Develop a healthcare business plan for Coastal Medical Centers possible new physical therapy clinic. Exhibits 7.3, 7.4, and 7.5 may be used as Coastal Medical Centers data. What do you see as the value of the healthcare business plan for Coastal Medical Centers future success?

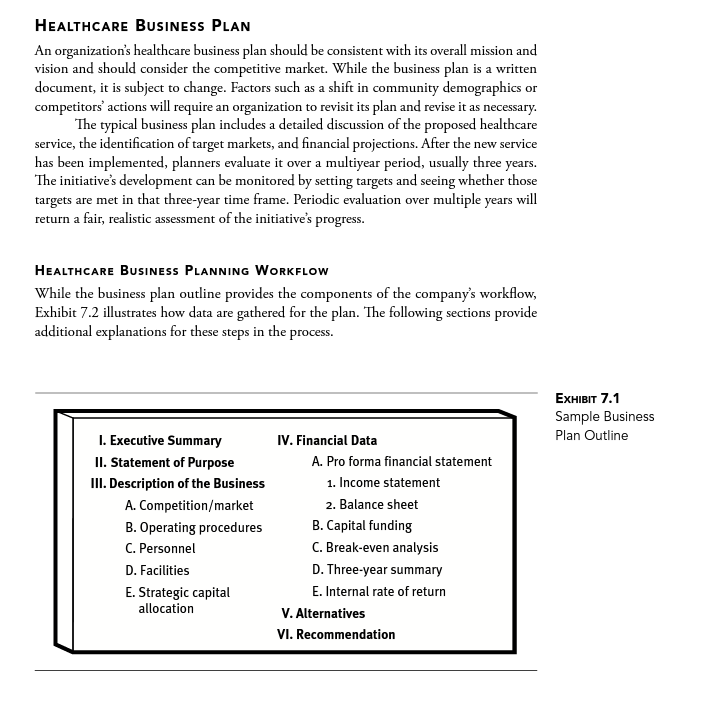

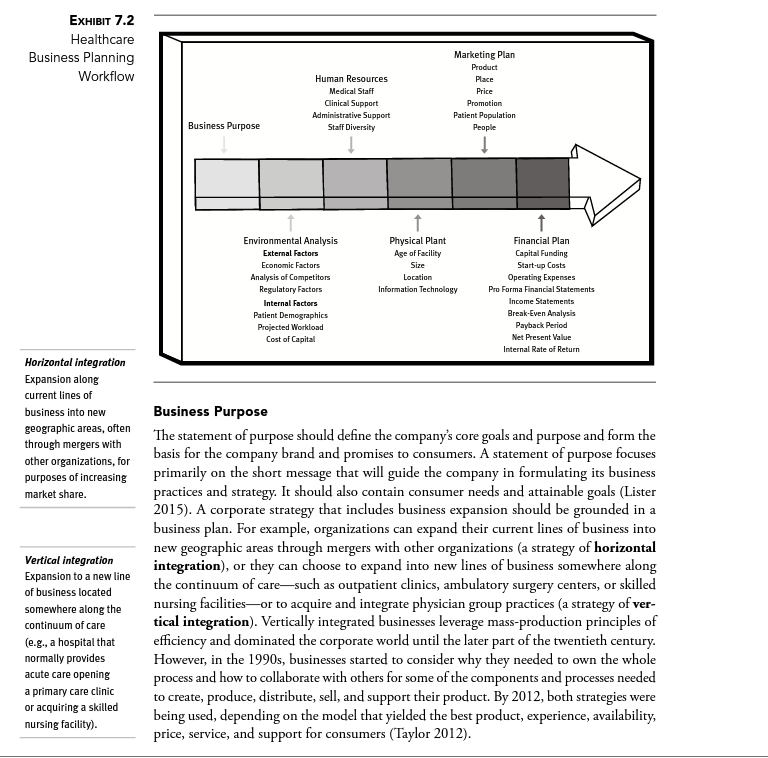

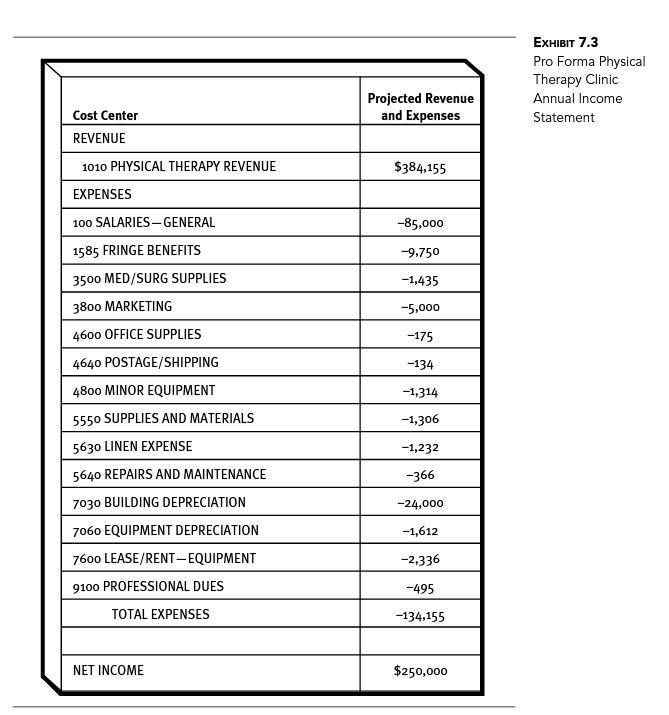

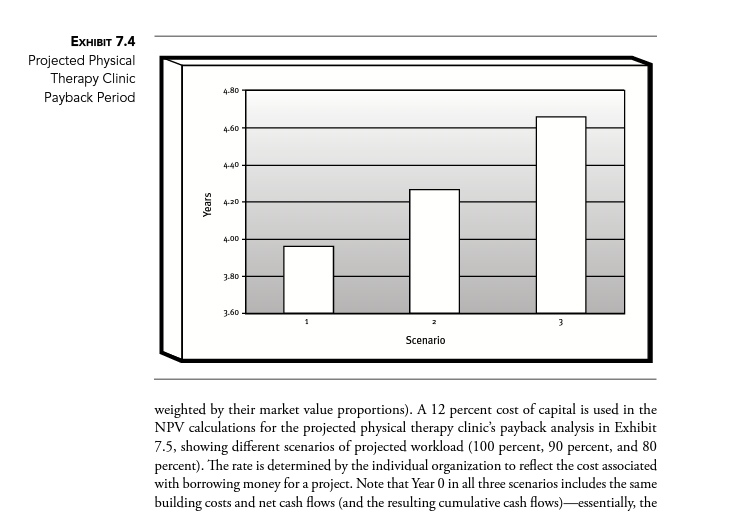

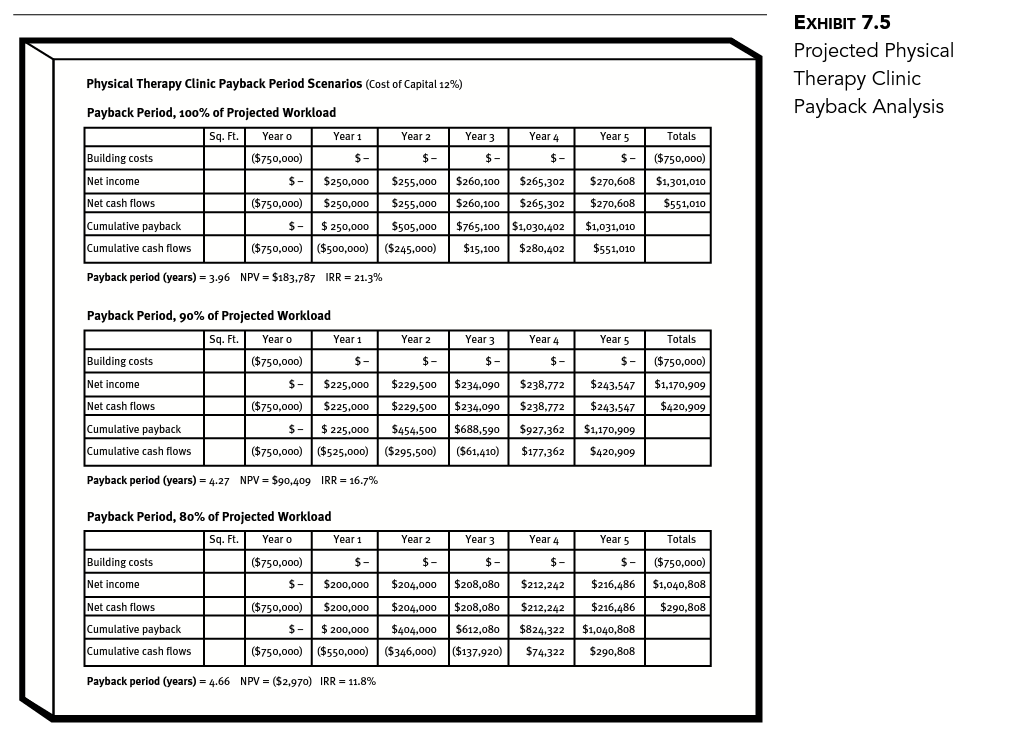

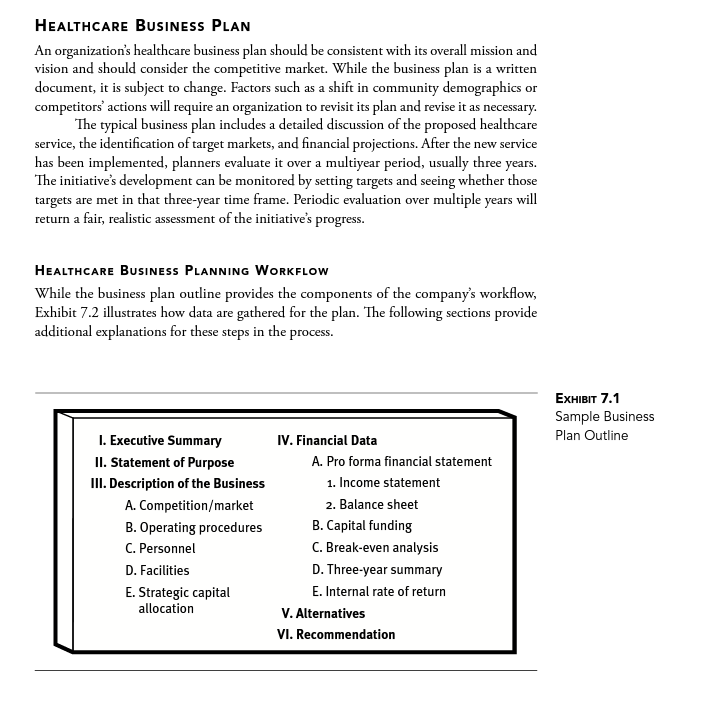

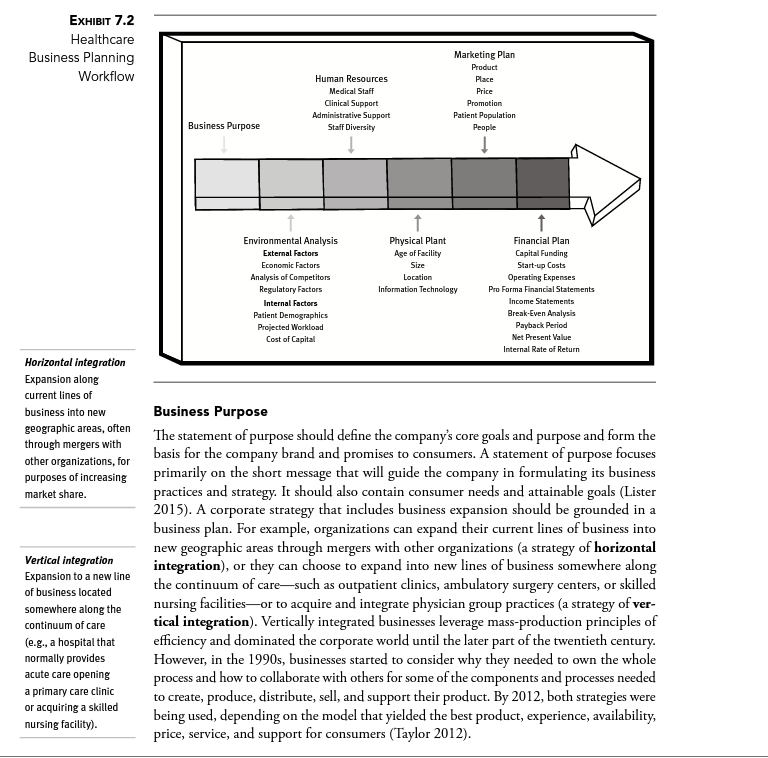

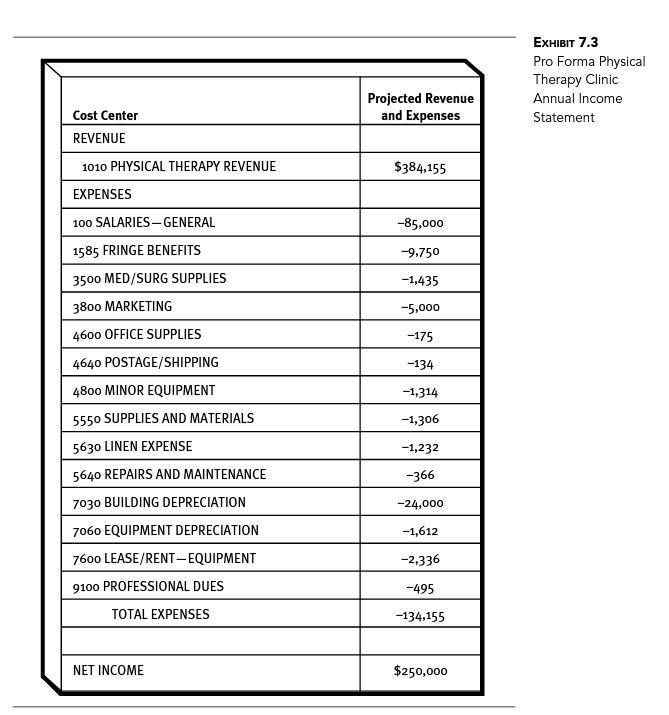

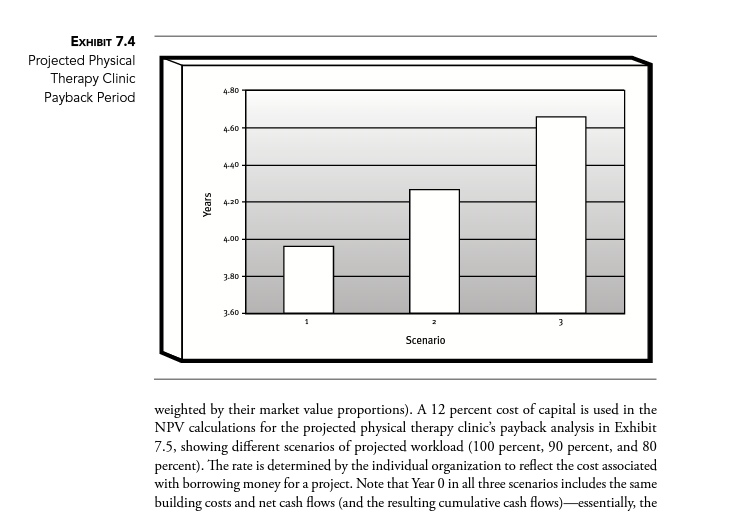

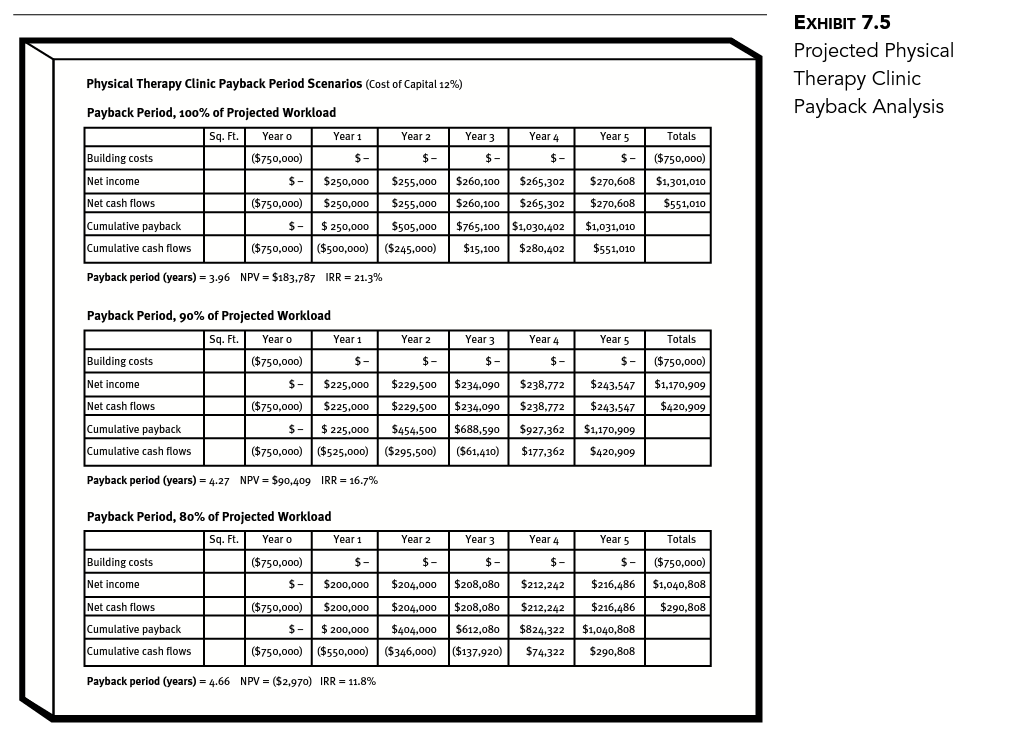

HEALTHCARE BUSINESs PLAN An organization's healthcare business plan should be consistent with its overall mission and vision and should consider the competitive market. While the business plan is a written document, it is subject to change. Factors such as a shift in community demographics or competitors' actions will require an organization to revisit its plan and revise it as necessary The typical business plan includes a detailed discussion of the proposed healthcare service, the identification of target markets, and financial projections. After the new service has been implemented, planners evaluate it over a multiyear The initiative's development can be monitored by setting targets and seeing whether those targets are met in that three-year time frame. Periodic evaluation over multiple years will return a fair, realistic assessment of the initi period, usually three years. HEALTHCARE BuSINESS PLANNING WORKFLOW While the business plan outline provides the components of the company's workflow, Exhibit 7.2 illustrates how data are gathered for the plan. The following sections provide additional explanations for these steps in the process. ExHBIT 7.1 Sample Business Plan Outline . Executive Summary II. Statement of Purpose III. Description of the Business IV. Financial Data A. Pro forma financial statement 1. Income statement A. Competition/market B. Operating procedures C. Personnel D. Facilities E. Strategic capital 2. Balance sheet B. Capital funding C. Break-even analysis D. Three-year summary E. Internal rate of return allocation V. Alternatives VI. Recommendation ExHIBIT 7.2 Healthcare Business Planning Workflow Human Resources Medical Staff Clinical Support Administrative Support Staff Diversity Marketing Plan Product Place Price Promotion Patient Population Busness Purpose Environmental Analysis External Factors Economic Factors Analysis of Competitors Regulatory Factors Internal Factors Patient Demographics Projected Workload Cost of Capital Physical Plant Age of Facility Size Location Information Technology Financial Plan Capital Funding Start-up Costs Operating Expenses Pro Forma Financial Statements Income Statements Break-Even Analysis Payback Period Net Present Value Internal Rate of Return Horizontal integration Expansion along current lines of business into new geographic areas, through mergers with other organizations, for purposes of increasing market share Business Purpose S ofenhe statement of purpose should define the company's core goals and purpose and form the basis for the company brand and promises to consumers. A statement of purpose focuses that will guide the company in formulating its business practices and strategy. It should also contain consumer needs and attainable goals (Lister 2015). A corporate strategy that includes business expansion should be grounded in a business plan. For example, organizations can expand their current lines of business into new geographic areas through mergers with other organizations (a strategy of horizontal integration), or they can choose to expand into new lines of business somewhere along the continuum of care-such as outpatient clinics, ambulatory surgery centers, or skilled somewhere along the nursing facilities-or to acquire and integrate physician group practices (a strategy of ver- tical integration). Vertically integrated businesses leverage mass-production principles of (e.g., a hospital that efficiency and dominated the corporate world until the later part of the twentieth century However, in the 1990s, businesses started to consider why they needed to own the whole process and how to collaborate with others for some of the components and processes needed to create, produce, distribute, sell, and support their product. By 2012, both strategies were being used, depending on the model that yielded the best product, experience, availability primarily on the short m essage Vertical integration Expansion to a new line of business located continuum of care normally provides acute care opening a primary care clinic or acquiring a skilled nursing facility) price, service, and support for consumers (Taylor 2012) ExHIBIT 7.3 Pro Forma Physical Therapy Clinic Annual Income Statement Projected Revenue and Expenses Cost Center REVENUE S384.155 1010 PHYSICAL THERAPY REVENUE EXPENSES 100 SALARIES-GENERAL 1585 FRINGE BENEFITS 3500 MED/SURG SUPPLIES 3800 MARKETING 4600 OFFICE SUPPLIES 4640 POSTAGE/SHIPPING 4800 MINOR EQUIPMENT 5550 SUPPLIES AND MATERIALS 5630 LINEN EXPENSE 5640 REPAIRS AND MAINTENANCE 7030 BUILDING DEPRECIATION 7060 EQUIPMENT DEPRECIATION 7600 LEASE/RENT-EQUIPMENT 9100 PROFESSIONAL DUES -85,000 9.750 -1,435 -5,000 -175 -134 -1,314 -1,306 -1,232 -366 -24,000 -1,612 -2,336 -495 -134,155 TOTAL EXPENSES NET INCOME $250,000 ExHIBIT 7.4 Projected Physical Therapy Clinic Payback Period 4.80 4-60 4-40 4-20 4.00 3.80_ 3.60 Scenario weighted by their market value proportions). A 12 percent cost of capital is used in the NPV calculations for the projected physical therapy clinic's payback analysis in Exhibit 7.5, showing different scenarios of projected workload (100 percent, 90 percent, and 80 percent). The rate is determined by the individual organization to reflect the cost associated with borrowing money for a project. Note that Year 0 in all three scenarios includes the same building costs and net cash flows (and the resulting cumulative cash flows)- essentially, the EXHIBIT 7.5 Projected Physical Therapy Clinic Payback Analysis Physical Therapy Clinic Payback Period Scenarios (Cost of Capital 12%) Payback Period, 100% of Projected workload Sq. Ft. Year o Year 1 Year 2 Year 3 Year 4 Year 5 Totals Building costs Net income Net cash flows Cumulative payback Cumulative cash flows Payback period (years)-3.96 $-($750,000) S$250,000$255,000$260,100$265,302$270,608 $1,301,010 ($750,000) $250,ooo 255,000$260,100$265,302 $270,608$551,010 ($750,000) S-$250,000$505,000$765,100 $1,030,402 $1,031,010 ($750,000) ($500,0oo ($245,000$15,100 $280,402$551,010 NPV-$183,787 IRR-21.3% Payback Period, 90% of Projected workload Sq. Ft.Year o Year 1 Year 2 Year 3 Year 4 Year 5 Totals ($750,000) Building costs Net income Net cash flows Cumulative payback Cumulative cash flows Payback period (years)-4.27 $-($750,000) S$225,000$229,500 $234,090 $238,772$243.547$1,170,909 ($750,000) $225,000 $229,500$234,090$238,772$243.547$420,9o9 S225,000$454,500 $688,590 $927,362$1,170.909 ($750,000) |($525,000)| ($295.500) ($61.410)| $177,362 $420,909 NPV $90,409 IRR-16.7% Payback Period, 80% of Projected workload Sq. Ft.Year o Year 1 Year 2 Year 3 Year 4 Year 5 Totals ($750,o00) S-$200,000$204,000$208,08 $212,242$216,486 $1,040,808 ($750,000)$200,ooo$204,000$208,080$212,242$216,486$290,8o8 Building costs Net income Net cash flows Cumulative payback Cumulative cash flows Payback period (years)-4.66 ($750,000) S200,000$404,000 $612,080 $824,322$1,040,808 ($750,000) ($550,o ($346,000) ($137.920)$74.322$290,808 NPV-($2,970) IRR 11.8% HEALTHCARE BUSINESs PLAN An organization's healthcare business plan should be consistent with its overall mission and vision and should consider the competitive market. While the business plan is a written document, it is subject to change. Factors such as a shift in community demographics or competitors' actions will require an organization to revisit its plan and revise it as necessary The typical business plan includes a detailed discussion of the proposed healthcare service, the identification of target markets, and financial projections. After the new service has been implemented, planners evaluate it over a multiyear The initiative's development can be monitored by setting targets and seeing whether those targets are met in that three-year time frame. Periodic evaluation over multiple years will return a fair, realistic assessment of the initi period, usually three years. HEALTHCARE BuSINESS PLANNING WORKFLOW While the business plan outline provides the components of the company's workflow, Exhibit 7.2 illustrates how data are gathered for the plan. The following sections provide additional explanations for these steps in the process. ExHBIT 7.1 Sample Business Plan Outline . Executive Summary II. Statement of Purpose III. Description of the Business IV. Financial Data A. Pro forma financial statement 1. Income statement A. Competition/market B. Operating procedures C. Personnel D. Facilities E. Strategic capital 2. Balance sheet B. Capital funding C. Break-even analysis D. Three-year summary E. Internal rate of return allocation V. Alternatives VI. Recommendation ExHIBIT 7.2 Healthcare Business Planning Workflow Human Resources Medical Staff Clinical Support Administrative Support Staff Diversity Marketing Plan Product Place Price Promotion Patient Population Busness Purpose Environmental Analysis External Factors Economic Factors Analysis of Competitors Regulatory Factors Internal Factors Patient Demographics Projected Workload Cost of Capital Physical Plant Age of Facility Size Location Information Technology Financial Plan Capital Funding Start-up Costs Operating Expenses Pro Forma Financial Statements Income Statements Break-Even Analysis Payback Period Net Present Value Internal Rate of Return Horizontal integration Expansion along current lines of business into new geographic areas, through mergers with other organizations, for purposes of increasing market share Business Purpose S ofenhe statement of purpose should define the company's core goals and purpose and form the basis for the company brand and promises to consumers. A statement of purpose focuses that will guide the company in formulating its business practices and strategy. It should also contain consumer needs and attainable goals (Lister 2015). A corporate strategy that includes business expansion should be grounded in a business plan. For example, organizations can expand their current lines of business into new geographic areas through mergers with other organizations (a strategy of horizontal integration), or they can choose to expand into new lines of business somewhere along the continuum of care-such as outpatient clinics, ambulatory surgery centers, or skilled somewhere along the nursing facilities-or to acquire and integrate physician group practices (a strategy of ver- tical integration). Vertically integrated businesses leverage mass-production principles of (e.g., a hospital that efficiency and dominated the corporate world until the later part of the twentieth century However, in the 1990s, businesses started to consider why they needed to own the whole process and how to collaborate with others for some of the components and processes needed to create, produce, distribute, sell, and support their product. By 2012, both strategies were being used, depending on the model that yielded the best product, experience, availability primarily on the short m essage Vertical integration Expansion to a new line of business located continuum of care normally provides acute care opening a primary care clinic or acquiring a skilled nursing facility) price, service, and support for consumers (Taylor 2012) ExHIBIT 7.3 Pro Forma Physical Therapy Clinic Annual Income Statement Projected Revenue and Expenses Cost Center REVENUE S384.155 1010 PHYSICAL THERAPY REVENUE EXPENSES 100 SALARIES-GENERAL 1585 FRINGE BENEFITS 3500 MED/SURG SUPPLIES 3800 MARKETING 4600 OFFICE SUPPLIES 4640 POSTAGE/SHIPPING 4800 MINOR EQUIPMENT 5550 SUPPLIES AND MATERIALS 5630 LINEN EXPENSE 5640 REPAIRS AND MAINTENANCE 7030 BUILDING DEPRECIATION 7060 EQUIPMENT DEPRECIATION 7600 LEASE/RENT-EQUIPMENT 9100 PROFESSIONAL DUES -85,000 9.750 -1,435 -5,000 -175 -134 -1,314 -1,306 -1,232 -366 -24,000 -1,612 -2,336 -495 -134,155 TOTAL EXPENSES NET INCOME $250,000 ExHIBIT 7.4 Projected Physical Therapy Clinic Payback Period 4.80 4-60 4-40 4-20 4.00 3.80_ 3.60 Scenario weighted by their market value proportions). A 12 percent cost of capital is used in the NPV calculations for the projected physical therapy clinic's payback analysis in Exhibit 7.5, showing different scenarios of projected workload (100 percent, 90 percent, and 80 percent). The rate is determined by the individual organization to reflect the cost associated with borrowing money for a project. Note that Year 0 in all three scenarios includes the same building costs and net cash flows (and the resulting cumulative cash flows)- essentially, the EXHIBIT 7.5 Projected Physical Therapy Clinic Payback Analysis Physical Therapy Clinic Payback Period Scenarios (Cost of Capital 12%) Payback Period, 100% of Projected workload Sq. Ft. Year o Year 1 Year 2 Year 3 Year 4 Year 5 Totals Building costs Net income Net cash flows Cumulative payback Cumulative cash flows Payback period (years)-3.96 $-($750,000) S$250,000$255,000$260,100$265,302$270,608 $1,301,010 ($750,000) $250,ooo 255,000$260,100$265,302 $270,608$551,010 ($750,000) S-$250,000$505,000$765,100 $1,030,402 $1,031,010 ($750,000) ($500,0oo ($245,000$15,100 $280,402$551,010 NPV-$183,787 IRR-21.3% Payback Period, 90% of Projected workload Sq. Ft.Year o Year 1 Year 2 Year 3 Year 4 Year 5 Totals ($750,000) Building costs Net income Net cash flows Cumulative payback Cumulative cash flows Payback period (years)-4.27 $-($750,000) S$225,000$229,500 $234,090 $238,772$243.547$1,170,909 ($750,000) $225,000 $229,500$234,090$238,772$243.547$420,9o9 S225,000$454,500 $688,590 $927,362$1,170.909 ($750,000) |($525,000)| ($295.500) ($61.410)| $177,362 $420,909 NPV $90,409 IRR-16.7% Payback Period, 80% of Projected workload Sq. Ft.Year o Year 1 Year 2 Year 3 Year 4 Year 5 Totals ($750,o00) S-$200,000$204,000$208,08 $212,242$216,486 $1,040,808 ($750,000)$200,ooo$204,000$208,080$212,242$216,486$290,8o8 Building costs Net income Net cash flows Cumulative payback Cumulative cash flows Payback period (years)-4.66 ($750,000) S200,000$404,000 $612,080 $824,322$1,040,808 ($750,000) ($550,o ($346,000) ($137.920)$74.322$290,808 NPV-($2,970) IRR 11.8%