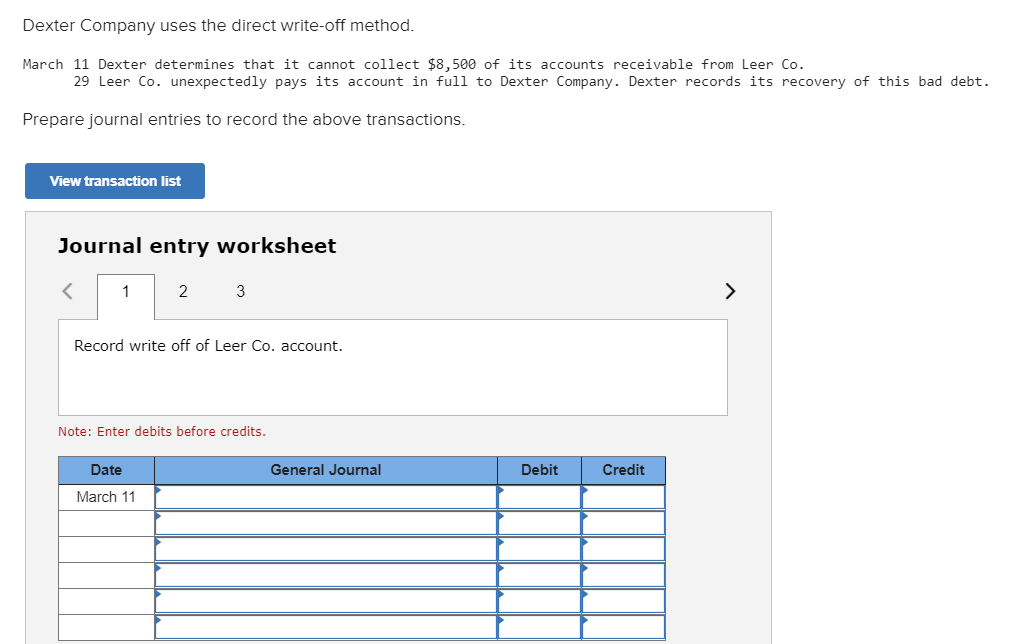

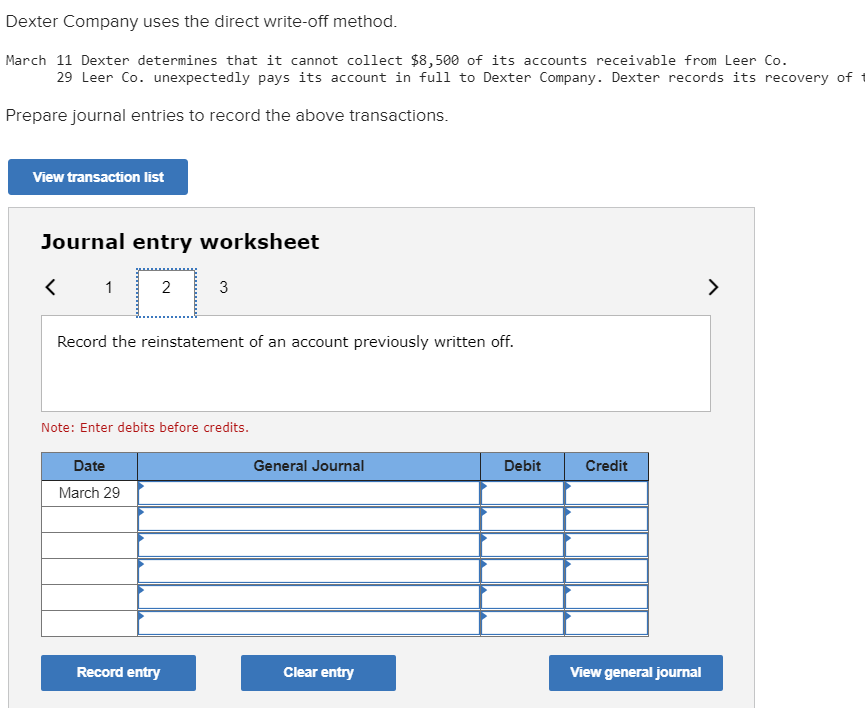

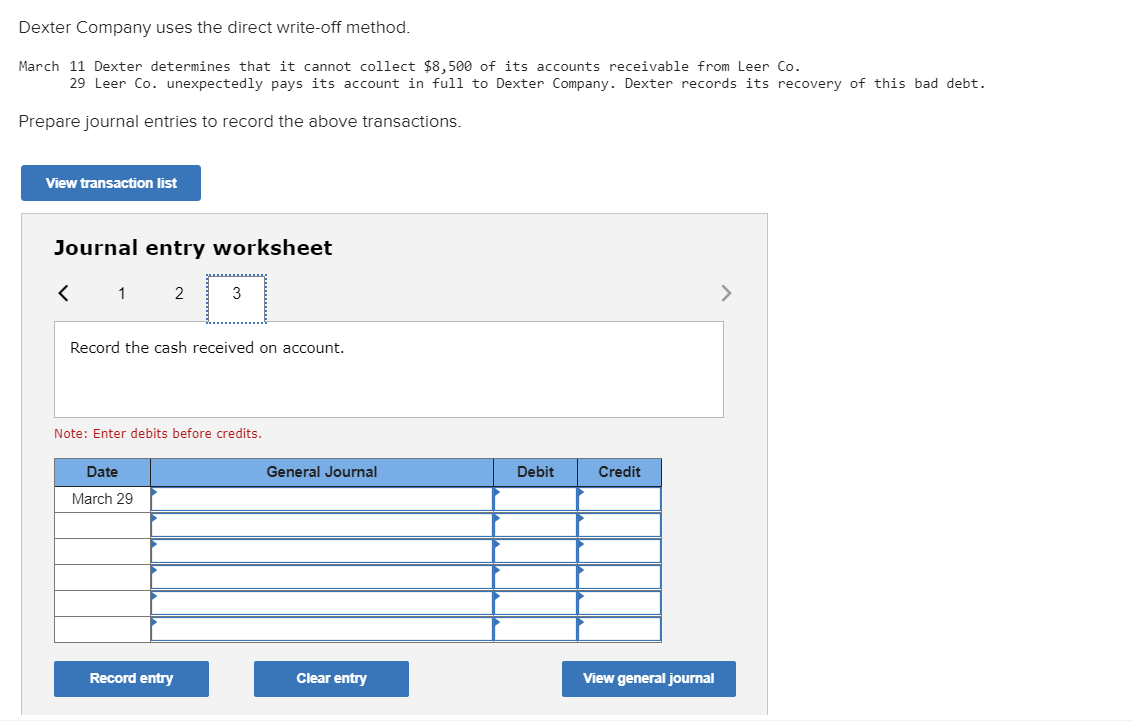

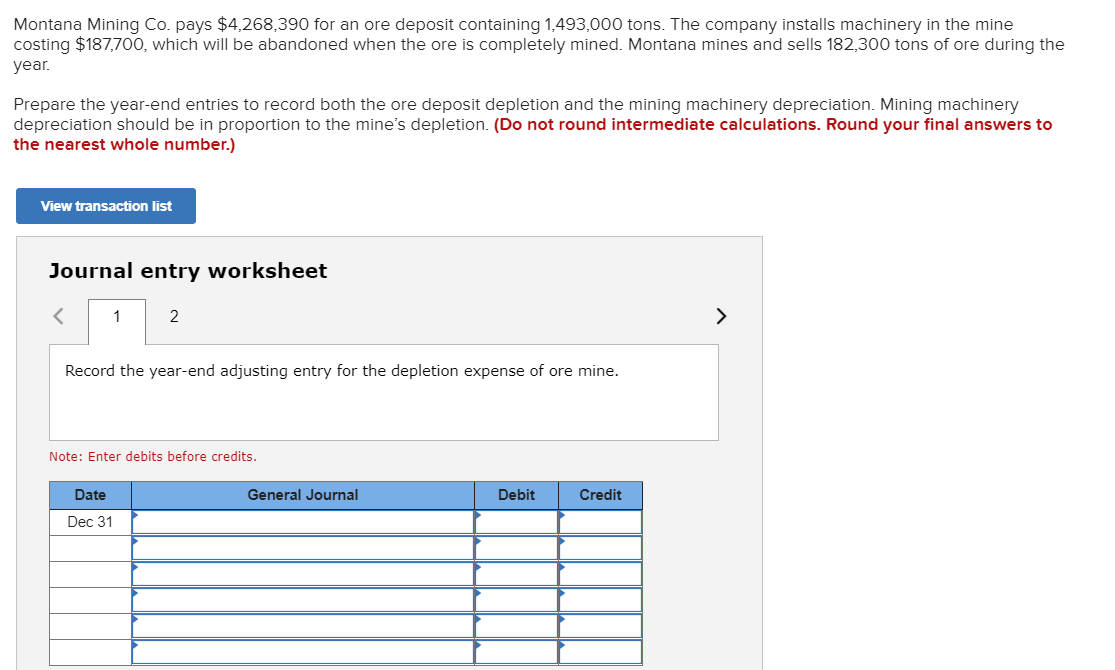

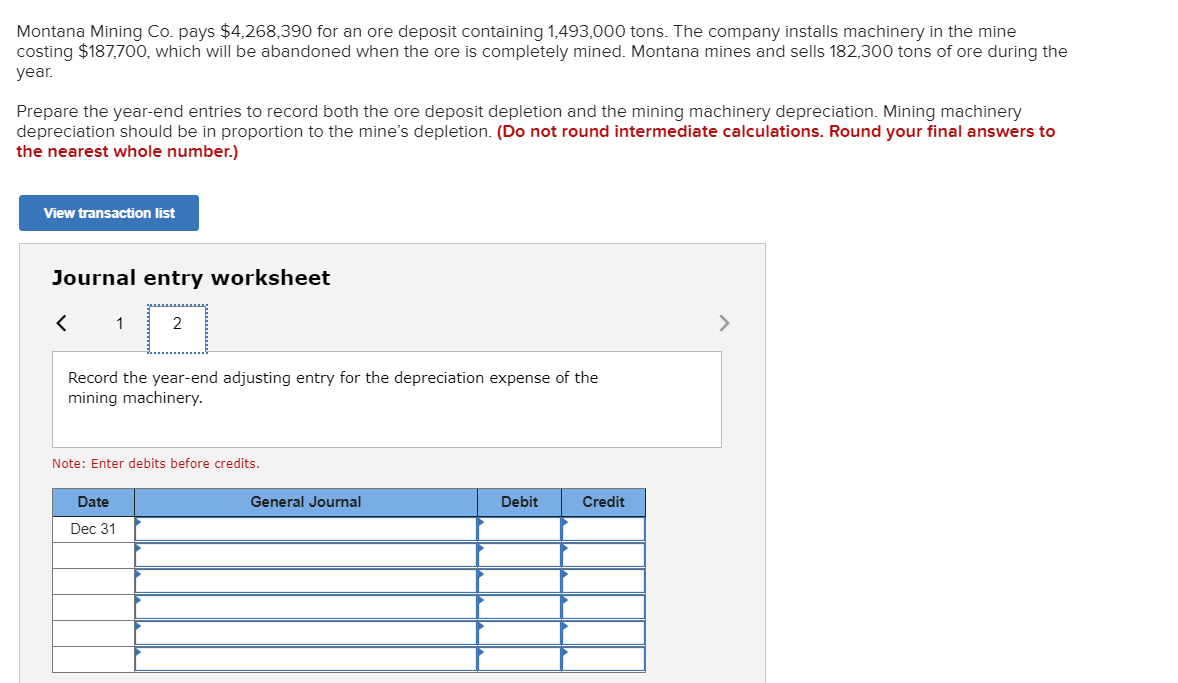

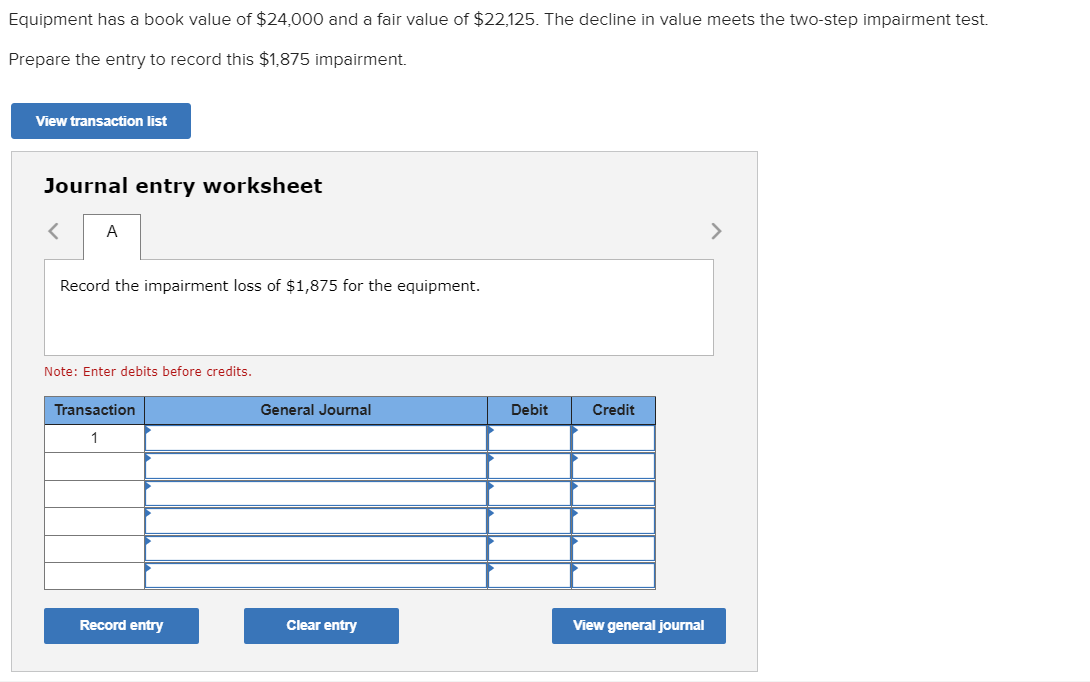

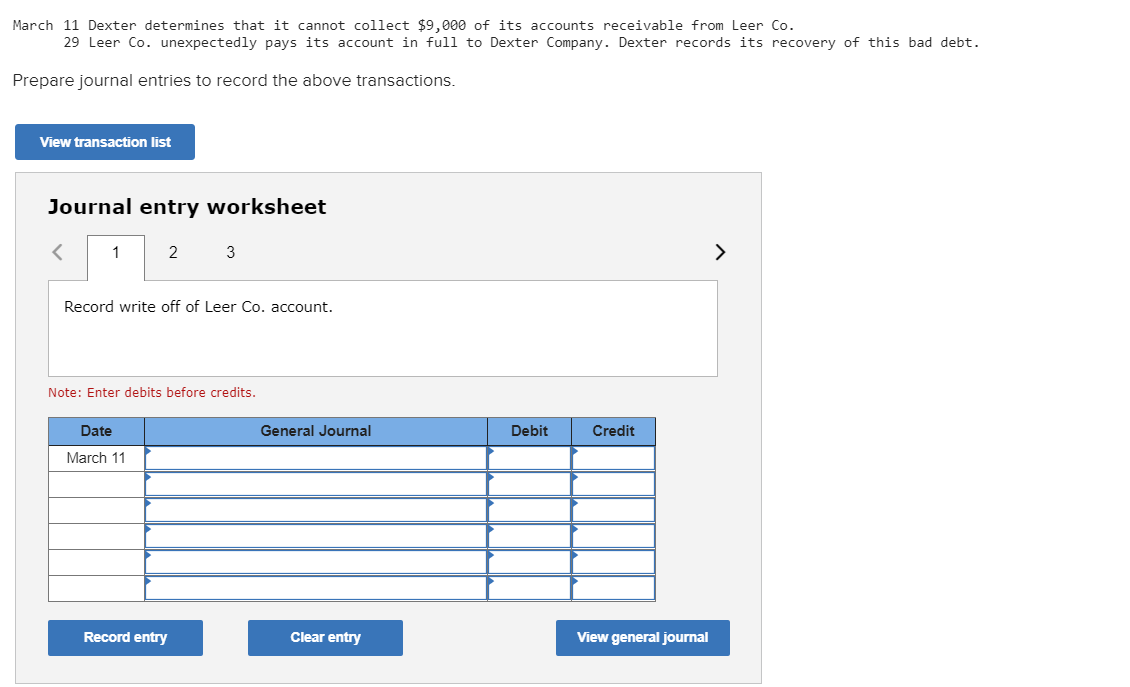

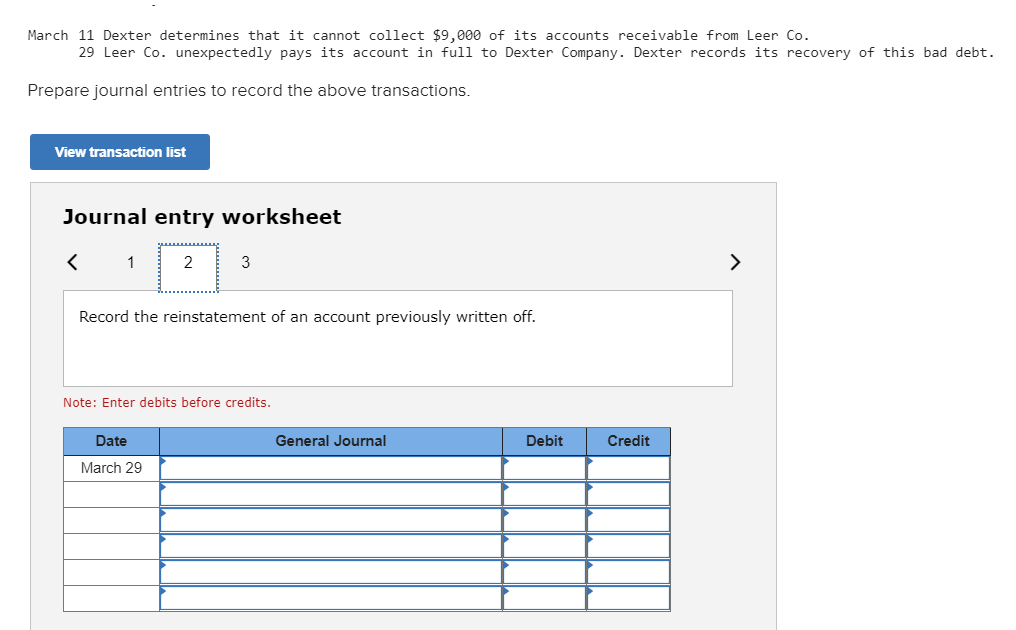

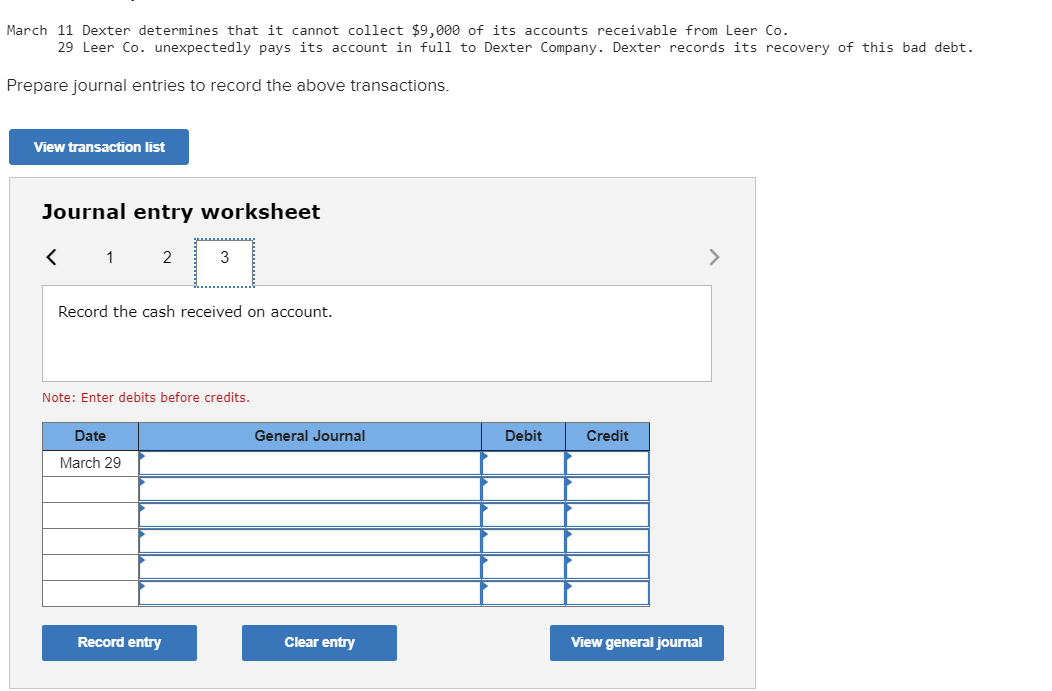

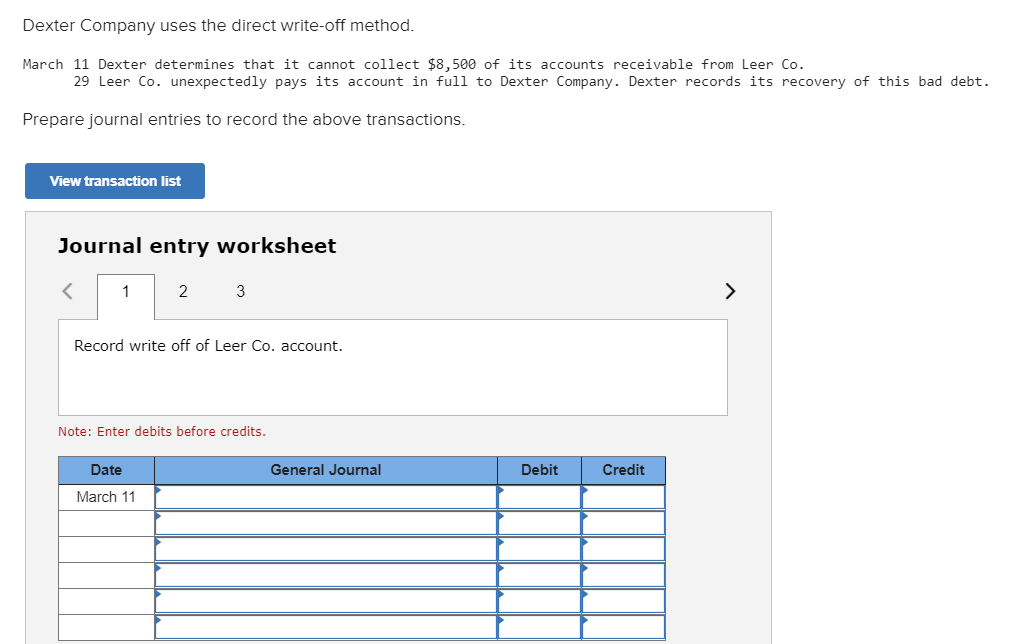

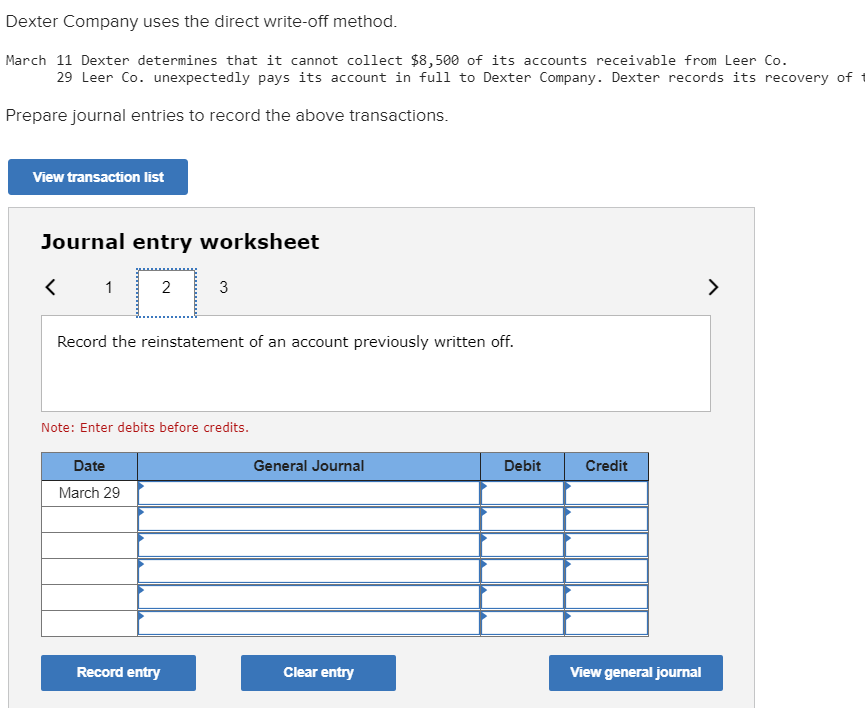

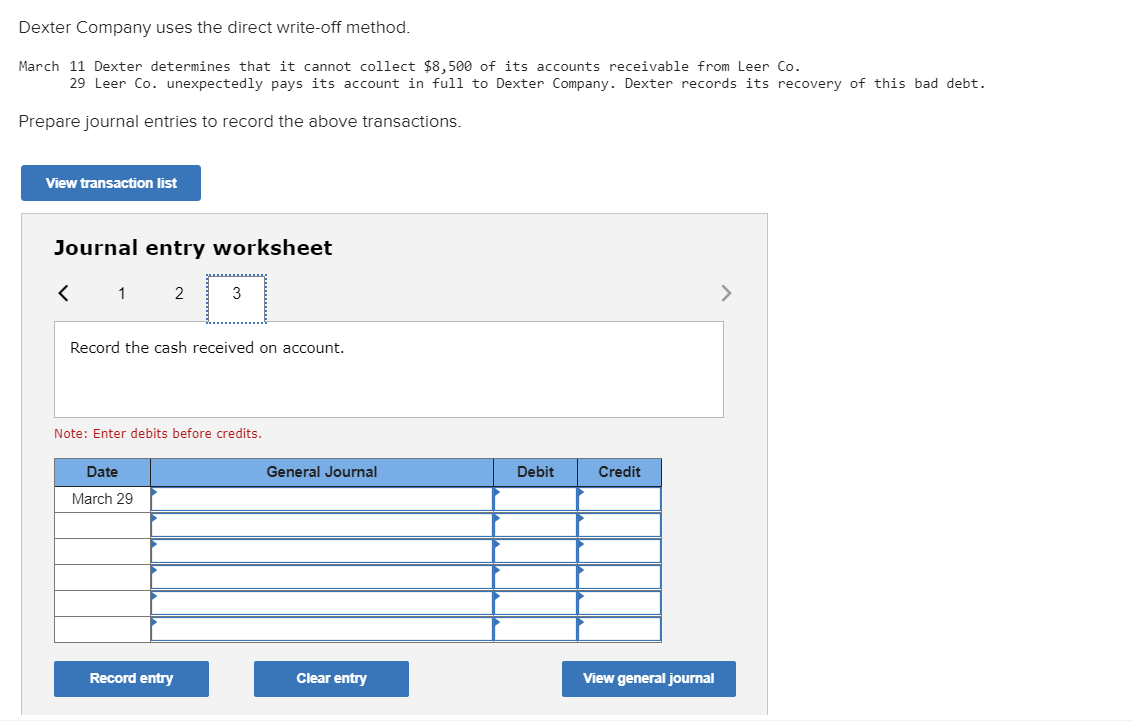

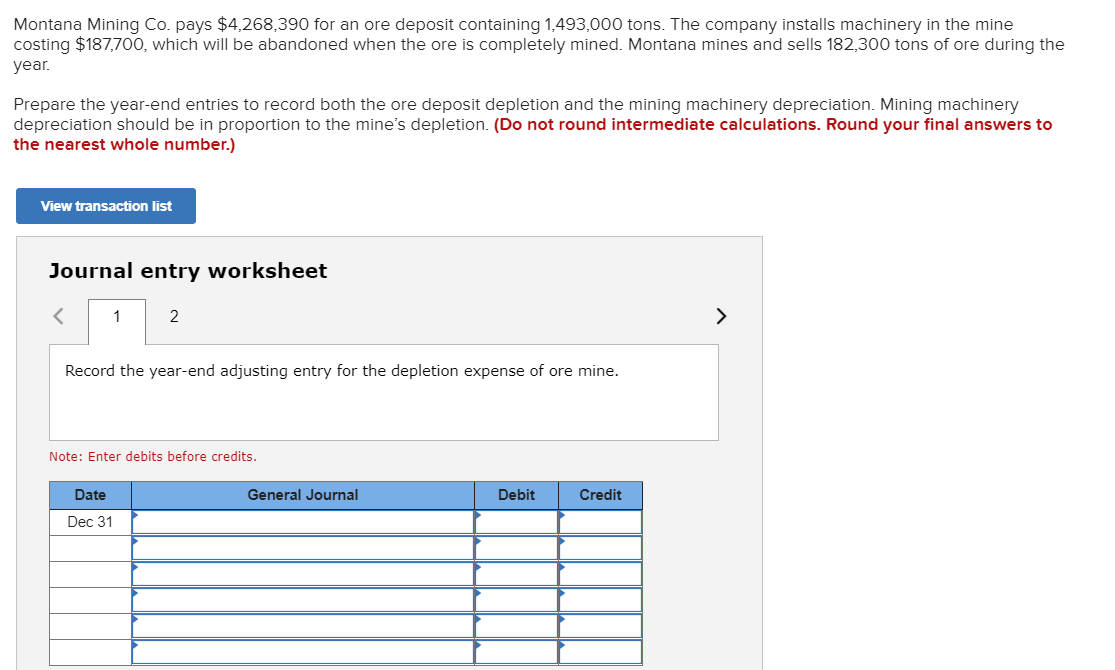

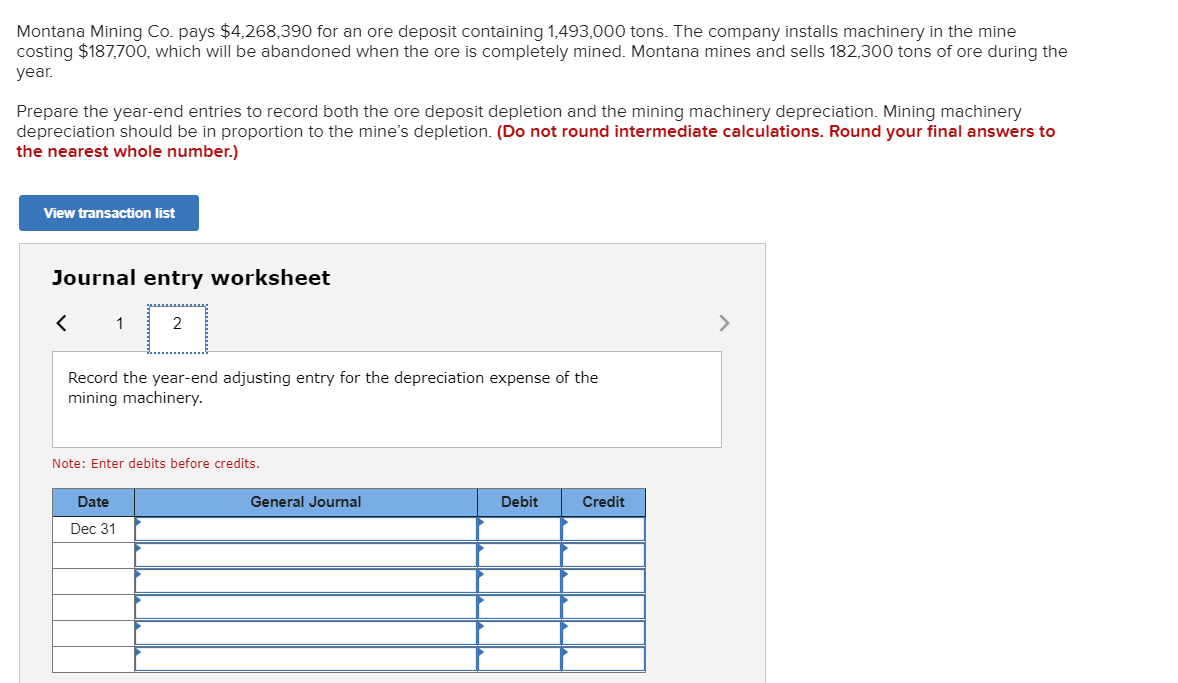

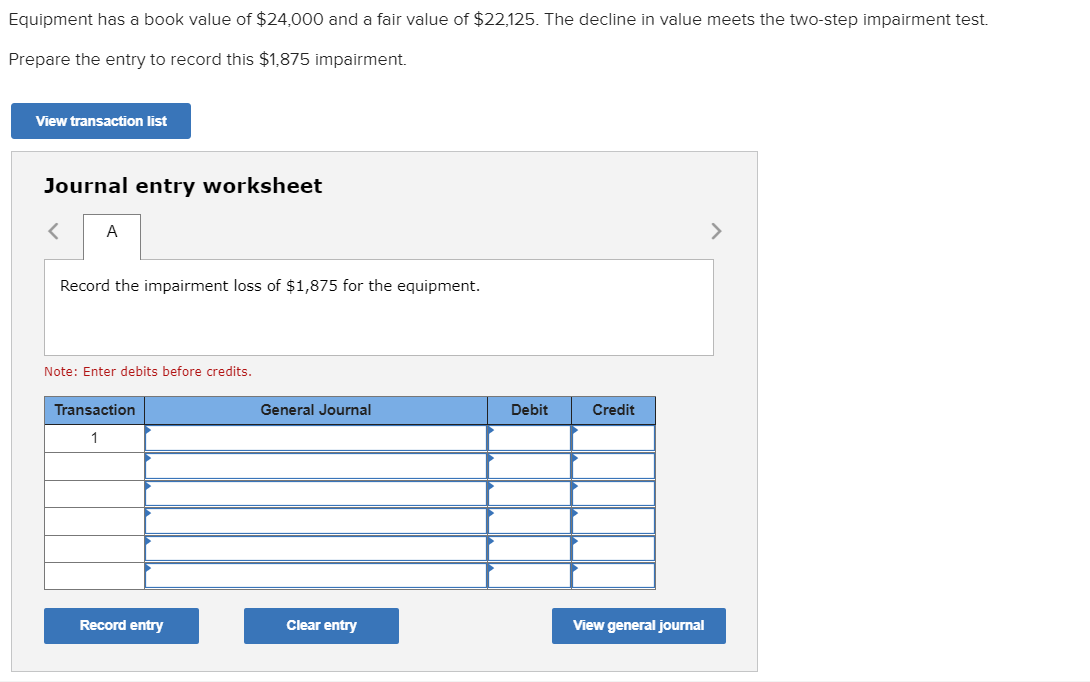

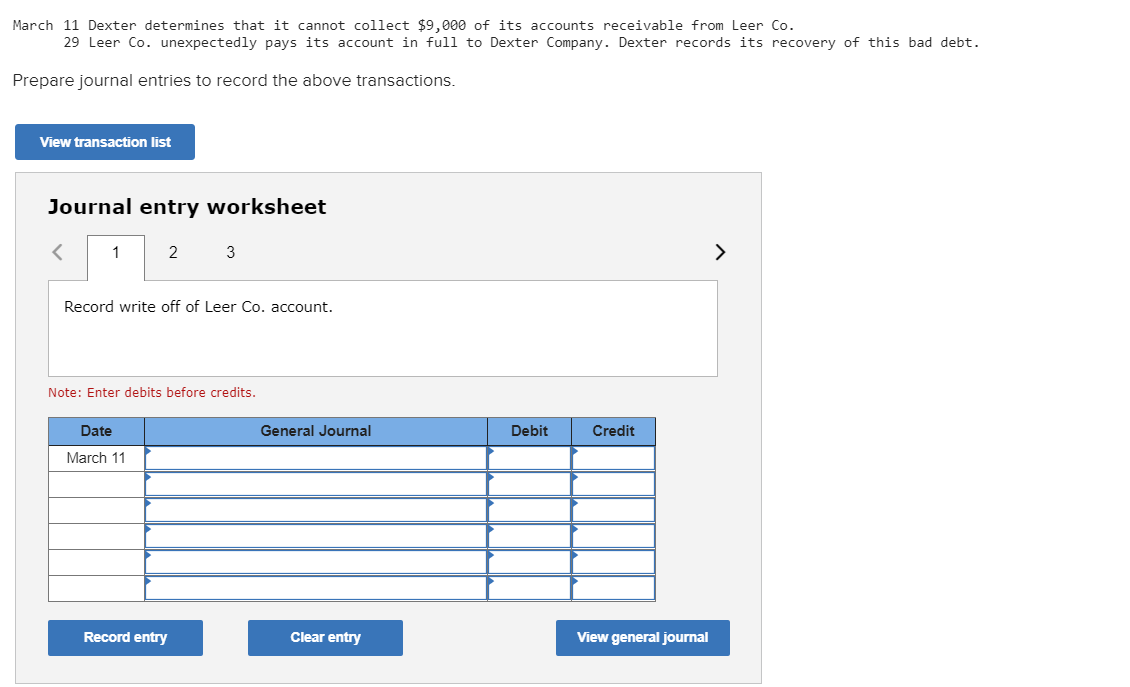

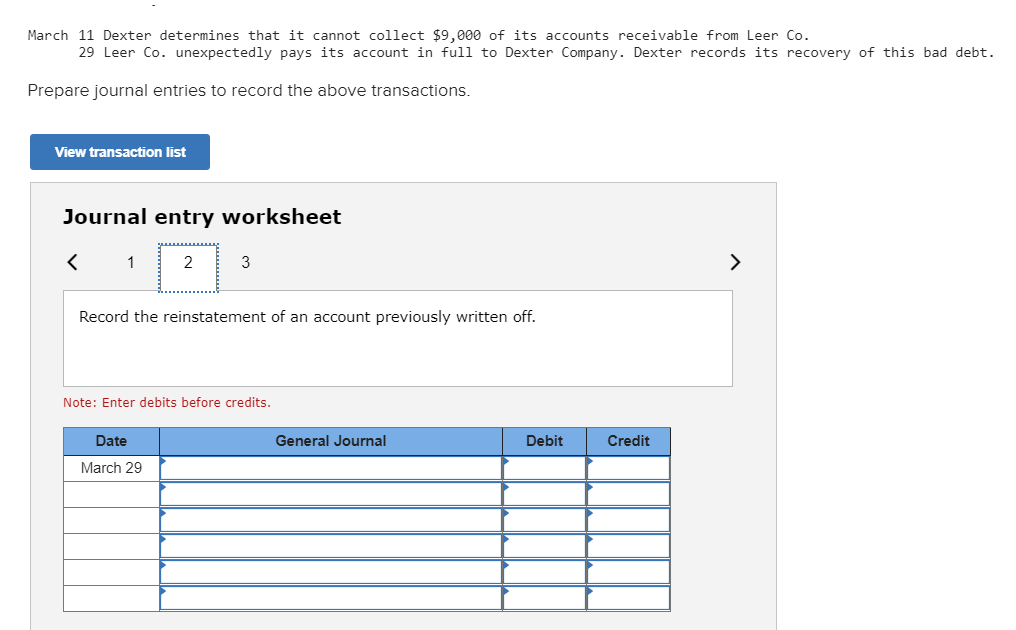

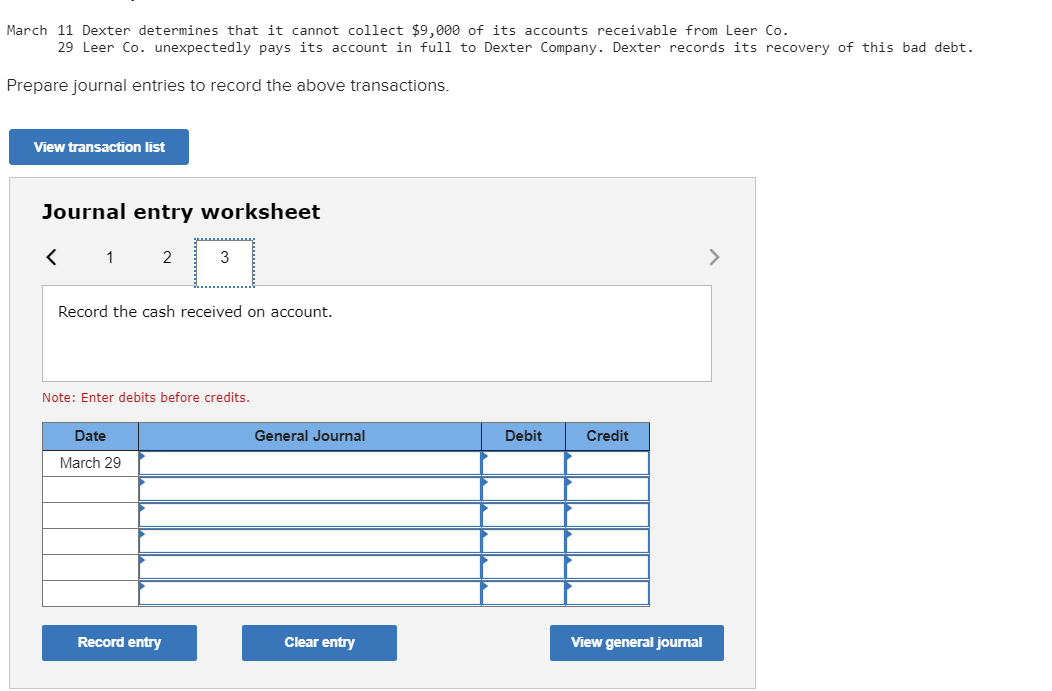

Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $8,500 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet Record write off of Leer Co. account. Note: Enter debits before credits. Date General Journal Debit Credit March 11 Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $8,500 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet Record the reinstatement of an account previously written off. Note: Enter debits before credits. General Journal Debit Credit Date March 29 Record entry Clear entry View general journal Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $8,500 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet Record the year-end adjusting entry for the depletion expense of ore mine. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Montana Mining Co. pays $4,268,390 for an ore deposit containing 1,493,000 tons. The company installs machinery in the mine costing $187,700, which will be abandoned when the ore is completely mined. Montana mines and sells 182,300 tons of ore during the year. Prepare the year-end entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) View transaction list Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of the mining machinery. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Equipment has a book value of $24,000 and a fair value of $22,125. The decline in value meets the two-step impairment test. Prepare the entry to record this $1,875 impairment. View transaction list Journal entry worksheet Record write off of Leer Co. account. Note: Enter debits before credits. Date General Journal Debit Credit March 11 Record entry Clear entry View general journal March 11 Dexter determines that it cannot collect $9,000 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet Record the reinstatement of an account previously written off. Note: Enter debits before credits. Date General Journal Debit Credit March 29 March 11 Dexter determines that it cannot collect $9,000 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet