Question

Deva. 9.56% comp Services recently hired you as a consultant to help with its capital budgeting process. The used hy is considering a new

Deva.

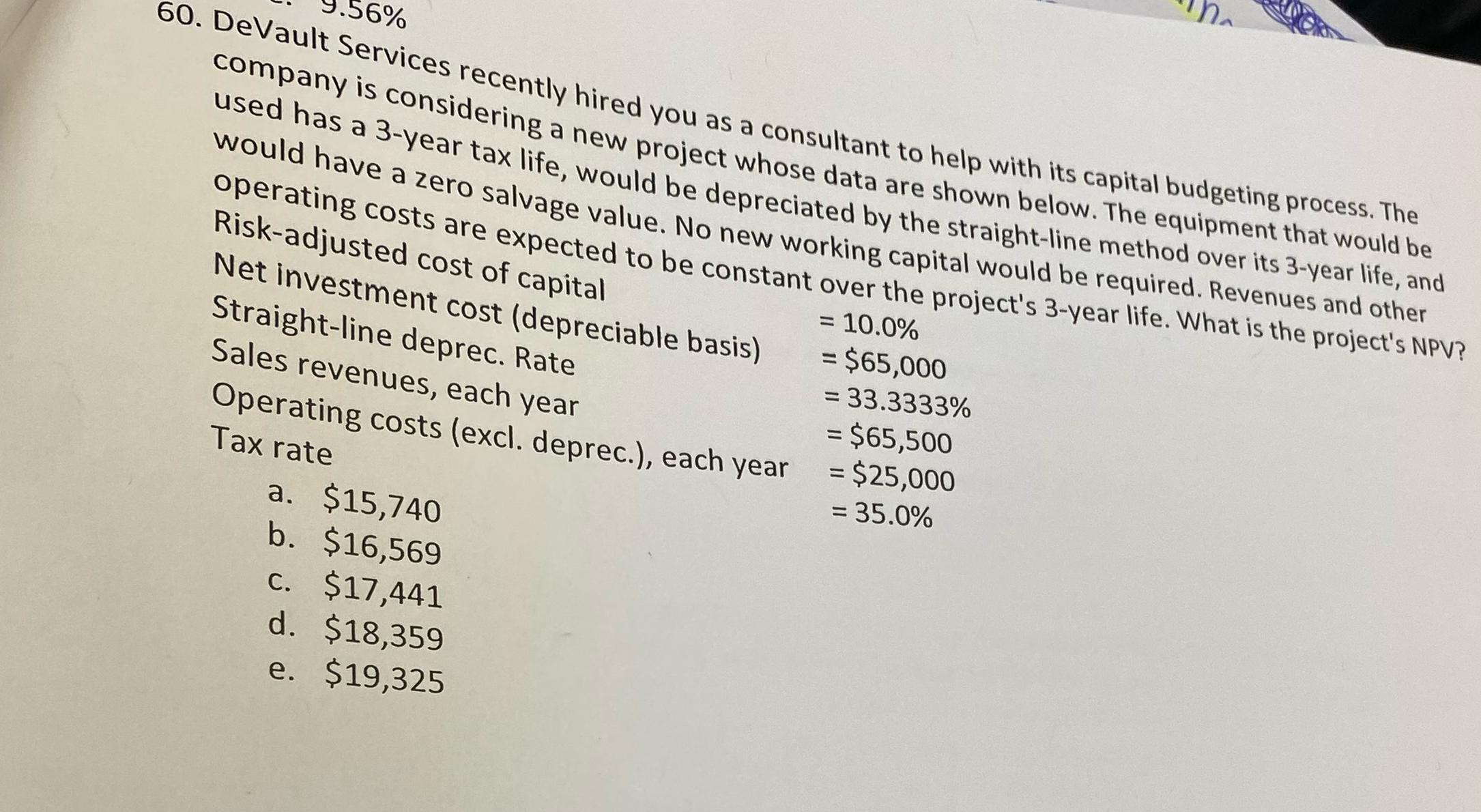

9.56%\ comp Services recently hired you as a consultant to help with its capital budgeting process. The used hy is considering a new project whose data are shown below. The equipment that would be would h a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and operatiave a zero salvage value. No new working capital would be required. Revenues and other Risk-adjus costs are expected to be constant over the project's 3-year life. What is the project's NPV? Net invested cost of capital\ Straight-linent cost (depreciable basis) Sales reve deprec. Rate\

=10.0%\ =$65,000\ =33.3333%\ =$65,500\ =$25,000\ =35.0%\

Operating costs (excl. deprec.), each year =$65,500\ Tax rate =33.0333%\ a. $15,740=35.0%\ b.

$16,569\ c.

$17,441\ d.

$18,359\ e.

$19,325

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started