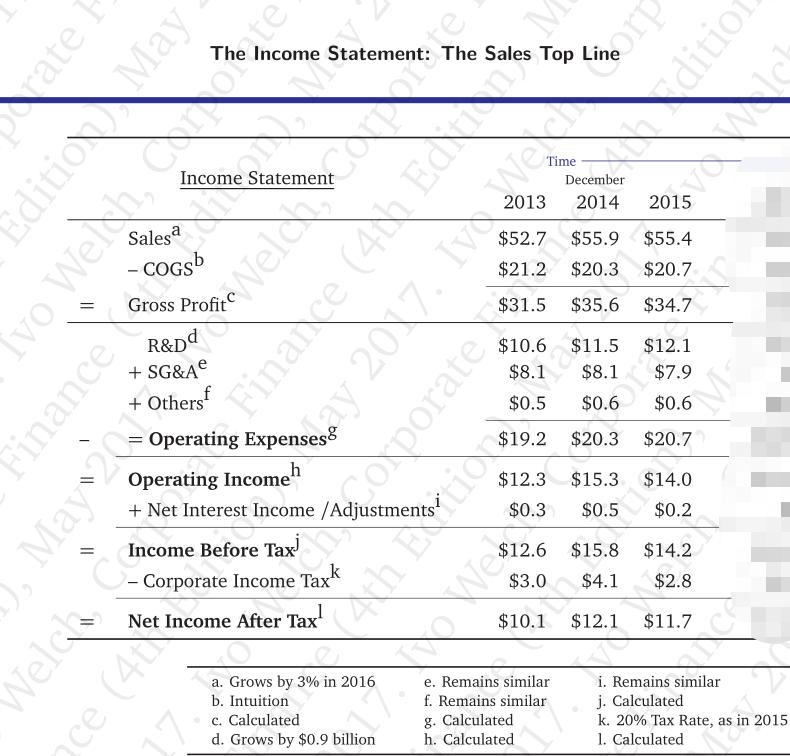

Develop a pro forma income statement, using the following assumptions at a minimum: Sales/revenues will decrease by 10% due to the impact of new tariffs

Develop a pro forma income statement, using the following assumptions at a minimum:

- Sales/revenues will decrease by 10% due to the impact of new tariffs on imports to other countries (for sales/manufacturing firms) or increasing competition (for other types of firms).

- Cost of Goods Sold (Cost of Sales) will increase by 5% due to increased costs from overseas suppliers due to tariffs on some imported materials (only applies to sales/manufacturing firms).

- Other expenses will increase by 3% due to inflation and wages increase.

- Interest expense will rise 10% due to increasing interest rates on short-term loans.

- Taxes will decrease by 35% due to new tax laws.

- What is the overall effect of these changes in planning assumptions on the organization’s financial performance (net income/profit) for next year?

- As a leader of this organization, what are some possible actions that could be taken now to mitigate and/or take advantage of the effects of these anticipated changes?

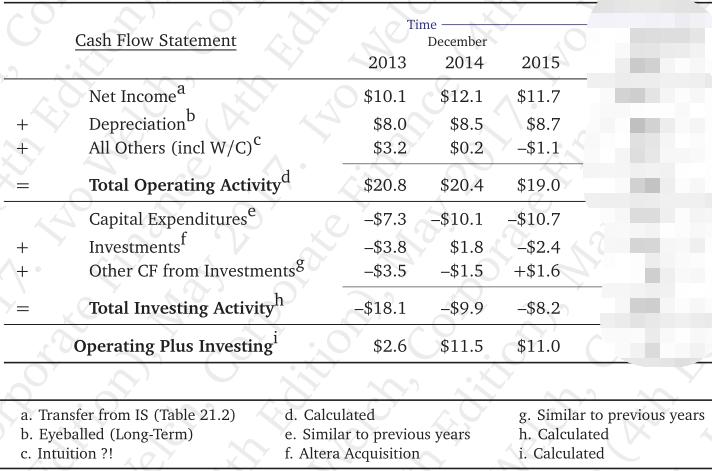

The Income Statement: The Sales Top Li - COGsb Time December 2013 2014 2015 Salesa $52.7 $55.9 $55.4 -COGSb $21.2 $20.3 $20.7 Gross $31.5 $35.6 $34.7 R&Dd + SG&A + Others $10.6 $11.5 $12.1 $8.1 $8.1 $7.9 $0.5 $0.6 $0.6 $19.2 $20.3 $20.7 Operating Income + Net Interest Income /Adjustments $12.3 $15.3 $14.0 $0.3 $0.5 $0.2 Income Before Tax $12.6 $15.8 $14.2 Corporate Income Tax $3.0 $4.1 $2.8 Net Income After Tax $10.1 $12.1 $11.7 i. Remains similar j. Calculated k. 20% Tax Rate, as in 2015 1. Calculated a. Grows by 3% in 2016 b. Intuition e. Remains similar c. Calculated d. Grows by $0.9 billion f. Remains similar g. Calculated h. Calculated State F Edition May Ivo Welch, Co Finance May 201a Welch PNelchComate (4h Edn M Finance ce (4t ay 2017. Ive Wec 17 i3 Cotporate dition 1th Etio oWeb

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Decemberin0 Income statement 2013 2014 2015 Sales 527 559 554 AdjusmentDecrease by 10 527 559 554 Af...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started