Develop and justify an indirect cost allocation using excel based on the provided information. Justify-

1) If it is fair to charge the dialysis center actual facilities costs if they were forced to move

2) If the actual cost concept were applied to the dialysis center, is the $400,000 annual allocation amount correct, especially with the building having a useful life significantly longer than the 20 years (life of the loan).

3) The revenue the dialysis center receives from patients' use of the pharmacy appears to be passed on directly to the pharmacy. i.e. the dialysis center books $800,000 in annual revenue but is charged %800,000 for the drugs used. Should this revenue be counted when general allocations are made?

this revenue be counted when general allocations are made?

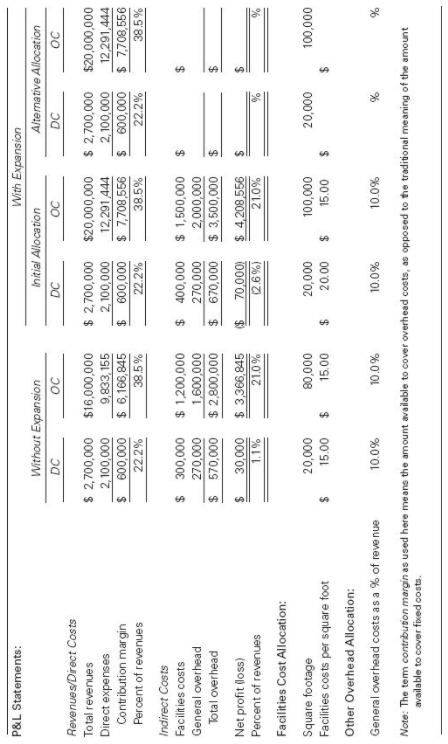

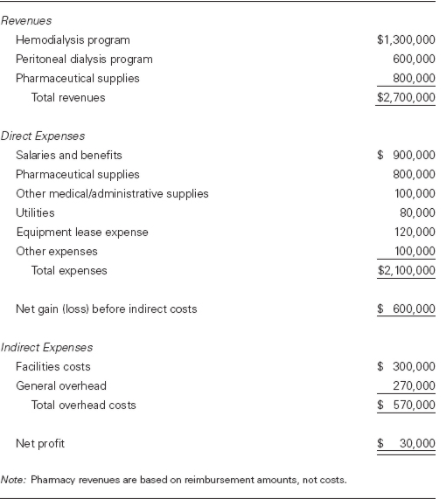

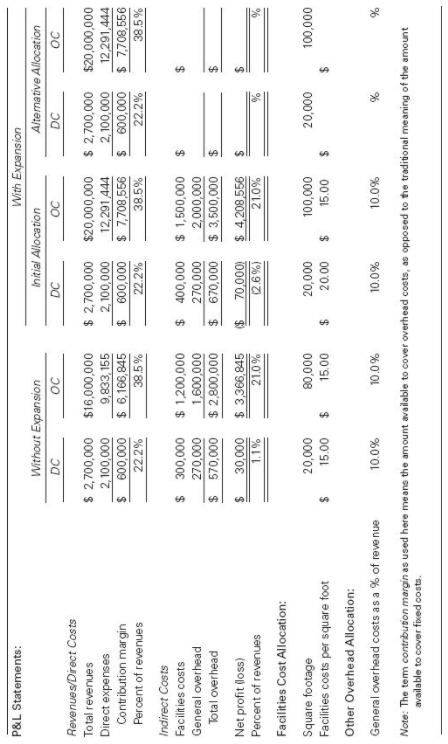

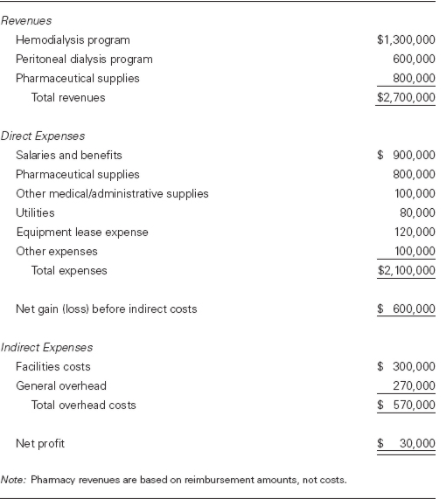

P&L Statements: Without Expansion DC OC With Expansion Initial Allocation Alternative Allocation DC DC OC Revenues/Direct Costs Total revenues Direct expenses Contribution margin Percent of revenues Indirect Costs Facilities costs General overhead Total overhead $ 2,700,000 2,100,000 $ 600,000 22.2% $16,000,000 9,833, 155 $ 6,166,845 38.5% $ 2,700,000 2,100,000 $ 600,000 22.2% $20,000,000 12,291 444 $ 7,708,556 38.5% $ 2,700,000 2,100,000 $ 600,000 22.2% $20,000,000 12,291,444 $ 7,708,556 38.5% $ $ 300,000 270,000 $ 570,000 $ 1,200,000 1,600,000 $ 2,800,000 $ 400,000 270,000 $ 670,000 $ 1,500,000 $ 2,000,000 $ 3,500,000 $ $ $ $ 30,000 1.1% $ 3,366,845 21.0% 70.000) 2.6%) $ 4,208,556 21.0% % % Net profit (loss) Percent of revenues Facilities Cost Allocation: Square footage Facilities costs per square foot Other Overhead Allocation: General overhead costs as a % of revenue 20,000 15.00 80,000 15.00 20,000 20.00 100,000 15.00 20,000 100,000 $ $ 10.0% 10.0% 10.0% 10.0% % % Note: The tem contribution margin as used here means the amount available to cover overhead costs, as opposed to the traditional meaning of the amount available to cover fixed costs. Revenues Hemodialysis program Peritoneal dialysis program Pharmaceutical supplies Total revenues $1,300,000 600,000 800,000 $2,700,000 Direct Expenses Salaries and benefits Pharmaceutical supplies Other medical/administrative supplies Utilities Equipment lease expense Other expenses Total expenses $ 900,000 800,000 100,000 80,000 120,000 100,000 $2,100,000 Net gain (loss) before indirect costs $ 600,000 Indirect Expenses Facilities costs General overhead Total overhead costs $ 300,000 270,000 $570,000 Net profit $ 30,000 Note: Phamacy revenues are based on reimbursement amounts, not costs. P&L Statements: Without Expansion DC OC With Expansion Initial Allocation Alternative Allocation DC DC OC Revenues/Direct Costs Total revenues Direct expenses Contribution margin Percent of revenues Indirect Costs Facilities costs General overhead Total overhead $ 2,700,000 2,100,000 $ 600,000 22.2% $16,000,000 9,833, 155 $ 6,166,845 38.5% $ 2,700,000 2,100,000 $ 600,000 22.2% $20,000,000 12,291 444 $ 7,708,556 38.5% $ 2,700,000 2,100,000 $ 600,000 22.2% $20,000,000 12,291,444 $ 7,708,556 38.5% $ $ 300,000 270,000 $ 570,000 $ 1,200,000 1,600,000 $ 2,800,000 $ 400,000 270,000 $ 670,000 $ 1,500,000 $ 2,000,000 $ 3,500,000 $ $ $ $ 30,000 1.1% $ 3,366,845 21.0% 70.000) 2.6%) $ 4,208,556 21.0% % % Net profit (loss) Percent of revenues Facilities Cost Allocation: Square footage Facilities costs per square foot Other Overhead Allocation: General overhead costs as a % of revenue 20,000 15.00 80,000 15.00 20,000 20.00 100,000 15.00 20,000 100,000 $ $ 10.0% 10.0% 10.0% 10.0% % % Note: The tem contribution margin as used here means the amount available to cover overhead costs, as opposed to the traditional meaning of the amount available to cover fixed costs. Revenues Hemodialysis program Peritoneal dialysis program Pharmaceutical supplies Total revenues $1,300,000 600,000 800,000 $2,700,000 Direct Expenses Salaries and benefits Pharmaceutical supplies Other medical/administrative supplies Utilities Equipment lease expense Other expenses Total expenses $ 900,000 800,000 100,000 80,000 120,000 100,000 $2,100,000 Net gain (loss) before indirect costs $ 600,000 Indirect Expenses Facilities costs General overhead Total overhead costs $ 300,000 270,000 $570,000 Net profit $ 30,000 Note: Phamacy revenues are based on reimbursement amounts, not costs

this revenue be counted when general allocations are made?

this revenue be counted when general allocations are made?