Question

Diane is a Financial Analyst working in one of the big retail stores in Penang. Her company is looking at the possibility of replacing the

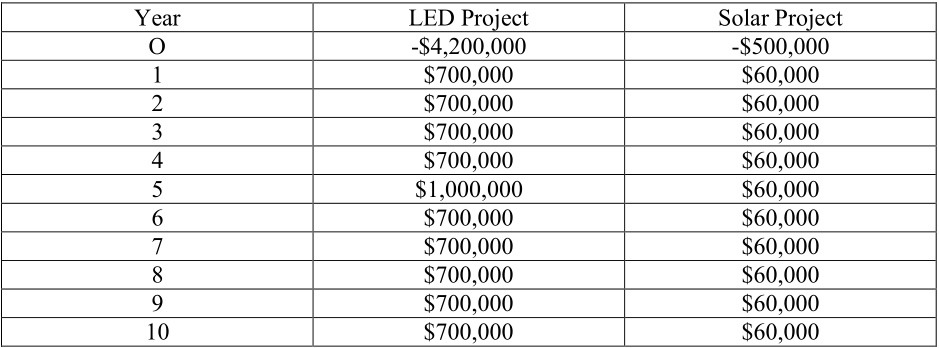

Diane is a Financial Analyst working in one of the big retail stores in Penang. Her company is looking at the possibility of replacing the existing fluorescent lights in all of its stores with LED lights. The main advantage of making this switch is that the LED lights are much more efficient and will cost less to operate. In addition, the LED lights much longer and will have to be replaced after ten years, whereas the existing lights have to be replaced after five years. Of course, making this change will require a large investment to purchase new LED lights and to pay for the labor of switching out tens of thousands of bulbs. Diane plans to use a 10-year horizon to analyze this proposal, figuring that changes to lighting technology will eventually make this investment obsolete. Dianes friend and coworker, David, has analyzed another energy-saving investment opportunity that involves replacing outdoor lighting with solar-powered fixtures in a few of the companys stores. David also used a 10-year horizon to conduct his analysis. The cash flow forecasts for each project appear below. The company uses a 10% discount rate to analyze capital budgeting proposals.  Required : (a) What is the NPV of each investment? Which investment should the company undertake? Besides David approaches Diane for a favor. David says that the solar lighting projects is a pet project of his boss, and David really wants to get the project approved to curry favor with his boss, He suggests to Diane that they roll their two project projects into a single proposal. The cash flows for this combined project would simply equal the sum of the two individual projects. Calculate the NPV of the combined project? Does it appear to be worth doing? Would you recommend investing in the combined project? (b) What is the ethical issue that Diane faces? Is any Harm done is she does the favor for David as he asks?

Required : (a) What is the NPV of each investment? Which investment should the company undertake? Besides David approaches Diane for a favor. David says that the solar lighting projects is a pet project of his boss, and David really wants to get the project approved to curry favor with his boss, He suggests to Diane that they roll their two project projects into a single proposal. The cash flows for this combined project would simply equal the sum of the two individual projects. Calculate the NPV of the combined project? Does it appear to be worth doing? Would you recommend investing in the combined project? (b) What is the ethical issue that Diane faces? Is any Harm done is she does the favor for David as he asks?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started