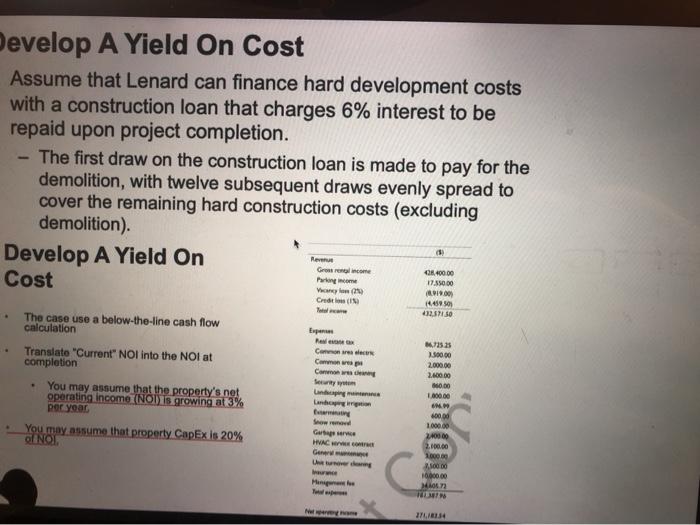

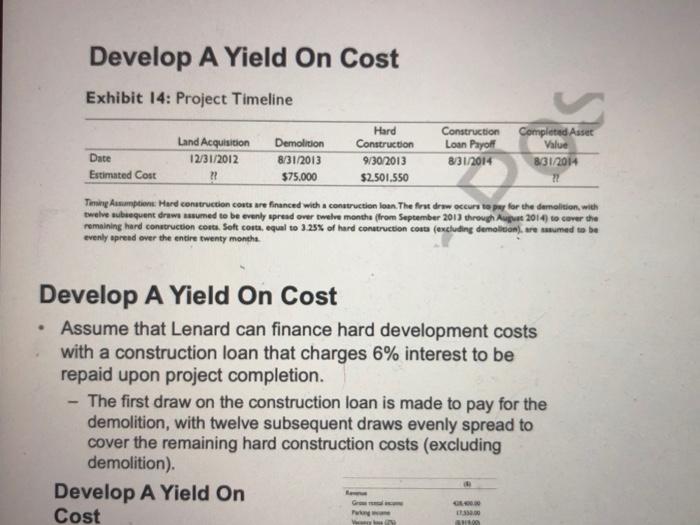

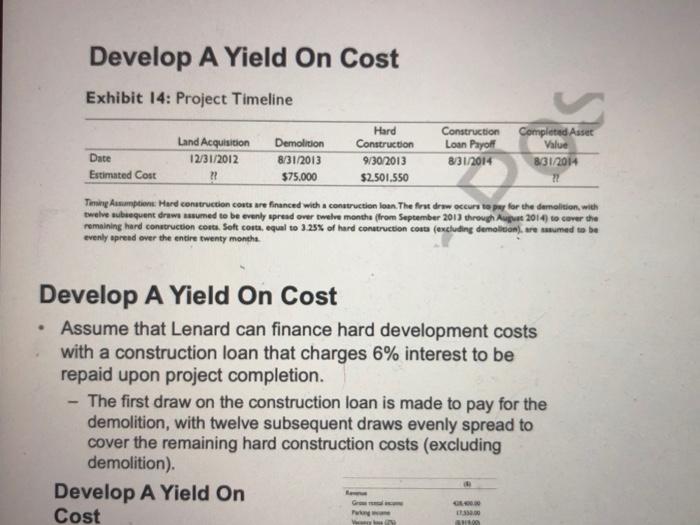

Develop A Yield On Cost Suppose instead you were considering developing to a yield on cost. You would be willing to make an investment into the development project as long as the annual cash flow of the property was at least 5.2% of the total development cost Cash flow is measured at project completion and the timing of development costs is ignored (except for when calculating construction loan interest) Development costs include both hard and soft costs, as well as interest on any construction loan. What is the supportable site acquisition cost? The supportable site acquisition cost is therefore the amount a developer can spend on the land such that the property cash flow is at least 5.2% of the total project cost, including land, hard and soft development costs, and construction financing. Develop A Yield On Cost Assume that Lenard can finance hard development costs with a construction loan that charges 6% interest to be repaid upon project completion. The first draw on the construction loan is made to pay for the demolition, with twelve subsequent draws evenly spread to cover the remaining hard construction costs (excluding demolition). Develop A Yield On Cost Reven Grore Parkingom Vacan Credit 08.400.00 17.350.00 A. 14.49 472.57150 Rel Canon Commonwee Commons The case use a below-the-line cash flow calculation Translate "Current" NOI into the Nol at completion You may assume that the property's net operating incomo (NOT) is growing at 3% per year You may assume that property CapExis 20% I NOI 1.500.00 2.000.00 2.600.00 0.00 1.000.00 EM. 10000 1.000.00 210000 2.000.00 Garte HVAC 10000 1000000 MOS HON 270134 Develop A Yield On Cost Exhibit 14: Project Timeline Land Acquisition 12/31/2012 Demolition 8/31/2013 $75,000 Date Estimated Cost Hard Construction 9/30/2013 $2.501.550 Construction Loan Payoff 8/31/2014 Completed Asset Value 831/2014 ?? Tin Amption Hard construction costs are financed with a construction loan. The first drew occurs to pay for the demolition, with twelve subsequent draws assumed to be evenly spread over twelve month (from September 2013 through Aug 2014 to cover the remaining hard construction conta. Soft cost equal to 1.25% of hard construction conta (excluding demolition resumed to be evenly spread over the entire twenty month. . Develop A Yield On Cost Assume that Lenard can finance hard development costs with a construction loan that charges 6% interest to be repaid upon project completion. The first draw on the construction loan is made to pay for the demolition, with twelve subsequent draws evenly spread to cover the remaining hard construction costs (excluding demolition) Develop A Yield On Cost Gm wing 255.0 Develop A Yield On Cost Suppose instead you were considering developing to a yield on cost. You would be willing to make an investment into the development project as long as the annual cash flow of the property was at least 5.2% of the total development cost Cash flow is measured at project completion and the timing of development costs is ignored (except for when calculating construction loan interest) Development costs include both hard and soft costs, as well as interest on any construction loan. What is the supportable site acquisition cost? The supportable site acquisition cost is therefore the amount a developer can spend on the land such that the property cash flow is at least 5.2% of the total project cost, including land, hard and soft development costs, and construction financing. Develop A Yield On Cost Assume that Lenard can finance hard development costs with a construction loan that charges 6% interest to be repaid upon project completion. The first draw on the construction loan is made to pay for the demolition, with twelve subsequent draws evenly spread to cover the remaining hard construction costs (excluding demolition). Develop A Yield On Cost Reven Grore Parkingom Vacan Credit 08.400.00 17.350.00 A. 14.49 472.57150 Rel Canon Commonwee Commons The case use a below-the-line cash flow calculation Translate "Current" NOI into the Nol at completion You may assume that the property's net operating incomo (NOT) is growing at 3% per year You may assume that property CapExis 20% I NOI 1.500.00 2.000.00 2.600.00 0.00 1.000.00 EM. 10000 1.000.00 210000 2.000.00 Garte HVAC 10000 1000000 MOS HON 270134 Develop A Yield On Cost Exhibit 14: Project Timeline Land Acquisition 12/31/2012 Demolition 8/31/2013 $75,000 Date Estimated Cost Hard Construction 9/30/2013 $2.501.550 Construction Loan Payoff 8/31/2014 Completed Asset Value 831/2014 ?? Tin Amption Hard construction costs are financed with a construction loan. The first drew occurs to pay for the demolition, with twelve subsequent draws assumed to be evenly spread over twelve month (from September 2013 through Aug 2014 to cover the remaining hard construction conta. Soft cost equal to 1.25% of hard construction conta (excluding demolition resumed to be evenly spread over the entire twenty month. . Develop A Yield On Cost Assume that Lenard can finance hard development costs with a construction loan that charges 6% interest to be repaid upon project completion. The first draw on the construction loan is made to pay for the demolition, with twelve subsequent draws evenly spread to cover the remaining hard construction costs (excluding demolition) Develop A Yield On Cost Gm wing 255.0