Answered step by step

Verified Expert Solution

Question

1 Approved Answer

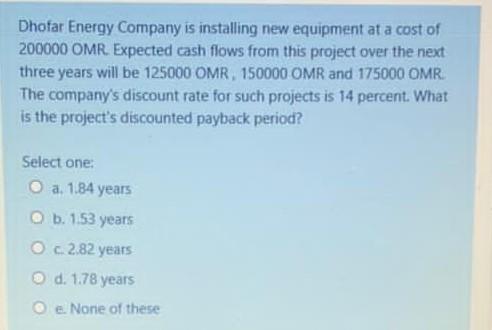

Dhofar Energy Company is installing new equipment at a cost of 200000 OMR. Expected cash flows from this project over the next three years will

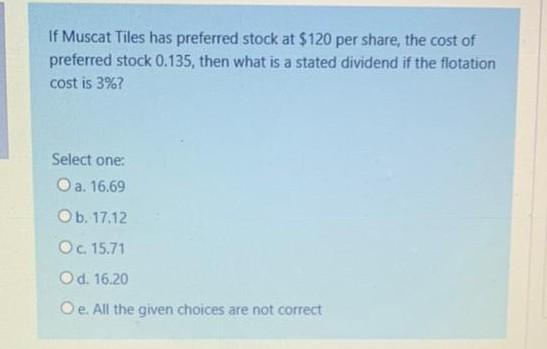

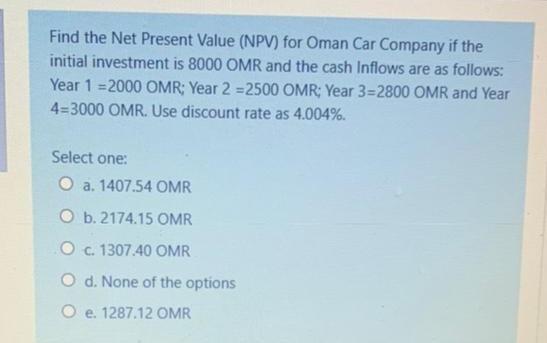

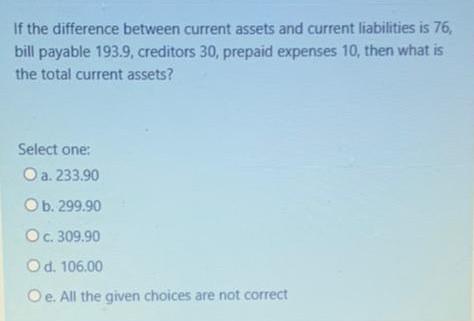

Dhofar Energy Company is installing new equipment at a cost of 200000 OMR. Expected cash flows from this project over the next three years will be 125000 OMR, 150000 OMR and 175000 OMR. The company's discount rate for such projects is 14 percent. What is the project's discounted payback period? Select one: O a. 1.84 years O b. 1.53 years O c.2.82 years d. 1.78 years e. None of these If Muscat Tiles has preferred stock at $120 per share, the cost of preferred stock 0.135, then what is a stated dividend if the flotation cost is 3%? Select one: O a. 16.69 O b. 17.12 Oc 15.71 O d. 16.20 Oe. All the given choices are not correct Find the Net Present Value (NPV) for Oman Car Company if the initial investment is 8000 OMR and the cash Inflows are as follows: Year 1 =2000 OMR; Year 2 =2500 OMR; Year 3=2800 OMR and Year 4=3000 OMR. Use discount rate as 4.004%. Select one: O a. 1407.54 OMR O b. 2174.15 OMR O c. 1307.40 OMR O d. None of the options O e. 1287.12 OMR If the difference between current assets and current liabilities is 76, bill payable 193.9, creditors 30, prepaid expenses 10, then what is the total current assets? Select one: O a. 233.90 b. 299.90 O c. 309.90 d. 106.00 Oe. All the given choices are not correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started