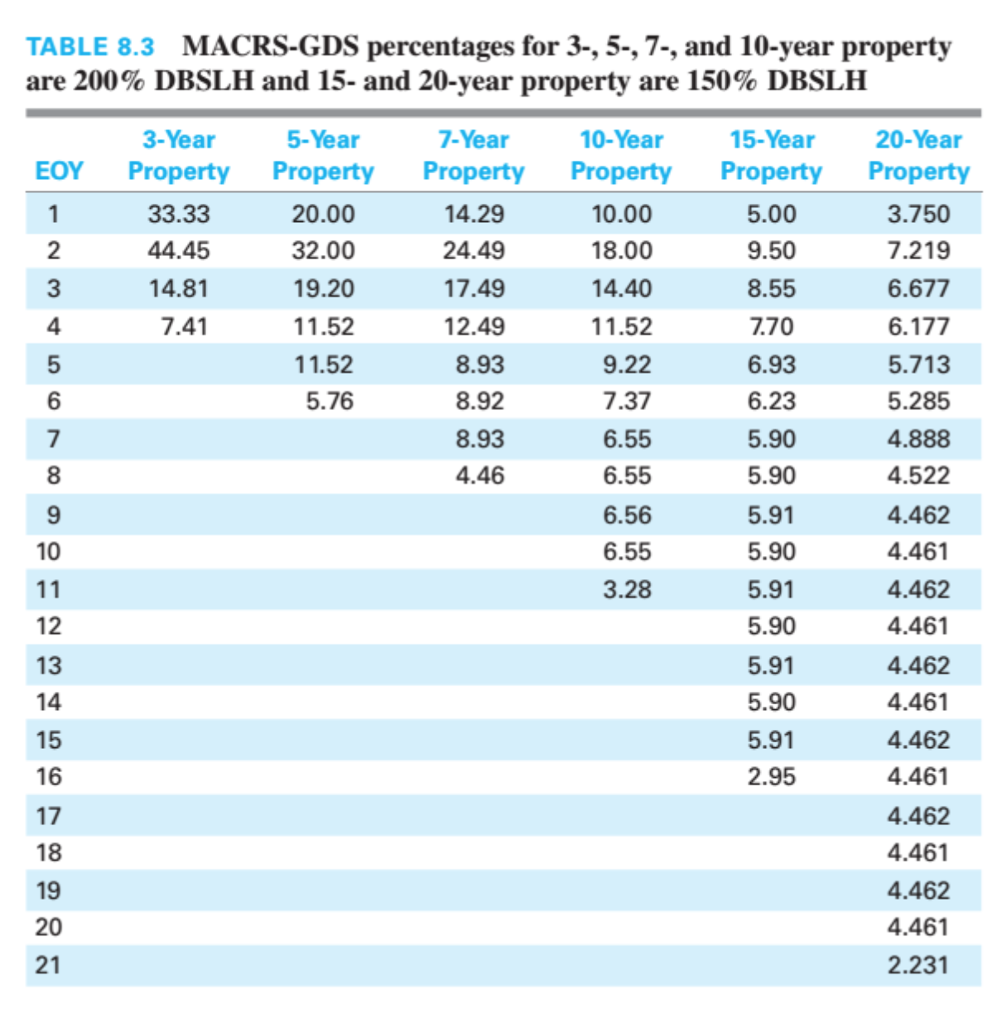

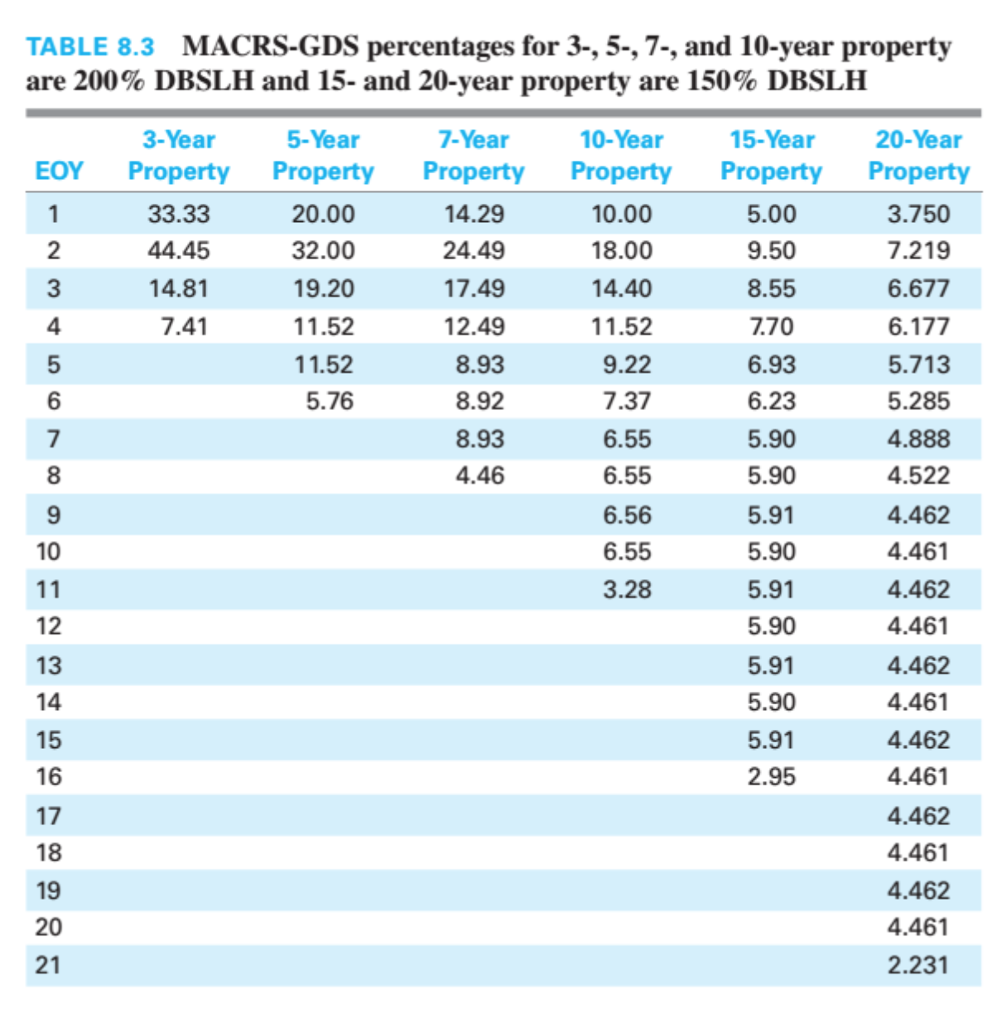

Develop an Excel spreadsheet model to analyze the scenario within the case. Show After-Tax Cash Flow Analysis for the investment (Find at least Present Worth). You work at an aerospace manufacturing company and you are selected to be part of a team that will evaluate the company's investment. The company can invest in the following: . Invest $9.9 million to establish manufacturing capability to build company's next generation unmanned craft o Increase of revenue in 18 year is $3,200,000. This amount goes up each year by 5% inflation rate. Market Value of $1,000,000 in today's dollars (Period 0). This amount goes up by 5% inflation for 5 years at which point it is sold off. Life 5 years Use Asset Class 37.2 Manufacturer of Aerospace Products- MACRS GDS 7 year recovery the old machines and for the upgrade investment. O o From Finance Committee: Committee has found investors willing to invest $16.25 million. Projects must meet after tax MARR 15% As an exchange rate, use 1 dollar = .7042 euro's State tax rate 7.7% Federal tax rate 21% Use MACRS GDS depreciation . TABLE 8.3 MACRS-GDS percentages for 3-, 5-, 7-, and 10-year property are 200% DBSLH and 15- and 20-year property are 150% DBSLH EOY 1 2 3-Year 5-Year Property Property 33.33 20.00 44.45 32.00 14.81 19.20 7.41 11.52 11.52 5.76 7-Year Property 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 15-Year Property 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 10-Year Property 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 20-Year Property 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4 5 6 7 8 9 10 5.91 5.90 5.91 5.90 5.91 5.90 4.462 4.461 4.462 4.461 11 12 13 4.462 14 15 5.91 2.95 4.461 4.462 4.461 16 17 18 19 4.462 4.461 4.462 4.461 2.231 20 21 Develop an Excel spreadsheet model to analyze the scenario within the case. Show After-Tax Cash Flow Analysis for the investment (Find at least Present Worth). You work at an aerospace manufacturing company and you are selected to be part of a team that will evaluate the company's investment. The company can invest in the following: . Invest $9.9 million to establish manufacturing capability to build company's next generation unmanned craft o Increase of revenue in 18 year is $3,200,000. This amount goes up each year by 5% inflation rate. Market Value of $1,000,000 in today's dollars (Period 0). This amount goes up by 5% inflation for 5 years at which point it is sold off. Life 5 years Use Asset Class 37.2 Manufacturer of Aerospace Products- MACRS GDS 7 year recovery the old machines and for the upgrade investment. O o From Finance Committee: Committee has found investors willing to invest $16.25 million. Projects must meet after tax MARR 15% As an exchange rate, use 1 dollar = .7042 euro's State tax rate 7.7% Federal tax rate 21% Use MACRS GDS depreciation . TABLE 8.3 MACRS-GDS percentages for 3-, 5-, 7-, and 10-year property are 200% DBSLH and 15- and 20-year property are 150% DBSLH EOY 1 2 3-Year 5-Year Property Property 33.33 20.00 44.45 32.00 14.81 19.20 7.41 11.52 11.52 5.76 7-Year Property 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 15-Year Property 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 10-Year Property 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 20-Year Property 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4 5 6 7 8 9 10 5.91 5.90 5.91 5.90 5.91 5.90 4.462 4.461 4.462 4.461 11 12 13 4.462 14 15 5.91 2.95 4.461 4.462 4.461 16 17 18 19 4.462 4.461 4.462 4.461 2.231 20 21