Answered step by step

Verified Expert Solution

Question

1 Approved Answer

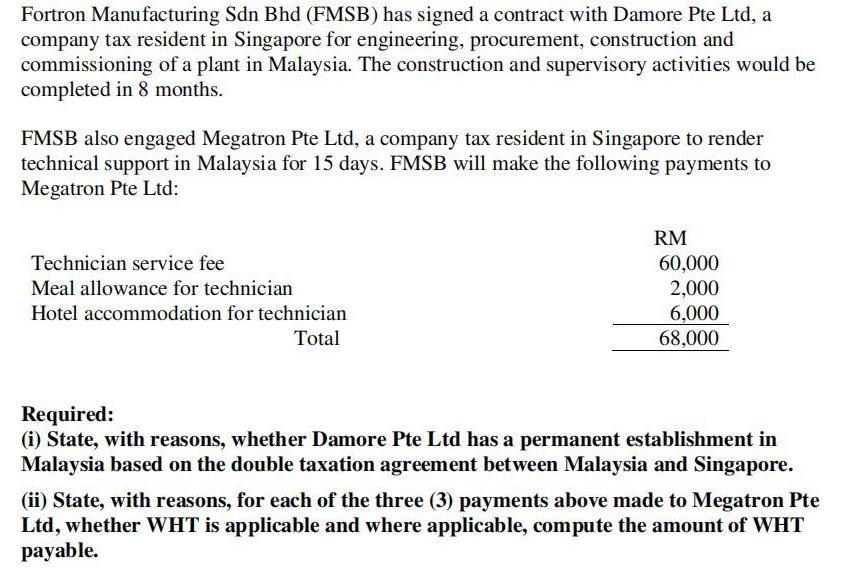

Fortron Manufacturing Sdn Bhd (FMSB) has signed a contract with Damore Pte Ltd, a company tax resident in Singapore for engineering, procurement, construction and

Fortron Manufacturing Sdn Bhd (FMSB) has signed a contract with Damore Pte Ltd, a company tax resident in Singapore for engineering, procurement, construction and commissioning of a plant in Malaysia. The construction and supervisory activities would be completed in 8 months. FMSB also engaged Megatron Pte Ltd, a company tax resident in Singapore to render technical support in Malaysia for 15 days. FMSB will make the following payments to Megatron Pte Ltd: Technician service fee Meal allowance for technician Hotel accommodation for technician Total RM 60,000 2,000 6,000 68,000 Required: (i) State, with reasons, whether Damore Pte Ltd has a permanent establishment in Malaysia based on the double taxation agreement between Malaysia and Singapore. (ii) State, with reasons, for each of the three (3) payments above made to Megatron Pte Ltd, whether WHT is applicable and where applicable, compute the amount of WHT payable.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

i Based on the double taxation agreement between Malaysia and Singapore Damore Pte Ltd has a permane...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started