Question

Dexters Chicken Dexter pored over the table of data he had compiled using inputs from purchasing, internal inventory managers, accounting, and Disco (Dexters Chickens purchasing

Dexters Chicken

Dexter pored over the table of data he had compiled using inputs from purchasing, internal inventory managers, accounting, and Disco (Dexters Chickens purchasing co-op and sole distributor). He hoped that he had enough information to make a well-founded decision regarding whether, and how, to invest in the product traceability initiative he and Disco had been discussing. Dexters Chicken was a popular restaurant chain with about 250 stores located throughout the Southeast United States. While sales growth had been steady, Dexter (the owner of the company) was concerned about the large capital investments the company had been making in inventories to support sales growth. In addition to adding stores, Dexters had frequently been adding new menu items, including limited-time-offer (LTO) items as a way to attract new customers. These tactics were common in the quick service restaurant (QSR) industry, as growing competition continued to put pressure on prices and QSR chains fiercely fought for market share. However, slowly rising inflation on produce, dairy, and other food items threatened to shrink profit margins, and the costs of inventory were becoming more and more noticeable as a major sink of funds. Because of the recent Food Modernization Act, along with a number of highly publicized foodborne illness incidents, QSR firms were becoming much more concerned about food safety and recalls. These demands necessitated greater levels of traceability in QSR supply chains. Traceability is the ability of food service partners to quickly verify the history, location, and usage of product. It requires coordinated efforts of trading partners to collect and maintain product information that supports batch/lot or serial number visibility of the products movement through distribution channels. Practically speaking, building traceability for QSR firms usually meant making heavy investments in setting product identification standards, installing scanning technology, and developing data management systems. These investments would be required at least at Dexters distributors and in the back office receiving areas of its stores. Dexter wanted to make sure that he considered all the costs and benefits of pursuing the traceability option. It seemed as though the industry was moving in this direction, and he did not want to fall behind. However, Disco estimated that it would need to raise prices by 3 percent across the board in order to install scanners, systems, and training required to support the traceability initiative. Dexter estimated that required investments in his own restaurant stores would total $11.5 million, but he expected that inventory management costs should actually go down. Automation and more accurate inventory information provided by scanning and tracking would cut down on uncertainties in the deliveries and availability of items in the stores. Shelf life was a big issue in stores, with food spoilage rates of up to 40 percent. Better traceability might also significantly lower the cost and improve the accuracy of product recalls, should a quality problem arise. Finally, a growing number of consumers wanted to know the provenance (origins) of the foods that they ate, causing Dexter to wonder if there might be some positive brand benefits from traceability investments.

Questions

1. Should Dexter go ahead with the traceability initiative? How much should he be willing to invest in technology and training to implement new processes?

2. What else can be done to reduce inventory costs at Dexters Chicken?

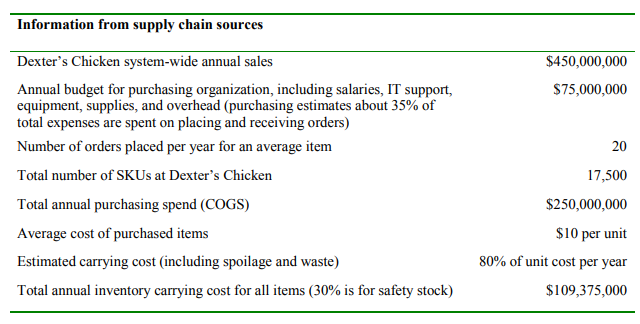

Information from supply chain sources \begin{tabular}{lr} \hline Dexter's Chicken system-wide annual sales & $450,000,000 \\ Annual budget for purchasing organization, including salaries, IT support, & $75,000,000 \\ equipment, supplies, and overhead (purchasing estimates about 35% of total expenses are spent on placing and receiving orders) & 20 \\ Number of orders placed per year for an average item & 17,500 \\ Total number of SKUs at Dexter's Chicken & $250,000,000 \\ Total annual purchasing spend (COGS) & $10 per unit \\ Average cost of purchased items & 80% of unit cost per year \\ Estimated carrying cost (including spoilage and waste) & $109,375,000 \\ \hline Total annual inventory carrying cost for all items (30\% is for safety stock) & \\ \hline \end{tabular} Information from supply chain sources \begin{tabular}{lr} \hline Dexter's Chicken system-wide annual sales & $450,000,000 \\ Annual budget for purchasing organization, including salaries, IT support, & $75,000,000 \\ equipment, supplies, and overhead (purchasing estimates about 35% of total expenses are spent on placing and receiving orders) & 20 \\ Number of orders placed per year for an average item & 17,500 \\ Total number of SKUs at Dexter's Chicken & $250,000,000 \\ Total annual purchasing spend (COGS) & $10 per unit \\ Average cost of purchased items & 80% of unit cost per year \\ Estimated carrying cost (including spoilage and waste) & $109,375,000 \\ \hline Total annual inventory carrying cost for all items (30\% is for safety stock) & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started