Answered step by step

Verified Expert Solution

Question

1 Approved Answer

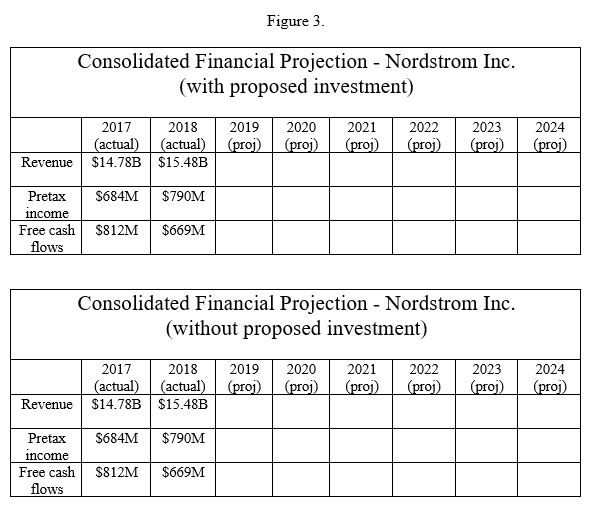

Develop a consolidated financial projection of revenue, pretax income, and cash flow for the overall business, over that same number of years, both with and

Develop a consolidated financial projection of revenue, pretax income, and cash flow for the overall business, over that same number of years, both with and without the proposed investment. Use a spreadsheet or other relevant presentation vehicle to support your narrative, being sure to describe any relevant assumptions.

Complete the projections with and without the proposed store opening investment in South Korea.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started