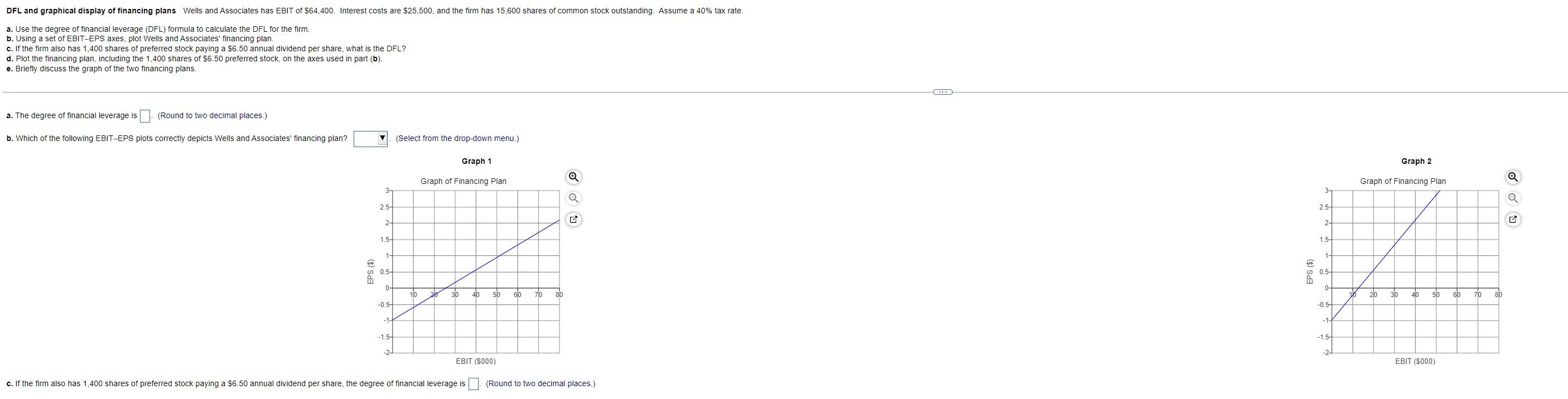

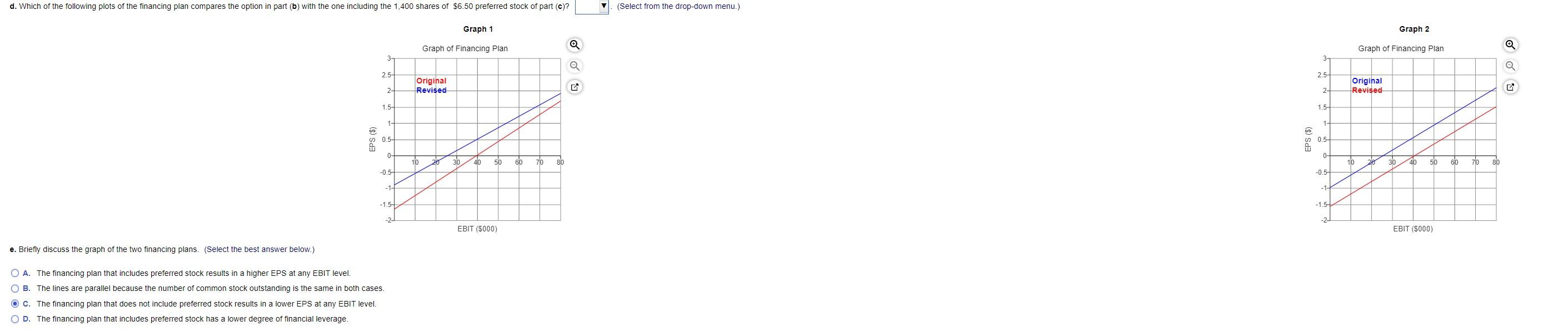

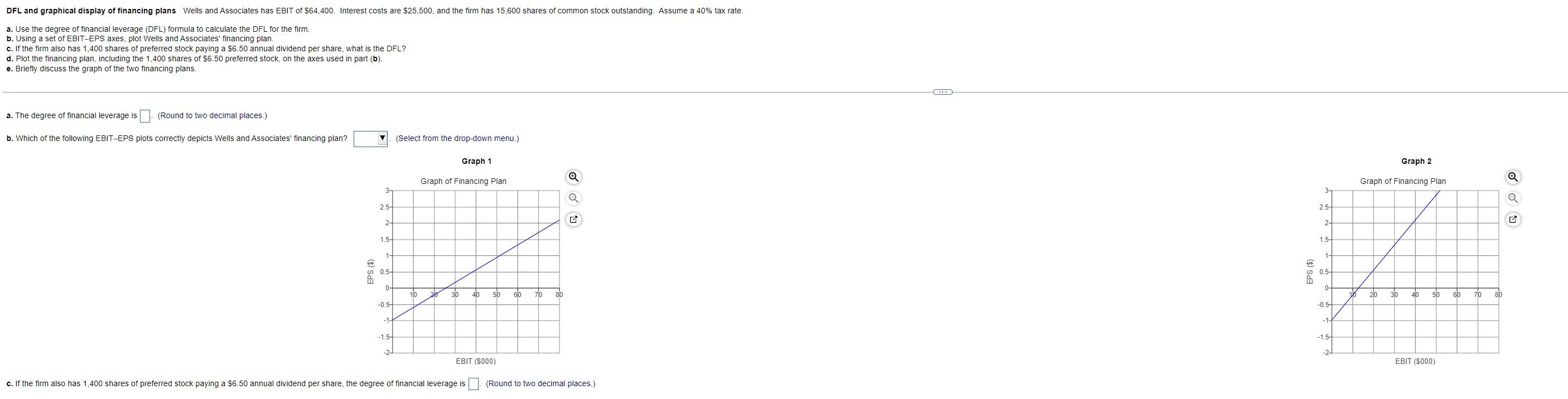

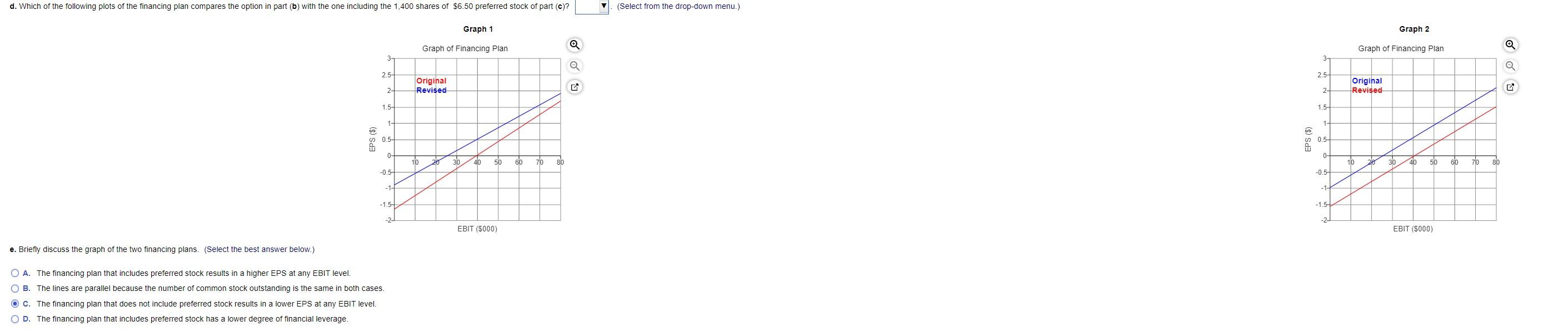

DFL and graphical display of financing plans Wells and Associates has EBIT of $64,400. Interest costs are $25,500, and the firm has 15,600 shares of common stock outstanding. Assume a 40% tax rate. a. Use the degree of financial leverage (DFL) formula to calculate the DFL for the firm. b. Using a set of EBIT-EPS axes, plot Wells and Associates' financing plan. c. If the firm also has 1,400 shares of preferred stock paying a $6.50 annual dividend per share, what is the DFL? d. Plot the financing plan, including the 1,400 shares of $6.50 preferred stock, on the axes used in part (b). e. Briefly discuss the graph of the two financing plans. a. The degree of financial leverage is (Round to two decimal places.) b. Which of the following EBIT-EPS plots correctly depicts Wells and Associates' financing plan? (Select from the drop-down menu.) Graph 1 Graph of Financing Plan 3- 2.5- 2- 1.5- 1- 0.5- 0- 30 40 50 -0.5- -1- -1.5- -2- EBIT (5000) c. If the firm also has 1,400 shares of preferred stock paying a $6.50 annual dividend per share, the degree of financial leverage is EPS ($) 10 20 60 Q 710 80 (Round to two decimal places.) C... EPS ($) 3 2.5- 2- 1.5- 1- 0.5- 0- -0.5- -1- -1.5- -2- 10 Graph 2 Graph of Financing Plan 30 40 50 EBIT ($000) 20 60 710 80 Q d. Which of the following plots of the financing plan compares the option in part (b) with the one including the 1,400 shares of $6.50 preferred stock of part (c)? Graph 1 Graph of Financing Plan 2.5- Original Revised 2- 1.5- 1- 0.5- 0- 20 -0.5- -1- -1.5- -2 e. Briefly discuss the graph of the two financing plans. (Select the best answer below.) O A. The financing plan that includes preferred stock results in a higher EPS at any EBIT level. O B. The lines are parallel because the number of common stock outstanding is the same in both cases. Oc. The financing plan that does not include preferred stock results in a lower EPS at any EBIT level. O D. The financing plan that includes preferred stock has a lower degree of financial leverage. EPS ($) 10 30 40 EBIT ($000) 50 60 710 80 N (Select from the drop-down menu.) EPS ($) 3- 2.5- 2 1.5- 1- 0.5- 0- -0.5- -1- -1.5- -2- Graph 2 Graph of Financing Plan Original Revised 50 EBIT ($000) 10 20 30 40 60 710 80 DFL and graphical display of financing plans Wells and Associates has EBIT of $64,400. Interest costs are $25,500, and the firm has 15,600 shares of common stock outstanding. Assume a 40% tax rate. a. Use the degree of financial leverage (DFL) formula to calculate the DFL for the firm. b. Using a set of EBIT-EPS axes, plot Wells and Associates' financing plan. c. If the firm also has 1,400 shares of preferred stock paying a $6.50 annual dividend per share, what is the DFL? d. Plot the financing plan, including the 1,400 shares of $6.50 preferred stock, on the axes used in part (b). e. Briefly discuss the graph of the two financing plans. a. The degree of financial leverage is (Round to two decimal places.) b. Which of the following EBIT-EPS plots correctly depicts Wells and Associates' financing plan? (Select from the drop-down menu.) Graph 1 Graph of Financing Plan 3- 2.5- 2- 1.5- 1- 0.5- 0- 30 40 50 -0.5- -1- -1.5- -2- EBIT (5000) c. If the firm also has 1,400 shares of preferred stock paying a $6.50 annual dividend per share, the degree of financial leverage is EPS ($) 10 20 60 Q 710 80 (Round to two decimal places.) C... EPS ($) 3 2.5- 2- 1.5- 1- 0.5- 0- -0.5- -1- -1.5- -2- 10 Graph 2 Graph of Financing Plan 30 40 50 EBIT ($000) 20 60 710 80 Q d. Which of the following plots of the financing plan compares the option in part (b) with the one including the 1,400 shares of $6.50 preferred stock of part (c)? Graph 1 Graph of Financing Plan 2.5- Original Revised 2- 1.5- 1- 0.5- 0- 20 -0.5- -1- -1.5- -2 e. Briefly discuss the graph of the two financing plans. (Select the best answer below.) O A. The financing plan that includes preferred stock results in a higher EPS at any EBIT level. O B. The lines are parallel because the number of common stock outstanding is the same in both cases. Oc. The financing plan that does not include preferred stock results in a lower EPS at any EBIT level. O D. The financing plan that includes preferred stock has a lower degree of financial leverage. EPS ($) 10 30 40 EBIT ($000) 50 60 710 80 N (Select from the drop-down menu.) EPS ($) 3- 2.5- 2 1.5- 1- 0.5- 0- -0.5- -1- -1.5- -2- Graph 2 Graph of Financing Plan Original Revised 50 EBIT ($000) 10 20 30 40 60 710 80