Answered step by step

Verified Expert Solution

Question

1 Approved Answer

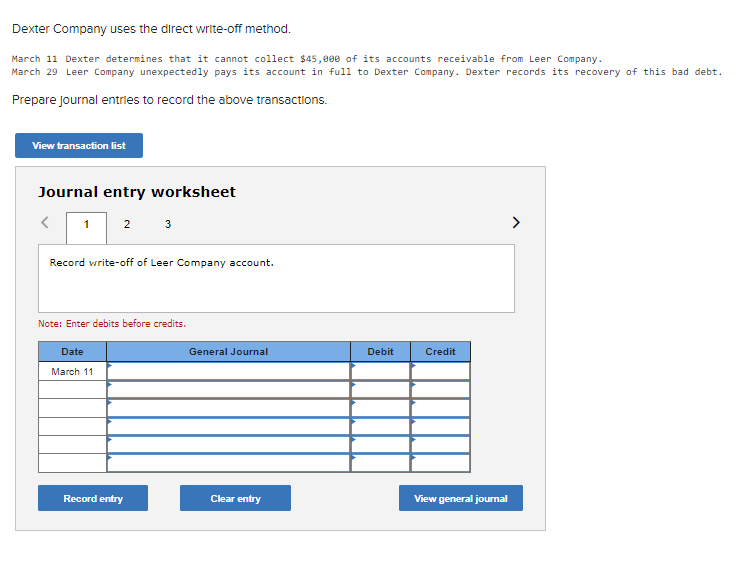

Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from Leer Company. March

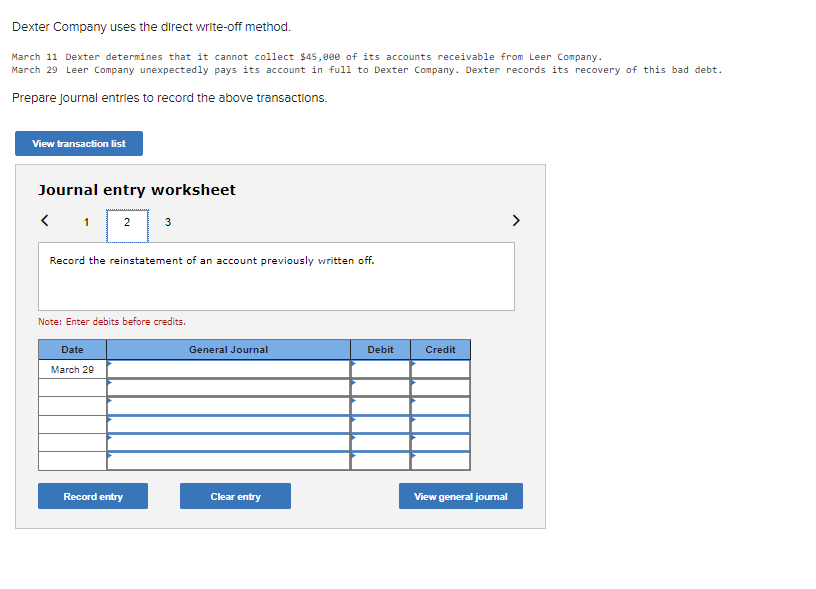

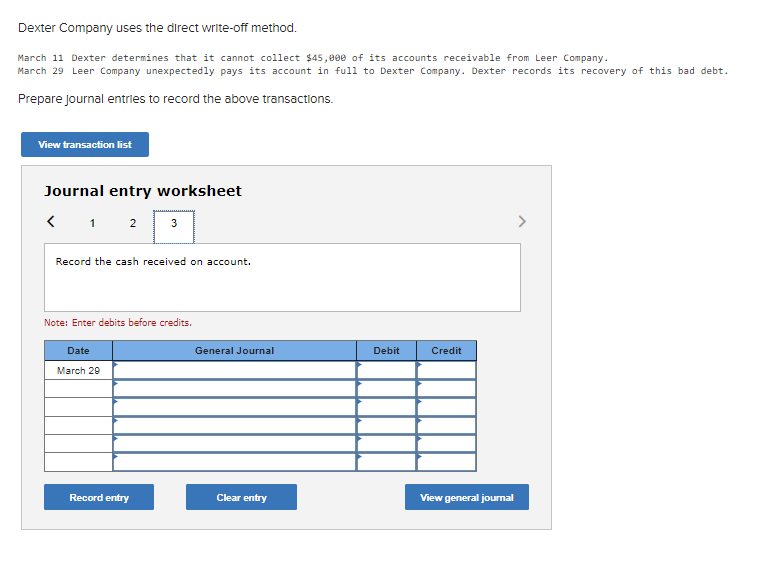

Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet < 1 2 3 Record write-off of Leer Company account. Note: Enter debits before credits. Date March 11 General Journal Debit Credit Record entry Clear entry View general journal > Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet 1 2 3 Record the reinstatement of an account previously written off. Note: Enter debits before credits. Date March 29 General Journal Debit Credit Record entry Clear entry View general journal Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet < 1 2 3 Record the cash received on account. Note: Enter debits before credits. Date March 29 General Journal Debit Credit Record entry Clear entry View general journal >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started