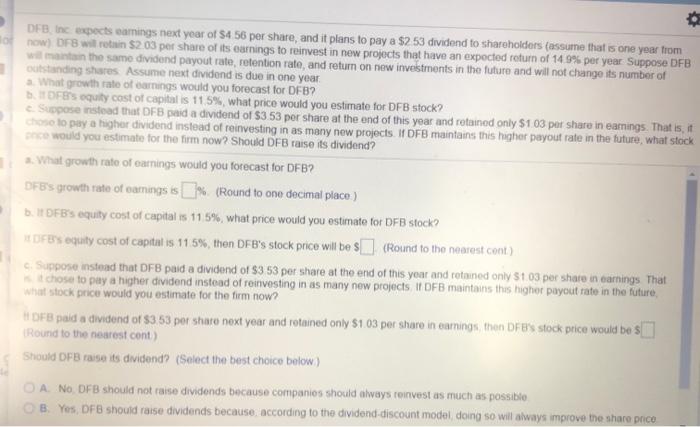

DFB Inc expects camings next year of $4 56 per share, and it plans to pay a $2 53 dividend to shareholders (assume that is one year from o now) DFB will retain $2 03 per share of its earnings to reinvest in new projects that have an expected return of 14.9% per year Suppose DFB w maten the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares Assume next dividend is due in one year What growth rate of earnings would you forecast for DFB? Fes equity cost of capital is 115%, what price would you estimate for DFB stock? Suspose instead that DFB paid a dividend of $3 53 per share at the end of this year and retained only $103 pat share in earnings. That is, it chose to pay a higher dividend instead of reinvesting in as many new projects. If DFB maintains this higher payout rate in the future, what stock co would you estimate for the firm now? Should DFB raise its dividend? What growth rate of earnings would you forecast for DFB? DFB's growth rate of earnings is % (Round to one decimal place) D. DFB's equity cost of capital is 115%, what price would you estimate for DFB stock DFBs equity cost of capital is 11.5%, then DFB's stock price will be $(Round to the nearest cont) c. Suppose instead that DFB paid a dividend of $3 53 per share at the end of this year and retained only St 03 per share in earnings That chose to pay a higher dividend instead of reinvesting in as many new projectsIt DFB maintains the higher payout rate in the future, What stock price would you estimate for the firm now? I DFB paid a dividend of $3,53 per share next year and retained only $1.03 per share in earnings, then DFBS stock price would be s Round to the nearest cont) Should DFB raise its dividend? (Select the best choice below) DA NO DFB should not raise dividends because companies should always reinvest as much as possible B: Yes, DFB should raise dividends because, according to the dividend-discount model, doing so will always improve the share pico