Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Develop a pro forma income statement and balance sheet for Wal-Mart for the fiscal year ending January 31, 2006. Assume the following (in addition to

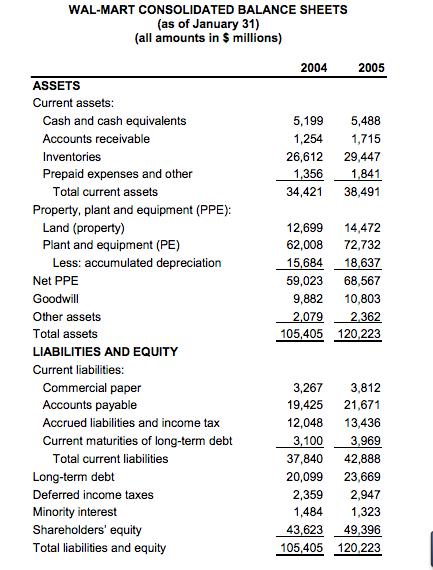

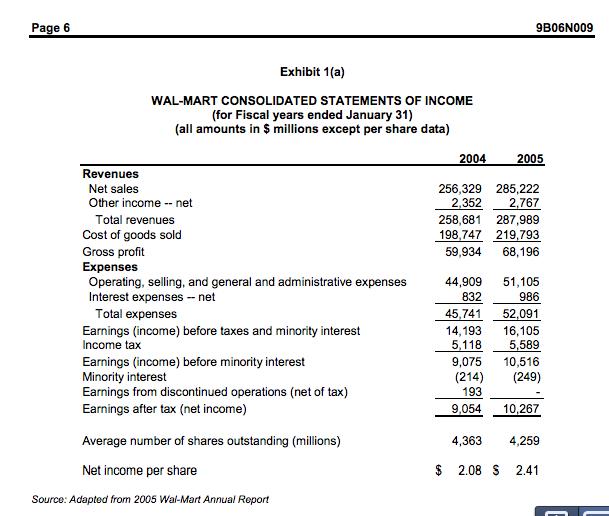

- Develop a pro forma income statement and balance sheet for Wal-Mart for the fiscal year ending January 31, 2006. Assume the following (in addition to the information provided in the case): selling, general and administrative expenses at 17.3 percent of anticipated net sales; interest on debt at an average rate of four percent; no change in the number of shares outstanding as of January 31, 2005; no change in prepaid and other current assets, other assets, accrued liabilities, deferred income tax, or minority from the January 31, 2005 levels. State any other key assumptions. How profitable do you anticipate Wal-Mart will be? Will Wal-Mart need to increase its reliance on external borrowing?

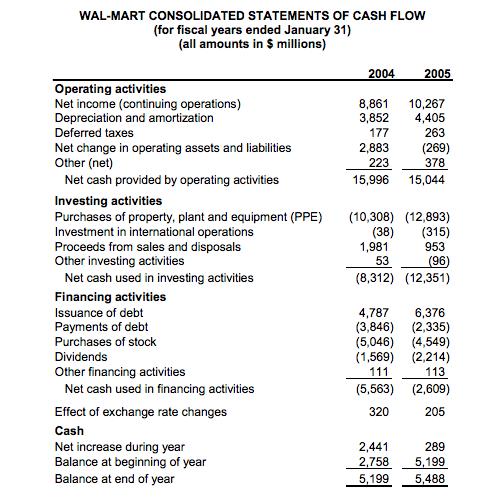

WAL-MART CONSOLIDATED STATEMENTS OF CASH FLOW (for fiscal years ended January 31) (all amounts in $ millions) 2004 2005 Operating activities Net income (continuing operations) Depreciation and amortization 8,861 3,852 10,267 4,405 Deferred taxes 177 263 (269) Net change in operating assets and liabilities Other (net) 2,883 223 378 Net cash provided by operating activities 15,996 15,044 Investing activities Purchases of property, plant and equipment (PPE) Investment in international operations Proceeds from sales and disposals Other investing activities (10,308) (12,893) (38) 1,981 53 (315) 953 (96) Net cash used in investing activities (8,312) (12,351) Financing activities Issuance of debt 6,376 (3,846) (2,335) (5,046) (4,549) (1,569) (2,214) 4,787 Payments of debt Purchases of stock Dividends Other financing activities Net cash used in financing activities 111 113 (5,563) (2,609) Effect of exchange rate changes 320 205 Cash Net increase during year Balance at beginning of year Balance at end of year 2,441 2,758 289 5,199 5,199 5,488 WAL-MART CONSOLIDATED STATEMENTS OF CASH FLOW (for fiscal years ended January 31) (all amounts in $ millions) 2004 2005 Operating activities Net income (continuing operations) Depreciation and amortization 8,861 3,852 10,267 4,405 Deferred taxes 177 263 (269) Net change in operating assets and liabilities Other (net) 2,883 223 378 Net cash provided by operating activities 15,996 15,044 Investing activities Purchases of property, plant and equipment (PPE) Investment in international operations Proceeds from sales and disposals Other investing activities (10,308) (12,893) (38) 1,981 53 (315) 953 (96) Net cash used in investing activities (8,312) (12,351) Financing activities Issuance of debt 6,376 (3,846) (2,335) (5,046) (4,549) (1,569) (2,214) 4,787 Payments of debt Purchases of stock Dividends Other financing activities Net cash used in financing activities 111 113 (5,563) (2,609) Effect of exchange rate changes 320 205 Cash Net increase during year Balance at beginning of year Balance at end of year 2,441 2,758 289 5,199 5,199 5,488 WAL-MART CONSOLIDATED STATEMENTS OF CASH FLOW (for fiscal years ended January 31) (all amounts in $ millions) 2004 2005 Operating activities Net income (continuing operations) Depreciation and amortization 8,861 3,852 10,267 4,405 Deferred taxes 177 263 (269) Net change in operating assets and liabilities Other (net) 2,883 223 378 Net cash provided by operating activities 15,996 15,044 Investing activities Purchases of property, plant and equipment (PPE) Investment in international operations Proceeds from sales and disposals Other investing activities (10,308) (12,893) (38) 1,981 53 (315) 953 (96) Net cash used in investing activities (8,312) (12,351) Financing activities Issuance of debt 6,376 (3,846) (2,335) (5,046) (4,549) (1,569) (2,214) 4,787 Payments of debt Purchases of stock Dividends Other financing activities Net cash used in financing activities 111 113 (5,563) (2,609) Effect of exchange rate changes 320 205 Cash Net increase during year Balance at beginning of year Balance at end of year 2,441 2,758 289 5,199 5,199 5,488

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started