Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dev Btach Jeruel mum and Crumpton, a small fevelry manufacturer, has been mucuesfill and has enjoyed a osthe growth tiend. Now BAC le plarning to

Dev Btach Jeruel

mum and Crumpton, a small fevelry manufacturer, has been mucuesfill and has enjoyed a osthe growth tiend. Now BAC le plarning to go pubilc with an lisue eif comman stock, and it faces he problem of setting an approprtate piloe for the stock. The comperry and its Irvertment baniss elleve thet the proper procedure is to conduct a waluetlon and select several sirrilter flimes whth ublldy traded common stack and to make relevant comparlsones.

everal fevely manufacturers are reasonably similar to BeC whth respact to product mby asset ompositton, and debtequity proportions. Of these companies, theremphing Jewelers and Gurter ashlons are most similer. When analyaine the followha data, assume that the most recent year ias been reasonably "nommel" In the sense that it was nelther espedally good nor espedally bad in ems of sales, earnings, and fiee cash llovec. Abevrambhals listed on the AMEX and Gunter an the MSE, while BAC will be traded in the NASDMQ marliet.

tableimpany deta,ShmpmpmpGunter,BedtandinaG million, millian,ne$Nareash flow ver share,value oer share,onte milion,$ millan,$ miflerdebt million, millian,$ millo

BAC Is a dowely held corporation with only shares outstanding. Free cash flaws have been low aghlo sopawease negative due to bles necent high sales gruwth rates, but as its expanalon phase comes to an end, BkCs free carh flows shouid increase. BuC antidpates the following frem cash llows over the neut years:

Atter Vear free cash flow growth will be stabie at the per year. Dumentiy, paC has no nonoperating assets, and iks WiDC is Using the free cash flow valustion model, estinate the

horizan value, Intrinsic value of operations, intrinstic walue of squiy, and intinaic per share price. Da not round intermedate calculations. Write out your arswer carmpletehy, For example, millan should be entered as Round your answers for the velue af oquly te the nearest dollar and for the value of equity per share to the neqrest cent

Hortzon value

Intrinsic value of operations

Intrinsic welue af equity

Intrinsic per sthare price

Calculste dest to total assets, PE marhet to book, PFCH and NoE for Atepoptrith, Gunter, and BaC. For calculatians that raguire a price for Betr, wie the per share price you dotained with tie orporate valuation model in Part a Do not round intermediste calculations. pound your arswers to two dacimal places.

Ahmpamhat

Gunter

Beac

DIA that

PIE

Marketraod

RoE

PIFCF

The ranow of pictost

froms ta t

How does this cumpare with the phoe you cat whp the corprrwhe whithoun modet?

Check My Work remaining

eBook

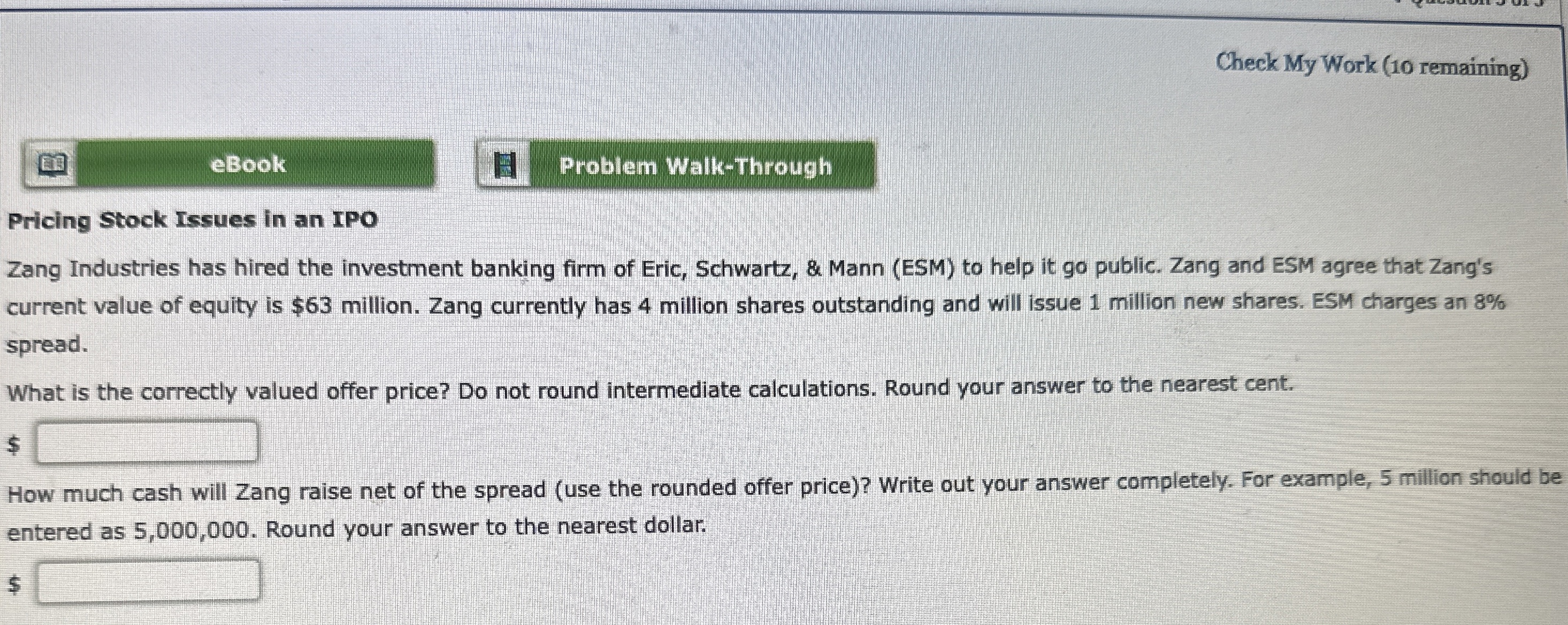

Pricing Stock Issues in an IPO

Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann ESM to help it go public. Zang and ESM agree that Zang's current value of equity is $ million. Zang currently has million shares outstanding and will issue million new shares. ESM charges an spread.

What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent.

$

How much cash will Zang raise net of the spread use the rounded offer price Write out your answer completely. For example, million should be entered as Round your answer to the nearest dollar.

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started