Answered step by step

Verified Expert Solution

Question

1 Approved Answer

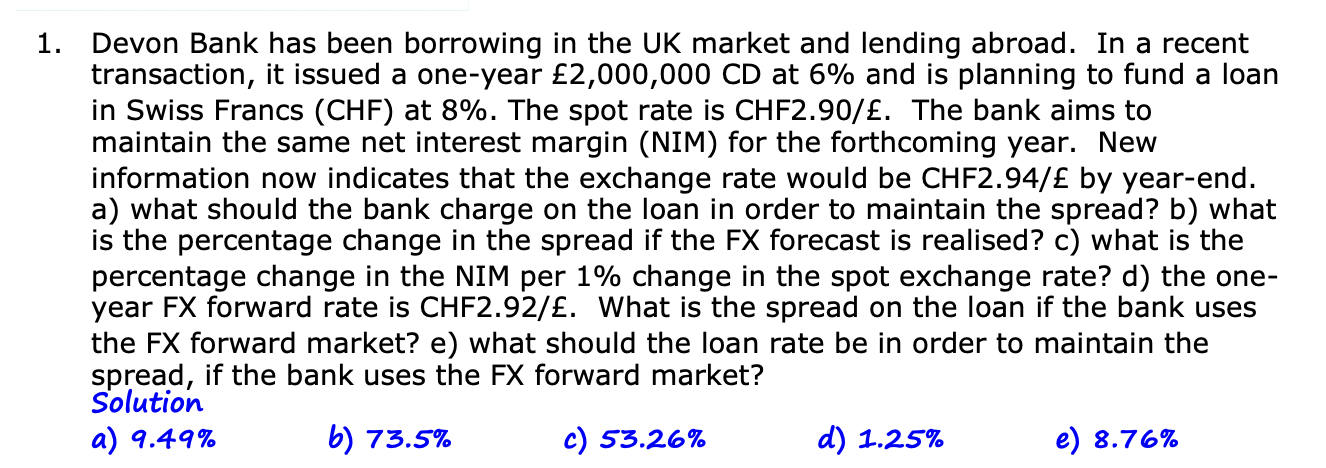

Devon Bank has been borrowing in the UK market and lending abroad. In a recent transaction, it issued a one - year 2 , 0

Devon Bank has been borrowing in the UK market and lending abroad. In a recent

transaction, it issued a oneyear at and is planning to fund a loan

in Swiss Francs CHF at The spot rate is CHF The bank aims to

maintain the same net interest margin NIM for the forthcoming year. New

information now indicates that the exchange rate would be CHF by yearend.

a what should the bank charge on the loan in order to maintain the spread? b what

is the percentage change in the spread if the FX forecast is realised? c what is the

percentage change in the NIM per change in the spot exchange rate? d the one

year FX forward rate is CHF What is the spread on the loan if the bank uses

the FX forward market? e what should the loan rate be in order to maintain the

spread, if the bank uses the FX forward market?

Solution

a

b

c

d

e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started