Answered step by step

Verified Expert Solution

Question

1 Approved Answer

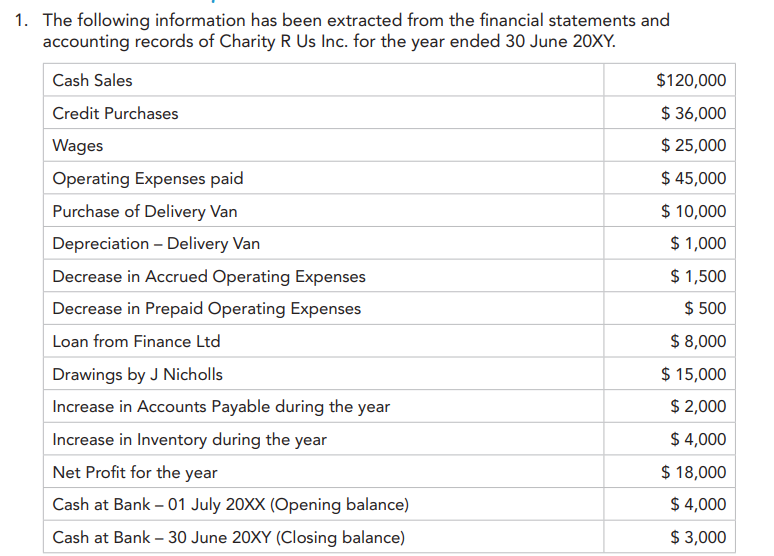

1. The following information has been extracted from the financial statements and accounting records of Charity R Us Inc. for the year ended 30

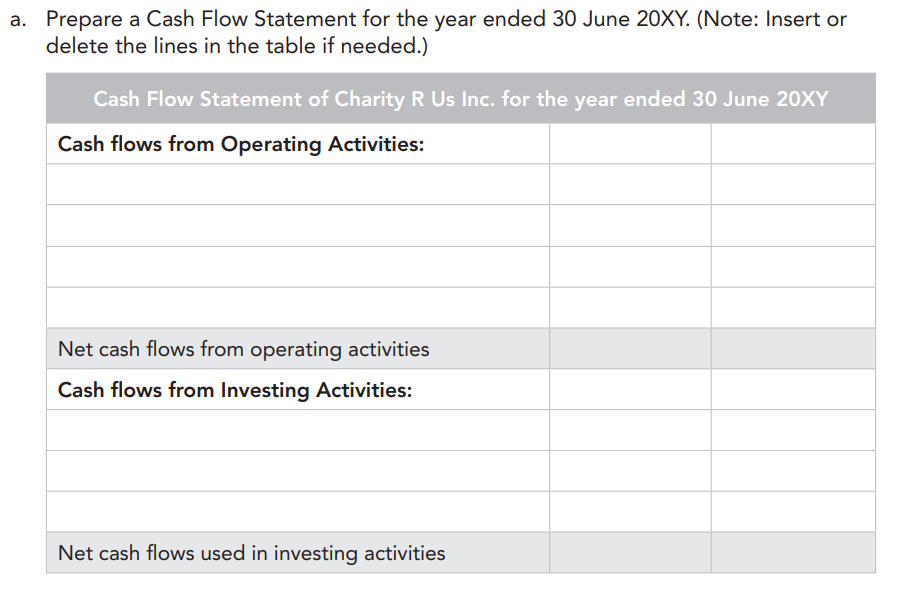

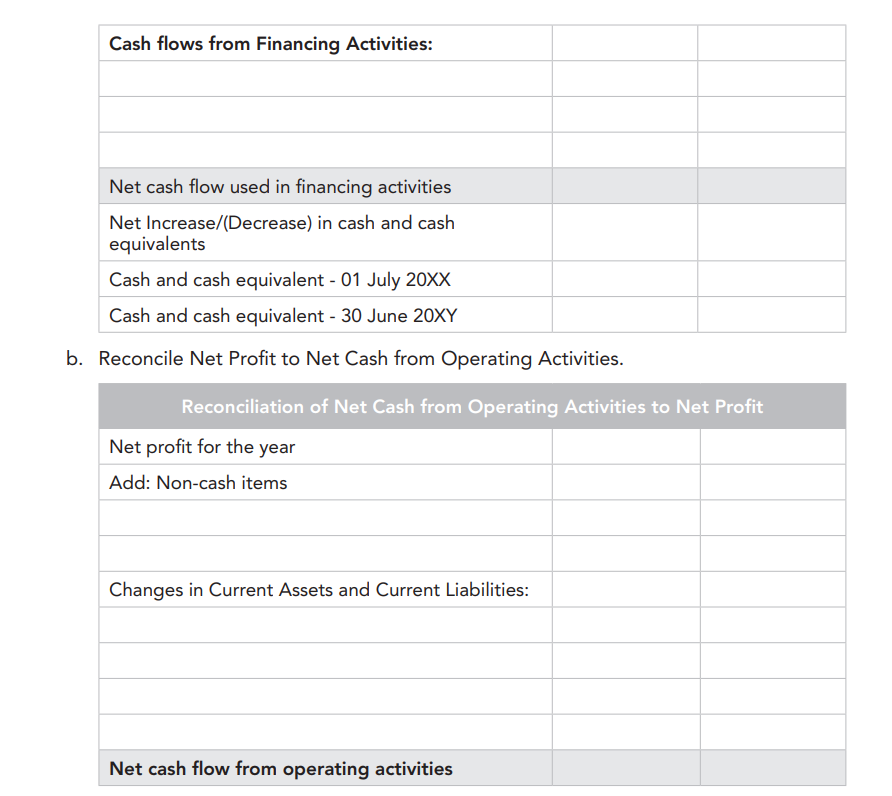

1. The following information has been extracted from the financial statements and accounting records of Charity R Us Inc. for the year ended 30 June 20XY. Cash Sales Credit Purchases Wages Operating Expenses paid Purchase of Delivery Van Depreciation - Delivery Van Decrease in Accrued Operating Expenses Decrease in Prepaid Operating Expenses Loan from Finance Ltd Drawings by J Nicholls Increase in Accounts Payable during the year Increase in Inventory during the year Net Profit for the year Cash at Bank - 01 July 20XX (Opening balance) Cash at Bank - 30 June 20XY (Closing balance) $120,000 $ 36,000 $ 25,000 $ 45,000 $ 10,000 $1,000 $1,500 $ 500 $ 8,000 $ 15,000 $ 2,000 $ 4,000 $ 18,000 $ 4,000 $ 3,000 a. Prepare a Cash Flow Statement for the year ended 30 June 20XY. (Note: Insert or delete the lines in the table if needed.) Cash Flow Statement of Charity R Us Inc. for the year ended 30 June 20XY Cash flows from Operating Activities: Net cash flows from operating activities Cash flows from Investing Activities: Net cash flows used in investing activities Cash flows from Financing Activities: Net cash flow used in financing activities Net Increase/(Decrease) in cash and cash equivalents Cash and cash equivalent - 01 July 20XX Cash and cash equivalent - 30 June 20XY b. Reconcile Net Profit to Net Cash from Operating Activities. Reconciliation of Net Cash from Operating Activities to Net Profit Net profit for the year Add: Non-cash items Changes in Current Assets and Current Liabilities: Net cash flow from operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started