Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dex owns and operates Feeling Rocky Inc (FR), a San Diego-based climbing gym. In 2022, FR reported $1,432,000 of book income on their audited

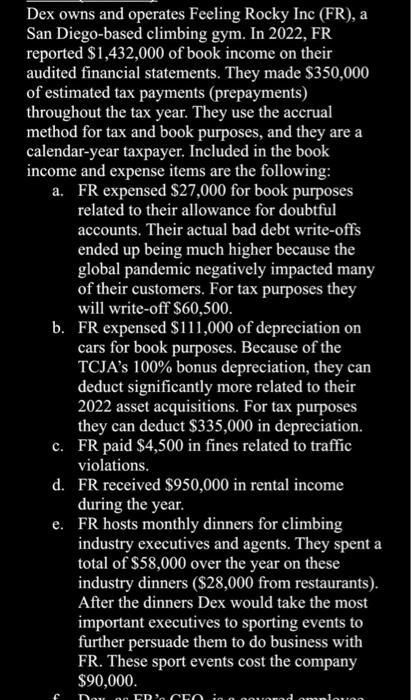

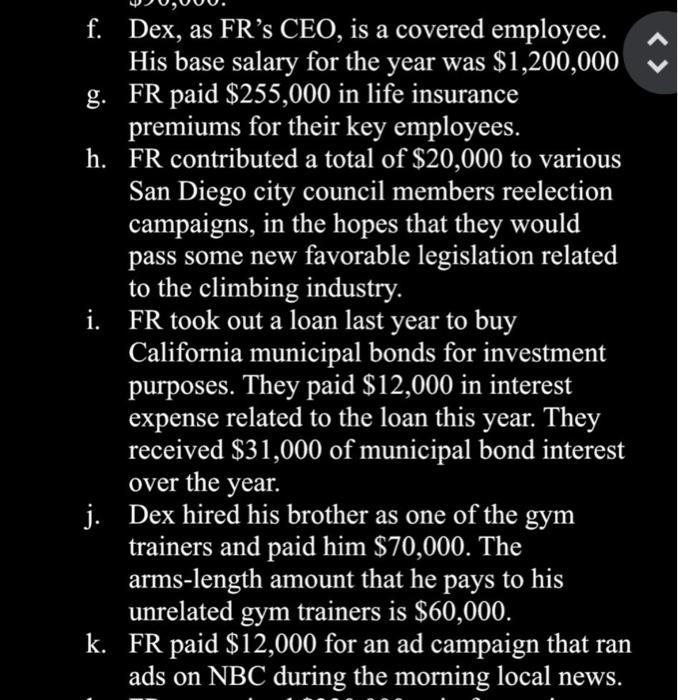

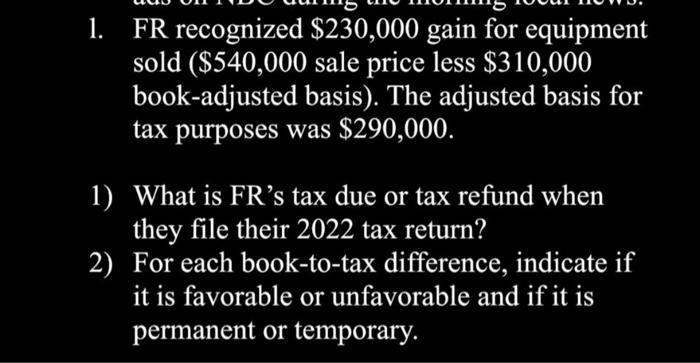

Dex owns and operates Feeling Rocky Inc (FR), a San Diego-based climbing gym. In 2022, FR reported $1,432,000 of book income on their audited financial statements. They made $350,000 of estimated tax payments (prepayments) throughout the tax year. They use the accrual method for tax and book purposes, and they are a calendar-year taxpayer. Included in the book income and expense items are the following: a. FR expensed $27,000 for book purposes related to their allowance for doubtful accounts. Their actual bad debt write-offs ended up being much higher because the global pandemic negatively impacted many of their customers. For tax purposes they will write-off $60,500. b. FR expensed $111,000 of depreciation on cars for book purposes. Because of the TCJA's 100% bonus depreciation, they can deduct significantly more related to their 2022 asset acquisitions. For tax purposes they can deduct $335,000 in depreciation. FR paid $4,500 in fines related to traffic violations. c. d. FR received $950,000 in rental income during the year. e. FR hosts monthly dinners for climbing industry executives and agents. They spent a total of $58,000 over the year on these industry dinners ($28,000 from restaurants). After the dinners Dex would take the most important executives to sporting events to further persuade them to do business with FR. These sport events cost the company $90,000. f Day on FR's CEO ing wad dovan f. Dex, as FR's CEO, is a covered employee. His base salary for the year was $1,200,000 FR paid $255,000 in life insurance premiums for their key employees. g. h. FR contributed a total of $20,000 to various San Diego city council members reelection campaigns, in the hopes that they would pass some new favorable legislation related to the climbing industry. i. FR took out a loan last year to buy California municipal bonds for investment purposes. They paid $12,000 in interest expense related to the loan this year. They received $31,000 of municipal bond interest over the year. j. Dex hired his brother as one of the gym trainers and paid him $70,000. The arms-length amount that he pays to his unrelated gym trainers is $60,000. k. FR paid $12,000 for an ad campaign that ran ads on NBC during the morning local news. 1. FR recognized $230,000 gain for equipment sold ($540,000 sale price less $310,000 book-adjusted basis). The adjusted basis for tax purposes was $290,000. 1) What is FR's tax due or tax refund when they file their 2022 tax return? 2) For each book-to-tax difference, indicate if it is favorable or unfavorable and if it is permanent or temporary.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started