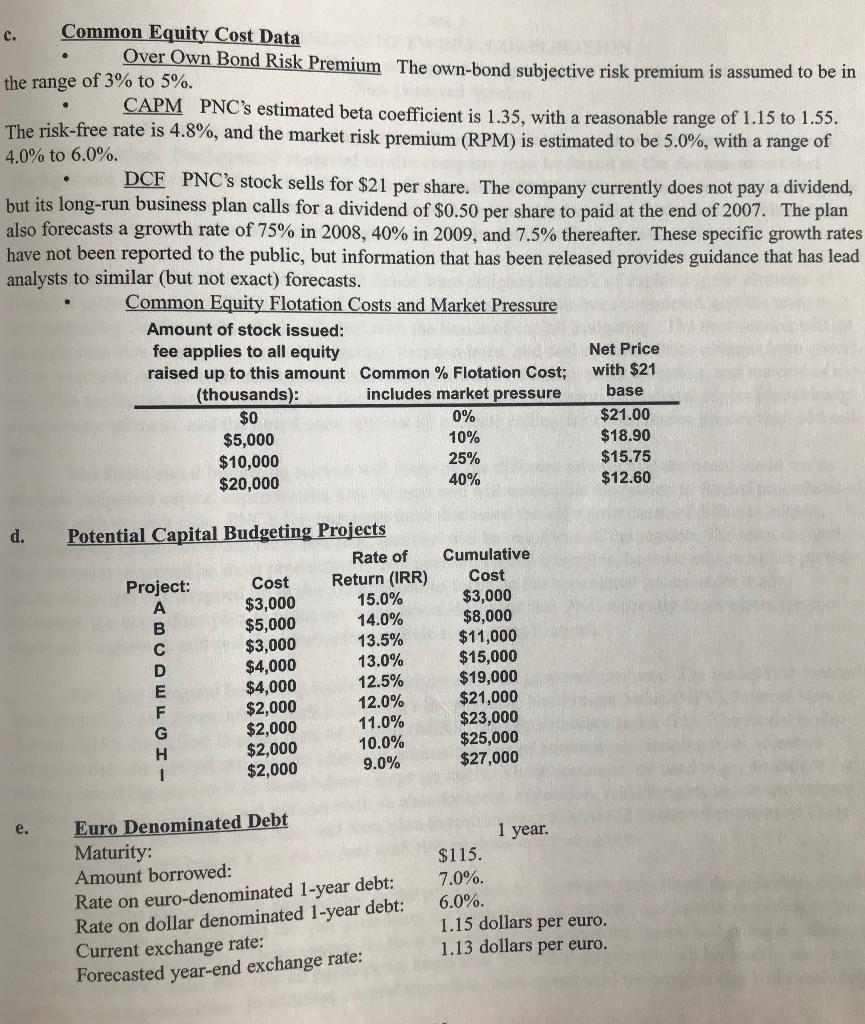

The costs of debt, preferred stock, common equity raised by retaining earnings, and the cost of equity raised by issuing and cons of the different procedures, and where the necessary data can be obtained, should also be explored. new stock. Different methods of estimating these costs, the pros PNC's WACC should be calculated and explained. The company's target capital structure calls for 15% debt, 2% preferred stock, and 83% common equity. The effect of the weights the WACC should be discussed. on 31 Table 1. Data Used in the Analysis Bond Data. Two dollar-denominated bonds are currently outstanding. Bond A has a 6.75 percent semiannual coupon, sells for 88.75 percent of par, matures on be called at a price of 105 on July 1, 2009. Bond B has a 9.0 percent semiannual coupon, sells for 112.25 percent of par, also matures on a. July 1, 2029, and can July 1, 2029, and can be called at a price of September 15, 2004, and use this as the settlement date (i.e., the July 1, 2009. PNC's federal-plus-state tax rate is 40 percent. Assume that the 107.50 on analysis is conducted on day the bond will be purchased). New bonds carrying the prevailing rate could be sold to institutional investors, and no bond flotation cost would be involved. Preferred Stock Data. PNC has one issue of preferred stock outstanding, a perpetual and non-callable preferred that pays a $6.25 annual dividend, has a $100 par value, and currently sells for $104 per share. Investment bankers have indicated that PNC could sell additional b. 32 Common Equity Cost Data c. Over Own Bond Risk Premium The own-bond subjective risk premium is assumed to be in the range of 3% to 5% CAPM PNC's estimated beta coefficient is 1.35. with a reasonable range of 1.15 to 1.55. The risk-free rate is 4.8% , and the market risk premium (RPM) is estimated to be 5.0%, with a range of 4.0% to 6.0%. DCF PNC's stock sells for $21 per share. The company currently does not pay a dividend, but its long-run business plan calls for a dividend of $0.50 per share to paid at the end of 2007. The plan also forecasts a growth rate of 75% in 2008, 40% in 2009, and 7.5% thereafter. These specific growth rates have not been reported to the public, but information that has been released provides guidance that has lead analysts to similar (but not exact) forecasts Common Equity Flotation Costs and Market Pressure Amount of stock issued: Net Price fee applies to all equity raised up to this amount Common % Flotation Cost; with $21 base includes market pressure (thousands): $21.00 $18.90 $15.75 0% 10 % $5,000 10,000 $20,000 25% $12.60 40% Potential Capital Budgeting Projects d. Cumulative Rate of Cost $3,000 $8,000 $11,000 $15,000 $19,000 $21,000 $23,000 $25,000 $27,000 Return (IRR) 15.0% Cost Project: A $3,000 $5,000 $3,000 $4,000 $4,000 $2,000 $2,000 $2,000 $2,000 14.0% B 13.5% 13.0% D 12.5% 12.0% E F 11.0% 10.0% 9.0% H Euro Denominated Debt Maturity: Amount borrowed: 1 year. e. $115. 7.0% 6.0%. Rate on euro-denominated 1-year debt: Rate on dollar denominated 1-year debt: Current exchange rate: Forecasted year-end exchange rate: 1.15 dollars per euro. 1.13 dollars per euro. The costs of debt, preferred stock, common equity raised by retaining earnings, and the cost of equity raised by issuing and cons of the different procedures, and where the necessary data can be obtained, should also be explored. new stock. Different methods of estimating these costs, the pros PNC's WACC should be calculated and explained. The company's target capital structure calls for 15% debt, 2% preferred stock, and 83% common equity. The effect of the weights the WACC should be discussed. on 31 Table 1. Data Used in the Analysis Bond Data. Two dollar-denominated bonds are currently outstanding. Bond A has a 6.75 percent semiannual coupon, sells for 88.75 percent of par, matures on be called at a price of 105 on July 1, 2009. Bond B has a 9.0 percent semiannual coupon, sells for 112.25 percent of par, also matures on a. July 1, 2029, and can July 1, 2029, and can be called at a price of September 15, 2004, and use this as the settlement date (i.e., the July 1, 2009. PNC's federal-plus-state tax rate is 40 percent. Assume that the 107.50 on analysis is conducted on day the bond will be purchased). New bonds carrying the prevailing rate could be sold to institutional investors, and no bond flotation cost would be involved. Preferred Stock Data. PNC has one issue of preferred stock outstanding, a perpetual and non-callable preferred that pays a $6.25 annual dividend, has a $100 par value, and currently sells for $104 per share. Investment bankers have indicated that PNC could sell additional b. 32 Common Equity Cost Data c. Over Own Bond Risk Premium The own-bond subjective risk premium is assumed to be in the range of 3% to 5% CAPM PNC's estimated beta coefficient is 1.35. with a reasonable range of 1.15 to 1.55. The risk-free rate is 4.8% , and the market risk premium (RPM) is estimated to be 5.0%, with a range of 4.0% to 6.0%. DCF PNC's stock sells for $21 per share. The company currently does not pay a dividend, but its long-run business plan calls for a dividend of $0.50 per share to paid at the end of 2007. The plan also forecasts a growth rate of 75% in 2008, 40% in 2009, and 7.5% thereafter. These specific growth rates have not been reported to the public, but information that has been released provides guidance that has lead analysts to similar (but not exact) forecasts Common Equity Flotation Costs and Market Pressure Amount of stock issued: Net Price fee applies to all equity raised up to this amount Common % Flotation Cost; with $21 base includes market pressure (thousands): $21.00 $18.90 $15.75 0% 10 % $5,000 10,000 $20,000 25% $12.60 40% Potential Capital Budgeting Projects d. Cumulative Rate of Cost $3,000 $8,000 $11,000 $15,000 $19,000 $21,000 $23,000 $25,000 $27,000 Return (IRR) 15.0% Cost Project: A $3,000 $5,000 $3,000 $4,000 $4,000 $2,000 $2,000 $2,000 $2,000 14.0% B 13.5% 13.0% D 12.5% 12.0% E F 11.0% 10.0% 9.0% H Euro Denominated Debt Maturity: Amount borrowed: 1 year. e. $115. 7.0% 6.0%. Rate on euro-denominated 1-year debt: Rate on dollar denominated 1-year debt: Current exchange rate: Forecasted year-end exchange rate: 1.15 dollars per euro. 1.13 dollars per euroStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started