Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Develop a Relative Market Valuation Model (Price Earning and Price to Book multiples) for the companys stock price for CY2020 and CY2019. Use the year-end

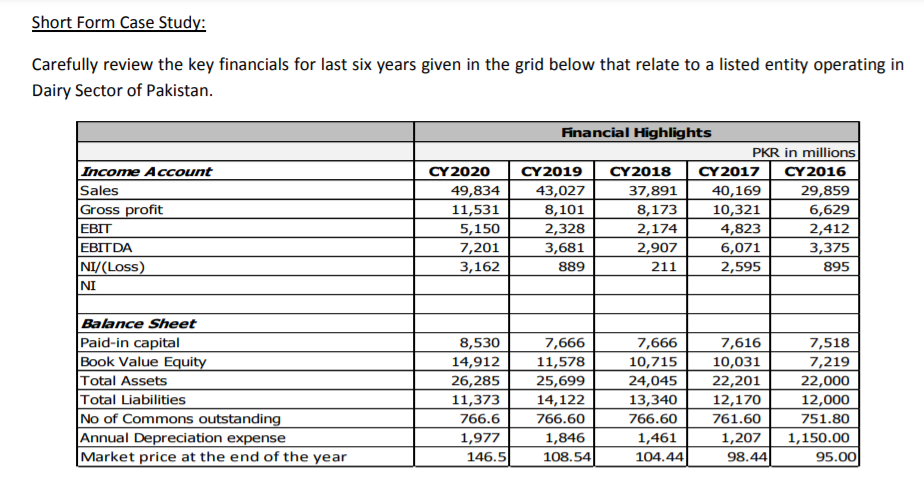

Develop a Relative Market Valuation Model (Price Earning and Price to Book multiples) for the companys stock price for CY2020 and CY2019. Use the year-end stock price given in the grid above.

Short Form Case Study: Carefully review the key financials for last six years given in the grid below that relate to a listed entity operating in Dairy Sector of Pakistan. Income Account Sales Gross profit |EBIT EBITDA NI/(Loss) NI CY2020 49,834 11,531 5,150 7,201 3,162 Financial Highlights PKR in millions CY2019 CY2018 CY2017 CY 2016 43,027 37,891 40,169 29,859 8,101 8,173 10,321 6,629 2,328 2,174 4,823 2,412 3,681 2,907 6,071 3,375 889 211 2,595 895 Balance Sheet Paid-in capital Book Value Equity Total Assets Total Liabilities No of Commons outstanding Annual Depreciation expense Market price at the end of the year 8,530 14,912 26,285 11,373 766.6 1,977 146.5 7,666 11,578 25,699 14,122 766.60 1,846 108.54 7,666 10,715 24,045 13,340 766.60 1,461 104.44 7,616 10,031 22,201 12,170 761.60 1,207 98.44 7,518 7,219 22,000 12,000 751.80 1,150.00 95.00 Short Form Case Study: Carefully review the key financials for last six years given in the grid below that relate to a listed entity operating in Dairy Sector of Pakistan. Income Account Sales Gross profit |EBIT EBITDA NI/(Loss) NI CY2020 49,834 11,531 5,150 7,201 3,162 Financial Highlights PKR in millions CY2019 CY2018 CY2017 CY 2016 43,027 37,891 40,169 29,859 8,101 8,173 10,321 6,629 2,328 2,174 4,823 2,412 3,681 2,907 6,071 3,375 889 211 2,595 895 Balance Sheet Paid-in capital Book Value Equity Total Assets Total Liabilities No of Commons outstanding Annual Depreciation expense Market price at the end of the year 8,530 14,912 26,285 11,373 766.6 1,977 146.5 7,666 11,578 25,699 14,122 766.60 1,846 108.54 7,666 10,715 24,045 13,340 766.60 1,461 104.44 7,616 10,031 22,201 12,170 761.60 1,207 98.44 7,518 7,219 22,000 12,000 751.80 1,150.00 95.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started