Comprehensive budgeting problem: activity based costing, operating and financial budgets. Yummi-Lik makes really big lollipops in two

Question:

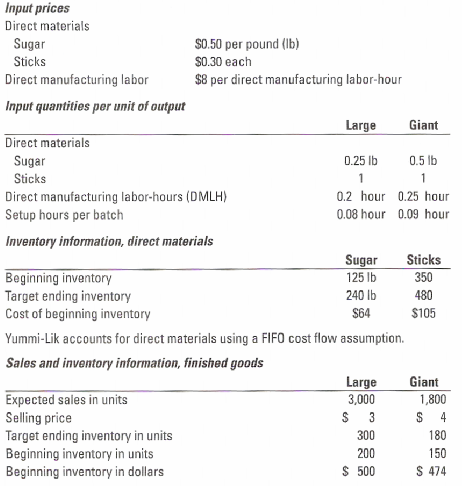

Comprehensive budgeting problem: activity based costing, operating and financial budgets. Yummi-Lik makes really big lollipops in two sizes, large and giant. Yummi-Lik sells these lollipops to convenience stores, fairs, schools for fundraisers, and in bulk on the internet. Summer is approaching, and Yummi-Lik is preparing its budget for the month of June. The lollipops are hand made, mostly out of sugar, and attached to wooden sticks. Expected sales are based on past experience.

Other information for the month of June follows:

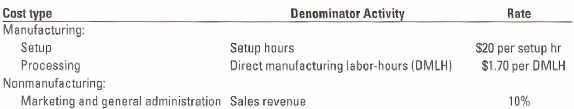

Yummi-Lik uses a FlEO cost flow assumption for finished goods inventory. All the lollipops are made in batches of 10. Yummi-Lik incurs manufacturing overhead costs, and marketing and general administration costs, but customers pay for shipping. Other than manufacturing labor costs, monthly processing costs are very small. Yummy-Lik uses activity-based costing and has classified all overhead costs for the month of June as shown in the following chart:

1. Prepare each of the following for June:

a. Revenues budget

b. Production budget in units

c. Direct material usage budget and direct material purchases budget

d. Direct manufacturing labor cost budget

e. Manufacturing overhead cost budgets for processing and setup activities

f. Budgeted unit cost of ending finished goods inventory and ending inventories budget

g. Cost of goods sold budget

h. Marketing and general administration costs budget

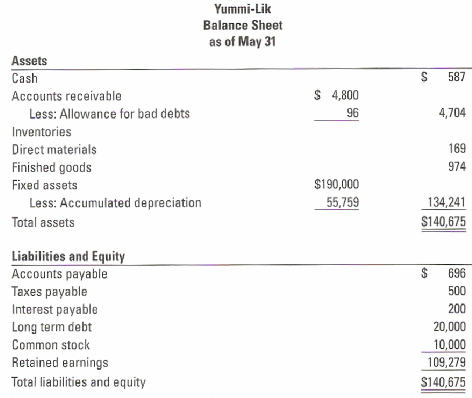

2. Yummi-Lik’s Balance Sheet for May31 follows. Use it and the following information to prepare a Cash Budget for Yummi-Uk for June.

- 80% of sales are on account of which half are collected in the month of the sale, 49% are collected the following month, and 1% are never collected and written off as bad debts.

- All purchases of materials are on account. Yummi-Lik pays for 70% of purchases in the month of purchase and 30% in the following month.

- All other costs are paid in the month incurred.

- Yummi-Lik is making monthly interest payments of 1% (12% per year) on a $20,000 long term loan.

- Yummi-Lik plans to pay the $500 of taxes owed as of May 31 in the month of June. Income tax expense for June is zero.

- 40% of processing and setup costs, and 30% of marketing and general administration costs are depreciation.

3. Prepare a budgeted income statement for June and a budgeted balance sheet for Yummi-Lik as of June30.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav