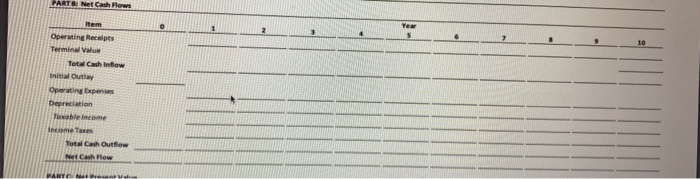

dgeting X Module 12 Assignment s/Module%2012%20Assignment.pdf Module 12 Assignment Using NPV, evaluate an investment in a hog farrow to finish enterprise. It is a small, capital intensive system that utilizes the latest technology in feed distribution, waste disposal, and animal care. The system has a capacity of 280 litters per year with 140 sows farrowing every six months. The litters can be sold for $1200 each at a cost of $965 Assume a cash purchase of the buildings, equipment, and livestock using the investor's equity capital. Given the above and following information, fill out the following table with your calculations. Round to the nearest dollar. Initial Investment $400,000 Buildings $80,000 Equipment $20,000 Breeding Livestock The breeding livestock fall in the four-year class for tax depreciation purposes while the buildings and equipment are in the twelve-year class. Depreciation is calculated using straight line depreciation methods and assuming no salvage value. The government has offered an incentive to encourage investment in buildings and equipment Depreciation on buildings and equipment can be accelerated to their typical useful life Planning Horizon The investor uses a 10-year planning horizon Terminal Value The terminal value in year 10 is projected to be $80,000 and is fully taxable Required rate-of-return The investor stipulates a required rate-of-return of 8 percent Net Cash Flows Net cash flows to the investor are determined by deducting projected operating expenses and income tax obligations from projected operating receipts in each year of the planning period. Remember that depreciation is a NONCASH expense that is used for calculating income taxes only The initial investment is a negative cash outflow at present The terminal value is considered part of the cash flow in the final period In response to inflation both the operating receipts and expenses are projected to increase at percent per year. For simplicity, an income tax rate of 20 percentis assumed When completed with your calculations anlain why this is a geodinament PART Net Cash Flows 0 4 Yew 5 10 Item Operating Recepts Termin Value Total Cash Inflow Initial Outly Operating Expenses Depreciation Texelence Income Taxes Total Cash Outfiow Net Cash Flow PARTNER dgeting X Module 12 Assignment s/Module%2012%20Assignment.pdf Module 12 Assignment Using NPV, evaluate an investment in a hog farrow to finish enterprise. It is a small, capital intensive system that utilizes the latest technology in feed distribution, waste disposal, and animal care. The system has a capacity of 280 litters per year with 140 sows farrowing every six months. The litters can be sold for $1200 each at a cost of $965 Assume a cash purchase of the buildings, equipment, and livestock using the investor's equity capital. Given the above and following information, fill out the following table with your calculations. Round to the nearest dollar. Initial Investment $400,000 Buildings $80,000 Equipment $20,000 Breeding Livestock The breeding livestock fall in the four-year class for tax depreciation purposes while the buildings and equipment are in the twelve-year class. Depreciation is calculated using straight line depreciation methods and assuming no salvage value. The government has offered an incentive to encourage investment in buildings and equipment Depreciation on buildings and equipment can be accelerated to their typical useful life Planning Horizon The investor uses a 10-year planning horizon Terminal Value The terminal value in year 10 is projected to be $80,000 and is fully taxable Required rate-of-return The investor stipulates a required rate-of-return of 8 percent Net Cash Flows Net cash flows to the investor are determined by deducting projected operating expenses and income tax obligations from projected operating receipts in each year of the planning period. Remember that depreciation is a NONCASH expense that is used for calculating income taxes only The initial investment is a negative cash outflow at present The terminal value is considered part of the cash flow in the final period In response to inflation both the operating receipts and expenses are projected to increase at percent per year. For simplicity, an income tax rate of 20 percentis assumed When completed with your calculations anlain why this is a geodinament PART Net Cash Flows 0 4 Yew 5 10 Item Operating Recepts Termin Value Total Cash Inflow Initial Outly Operating Expenses Depreciation Texelence Income Taxes Total Cash Outfiow Net Cash Flow PARTNER