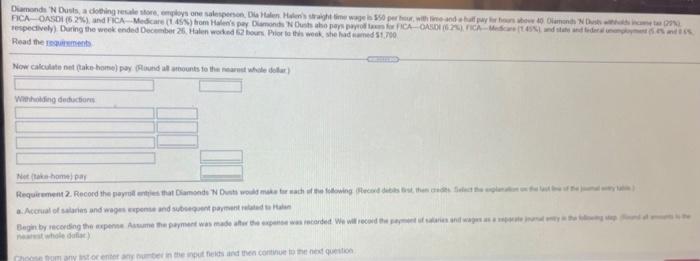

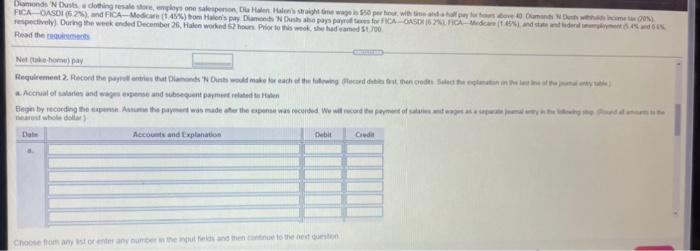

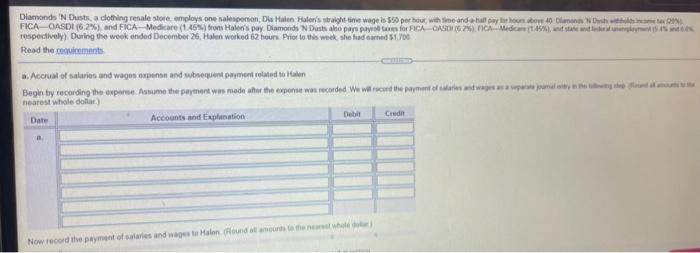

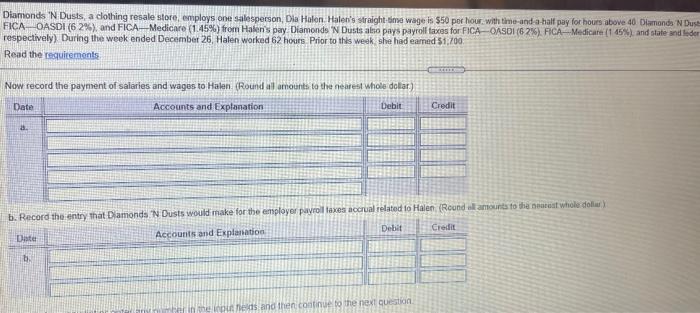

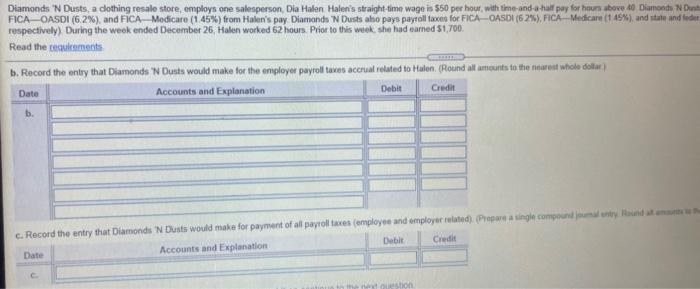

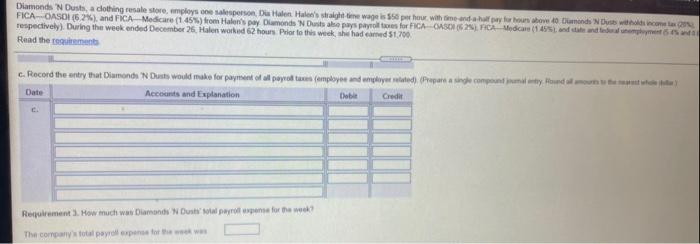

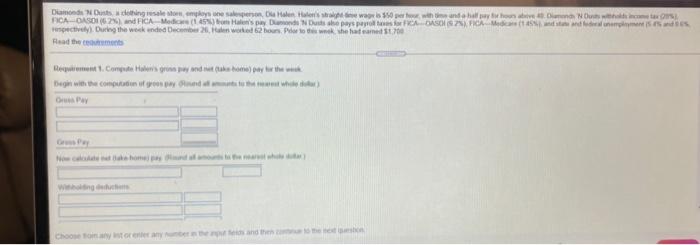

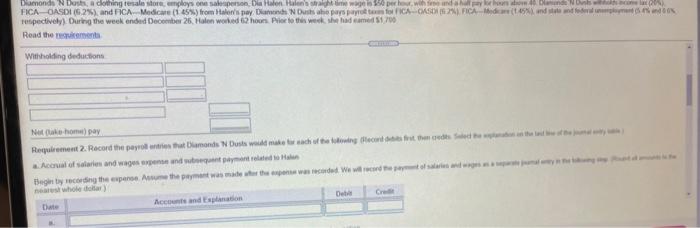

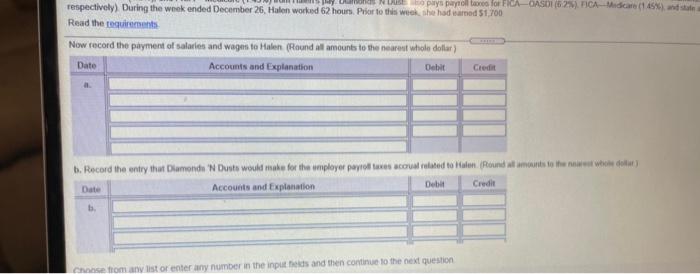

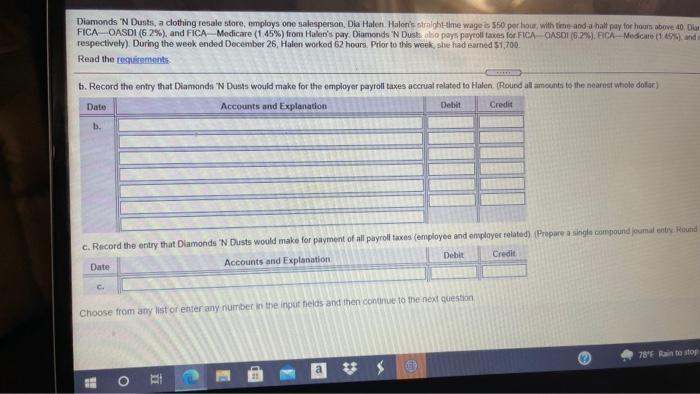

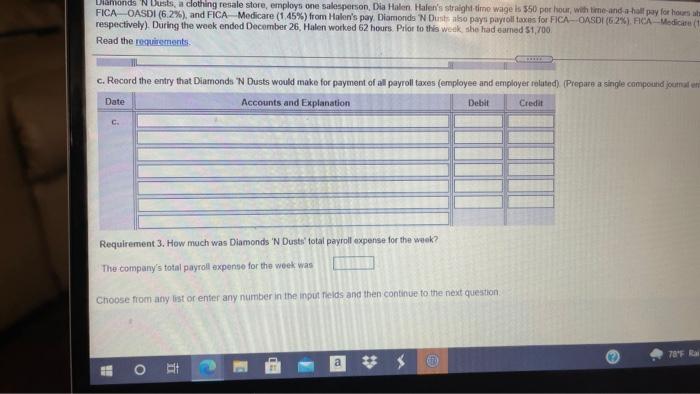

Diamonds Nuus, a dothing really one spompe 350 per month Olum 2013 FICA OASDI(52) and FICA Medicare (15) from He's pay mond Oussahe pas per CANLICA Modstate and tid respectively). During the week ended December 26. He worked hos Prior to this week headed 51700 Read the Now Calculate net (tako bone) pey und all mounts to the man whole cour) Winding deduction Not take home! Requirement. Record the payroll that Diamond Nuts would make reach the following records that the Accrual of sales and wages exponendamente Begin by recording the experne Assume the payment was made to the corded we will received the way whold) ocente berintetend the condition Diamonds N Outdothing so plysone senion Health newage 50 per with an FICA OASDI (62%and FICA-Medic (43%) from Halon's pey Dame Nusesh pas para for CA OASOLICAM and so respectively) During the weekended December 25, Hole worked hou. Prior to this would come 100 Read the Netthom) pay Requirement 2. Record the parents that made to make each of the word of the credits Salut Acciatores and pense and subsequent payment Begin by recording to an Am the news made to the second we wild we often are whole ole Account and Explanation Debih Ced Choose to store and then to the best Diamonds 'N Dusts, a clothing renale store employs on salesperson, Dla Halo Halon's right time wage is 350 per hour with me and a half pay for one Dishwa FICA-CASDI 6.2), and FICA Medicare (145) from Halen's pay Diamonds Dussalto pays pay for FICA OASIGA Medio 15 de and respectively). During the week ended December 26. Halen worked 62 hour. Prior to this week she had 51.ro Read the comes . Accrual of salaries and wages expense and subsequent payment related to an Begin by recording the expense Assume the payment was made after the expense was recorded we will rece payment was nearest whole dollar Date Accounts and Explanation Debi Croda Now record the payment of salaries and was talon Round mounts to the whole Diamonds 'N Dusts a clothing resale store, employs on salesperson, Dia Halon. Halen's straight time wage is $50 por hour, with time and a half pay for hours above 40 Dumonds N Dust FICA OASDI (62%) and FICAMedicare (1.45%) from Halen's pay Diamonds 'n Dusts also pays payroll taxes for FICA-OASDI(62%), FICA-Medicare (45%) and state and feder respectively) During the week ended December 26, Halen worked 62 hours Prior to this week she had earned $1,700 Read the requirements Now record the payment of salaries and wages to Halen (Round all amounts to the nearest Whole dollar.) Date Accounts and Explanation Debit Credit . b. Record the entry that Diamonds N Dusts would make for the employer payroll taxes accrual related to Halen (Round al amounts to the nearest whole doli Debit Credit Date Accounts and Explanation ti en elds and then continue to the next Question Diamonds 'N Dusts, a dothing resale store, employs one salesperson, Dia Halen Halen's straight-time wage is 550 per hour with time-and-a-half pay for hours above 40 Diamonth N D FICA -OASDI (6.2%), and FICA-Medicare (145%) from Halen's pay Diamonds "N Dusts aho pays payroll tages for FICA-OASDI (62%), FICA Medicare (45%), and state and luder respectively) During the week ended December 26, Halen worked 62 hours. Prior to this week she had earned $1,700. Read the requirements b. Record the entry that Diamonds N Dusts would make for the employer payroll teves accrual related to Halon (Round all amounts to the rest whole dollar) Date Accounts and Explanation Debit Credit b. c. Record the entry that Diamonds 'N Dusts would make for payment of all payroll faces (employee and employer related). Prepare a single compoundry Date Accounts and Explanation Debit Credit on Diamonds N Dusts, a clothing reale store employs coses person, Halen Halens straight time wage is 558 pothur with time and pay for hours showed mondo Nuswancom 2012 FICA-CASDI (62%), and FICA Medicare (145) from Halen's pay Diamonds N Duitse pays payrooms for FICA CASORCA Medicare (1951 andre respectively). During the week ended December 26. Halen worked 2 hours. Prior to this week shehaded 51.700 Read the role c. Record the entry that Diamonds N Dusts would make for payment of all payroll temployee and employered). Prepare a company Hodowe Date Account and Explanation Doble Credit C Requirement. How much was Diamonds Dust Sotal payroll for the wok? The company's total pay pows Die Nuts dingselemente personal news 50 per with and all the land Nica HICAGASOI62) FICA Med Han's Day De Nue pays po ASOLNICA ddides respectively). During the weekended Dec. wie 62 hours to the weshamed 100 Read the Rem Congress wind to pay the Begin with the computation of your pwd White) OP Nomad wings Choose Diamond N Dos doing resastre employers Dla Malen Halenschlime was perfew window FICA-QASDI 6.2%) and FCA Medicare (145) from Halons pay Diamond N Dussahe pars payroom for CA-CASO FICAM (5) end den respectively). During the week ended December 26, Hale worked 62 hours. Prior to this week she had come 1700 Road the requirements Withholding deduction Not a home pay Requirement 2. Record the payroll that Damonds N Dust would make each of the towing Record the Al of salaries and wages expense and went on redo Hali Begitty recording the expense the payment was made for the passende Wewe whole dar) Date A and Estimation Det E pyspatllare for FCA-OASO (628Adica (14%) anstate respectively) During the week ended December 26, Halen worked 62 hours. Prior to this week she had earned 51.700 Read the requirements Now record the payment of salaries and wages to Halen (Round all amounts to the nearest whole dollar) Dato Accounts and Explanation Debit C b. Record the entry that Diamonds N Dusts would make for the employer payroll escolated to Malan (Round mounts to the whole Date Accounts and Explanation Debit Credit chance from any list or enter in number in the input hields and then continue to the next question Diamonds 'N Dunts, a clothing resale store, employs one salesperson, Dia Halen Halons straight-time wage is 550 per hour with time and a halt pay for hours are 40 FICA OASDI (62%), and FICA-Medicare (145%) from Halen's pay Diamonds N Dusts pays payroll taxes for FICA OASDI (62%), FICA Medicare (149 and respectively). During the week ended December 26. Halen worked 62 hours. Prior to this week, she had earned 51,700 Read the requirements b. Record the entry that Diamonds "N Dusts would make for the employer payroll taxes accrual related to Halen (Round all amounts to the nearest whole dolar) Date Accounts and Explanation Debit Credit b. c. Record the entry that Diamonds 'N Dusts would make for payment of all payroll taxes (employee and employer related) Prepare a single compound ouma entry Round Date Accounts and Explanation Debit Credit Choose from any list of enter any number in the input fields and then continue to the next question 78' Ranto stop O Lamonds N Dusts, a clothing resale store, employs one salesperson, Dia Halen Halen's straight time wage is 550 per hour, with time and a half pay for hours FICA OASDI (6.2%), and FICA Medicare (1.45%) from Halen's pay Diamonds N Dust also pays payroll taxes for FICA-OASDI (6.2%), FICA-Medicare (1 respectively). During the week ended December 26, Halen worked 62 hours. Prior to this week she had samad 51,700 Read the resuirements IL c. Record the entry that Diamonds "N Dusts would make for payment of all payroll taxes (employee and employer related) (Prepare a single compound jumala Date Accounts and Explanation Debit Credit C. Requirement 3. How much was Diamonds 'N Dusts total payroll expense for the week? The company's total payroll expense for the week was Choose from any list or enter any number in the input rields and then continue to the next question 70 o ellt