Question

Develop a non-GAAP [generally accepted accounting principles] statement of operations (start with gross patient service revenue) and balance sheet for 2020 (you can assume the

Develop a non-GAAP [generally accepted accounting principles] statement of operations (start with gross patient service revenue) and balance sheet for 2020 (you can assume the format and numbers are correct on the 2019 balance sheet, and you can further assume that all balances carry forward to the 2020 balance sheet with the exception of accounting for the profit or loss from the 2020 statement of operations). With the exception of starting with gross patient service revenue, please ensure that you prepare the financial statement in current GAAP. Please use ratio analysis to analyze the ratios (use data from Optums 2018 Almanac ofHospital Financial and Operating Indi-cators for comparative statisticsuse the median for critical access hospitals which is provided in Table II [at the end of this case study])

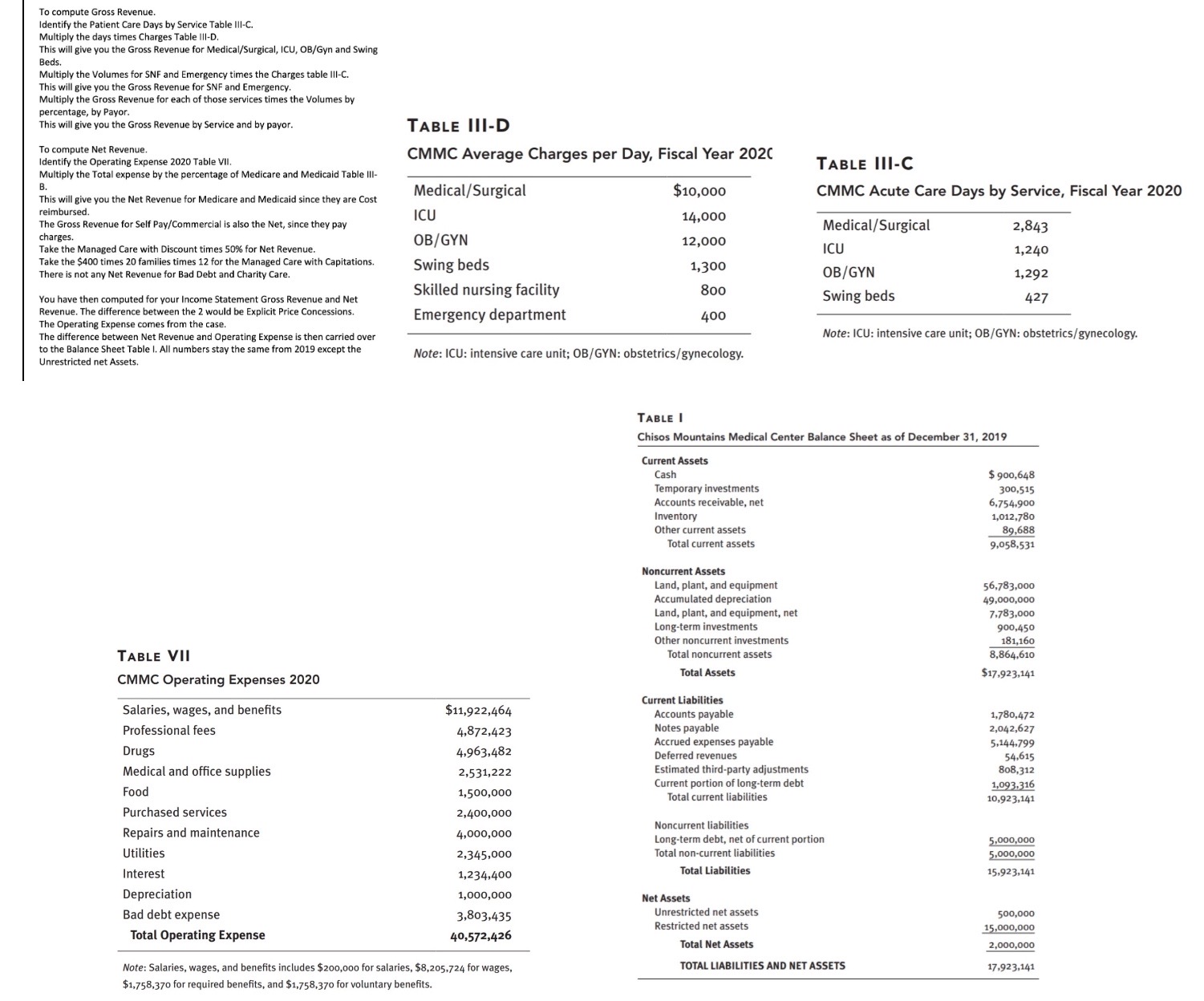

To compute Gross Revenue. Identify the Patient Care Days by Service Table III-C. Multiply the days times Charges Table III-D. This will give you the Gross Revenue for Medical/Surgical, ICU, OB/Gyn and Swing Beds. Multiply the Volumes for SNF and Emergency times the Charges table III-C. This will give you the Gross Revenue for SNF and Emergency. Multiply the Gross Revenue for each of those services times the Volumes by percentage, by Payor. This will give you the Gross Revenue by Service and by payor. To compute Net Revenue. Identify the Operating Expense 2020 Table VII. Multiply the Total expense by the percentage of Medicare and Medicaid Table IIIB. This will give you the Net Revenue for Medicare and Medicaid since they are Cost reimbursed. The Gross Revenue for Self Pay/Commercial is also the Net, since they pay charges. Take the Managed Care with Discount times 50\% for Net Revenue. Take the $400 times 20 families times 12 for the Managed Care with Capitations. There is not any Net Revenue for Bad Debt and Charity Care. You have then computed for your Income Statement Gross Revenue and Net Revenue. The difference between the 2 would be Explicit Price Concessions. The Operating Expense comes from the case. The difference between Net Revenue and Operating Expense is then carried over to the Balance Sheet Table I. All numbers stay the same from 2019 except the TABLE III-D Unrestricted net Assets. CMMC Average Charges per Day, Fiscal Year 202C Note: ICU: intensive care unit; OB/GYN: obstetrics/gynecology. TABLE III-C CMMC Acute Care Days by Service, Fiscal Year 2020 Note: ICU: intensive care unit; OB/GYN: obstetrics/gynecology. Table VII CMMC Operating Expenses 2020 Note: Salaries, wages, and benefits includes $200,000 for salaries, $8,205,724 for wages, $1,758,370 for required benefits, and $1,758,370 for voluntary benefits

To compute Gross Revenue. Identify the Patient Care Days by Service Table III-C. Multiply the days times Charges Table III-D. This will give you the Gross Revenue for Medical/Surgical, ICU, OB/Gyn and Swing Beds. Multiply the Volumes for SNF and Emergency times the Charges table III-C. This will give you the Gross Revenue for SNF and Emergency. Multiply the Gross Revenue for each of those services times the Volumes by percentage, by Payor. This will give you the Gross Revenue by Service and by payor. To compute Net Revenue. Identify the Operating Expense 2020 Table VII. Multiply the Total expense by the percentage of Medicare and Medicaid Table IIIB. This will give you the Net Revenue for Medicare and Medicaid since they are Cost reimbursed. The Gross Revenue for Self Pay/Commercial is also the Net, since they pay charges. Take the Managed Care with Discount times 50\% for Net Revenue. Take the $400 times 20 families times 12 for the Managed Care with Capitations. There is not any Net Revenue for Bad Debt and Charity Care. You have then computed for your Income Statement Gross Revenue and Net Revenue. The difference between the 2 would be Explicit Price Concessions. The Operating Expense comes from the case. The difference between Net Revenue and Operating Expense is then carried over to the Balance Sheet Table I. All numbers stay the same from 2019 except the TABLE III-D Unrestricted net Assets. CMMC Average Charges per Day, Fiscal Year 202C Note: ICU: intensive care unit; OB/GYN: obstetrics/gynecology. TABLE III-C CMMC Acute Care Days by Service, Fiscal Year 2020 Note: ICU: intensive care unit; OB/GYN: obstetrics/gynecology. Table VII CMMC Operating Expenses 2020 Note: Salaries, wages, and benefits includes $200,000 for salaries, $8,205,724 for wages, $1,758,370 for required benefits, and $1,758,370 for voluntary benefits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started