Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Devon's gross annual salary is $200,654 with biweekly paychecks. If he is single with 1 dependent child, compute the biweekly withholding his employer will send

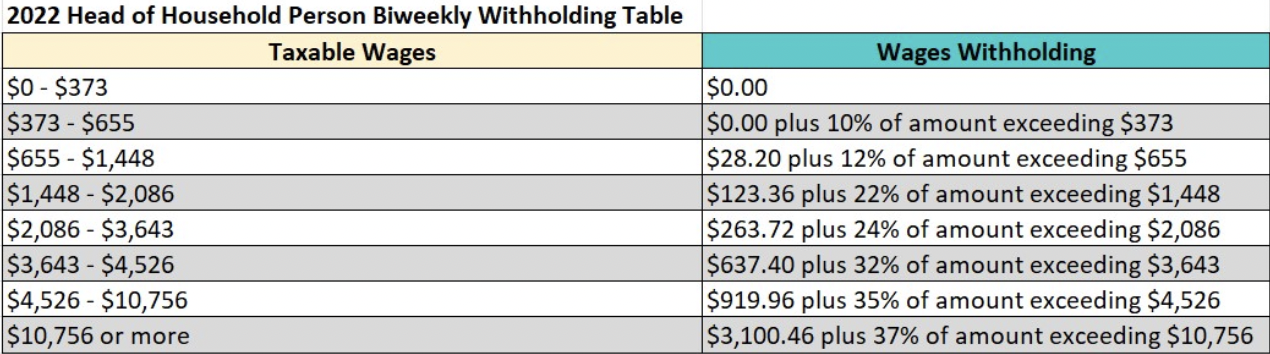

Devon's gross annual salary is $200,654 with biweekly paychecks. If he is single with 1 dependent child, compute the biweekly withholding his employer will send to the IRS.

Use the following information:

Biweekly allowance: $165.38 per person.

Round your answer to the nearest dollar.

2022 Head of Household Person Biweekly Withholding Table \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Taxable Wages } & \multicolumn{1}{c|}{ Wages Withholding } \\ \hline$0$373 & $0.00 \\ \hline$373$655 & $0.00 plus 10% of amount exceeding $373 \\ \hline$655$1,448 & $28.20 plus 12% of amount exceeding $655 \\ \hline$1,448$2,086 & $123.36 plus 22% of amount exceeding $1,448 \\ \hline$2,086$3,643 & $263.72 plus 24% of amount exceeding $2,086 \\ \hline$3,643$4,526 & $637.40 plus 32% of amount exceeding $3,643 \\ \hline$4,526$10,756 & $919.96 plus 35% of amount exceeding $4,526 \\ \hline$10,756 or more & $3,100.46 plus 37% of amount exceeding $10,756 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started