Answered step by step

Verified Expert Solution

Question

1 Approved Answer

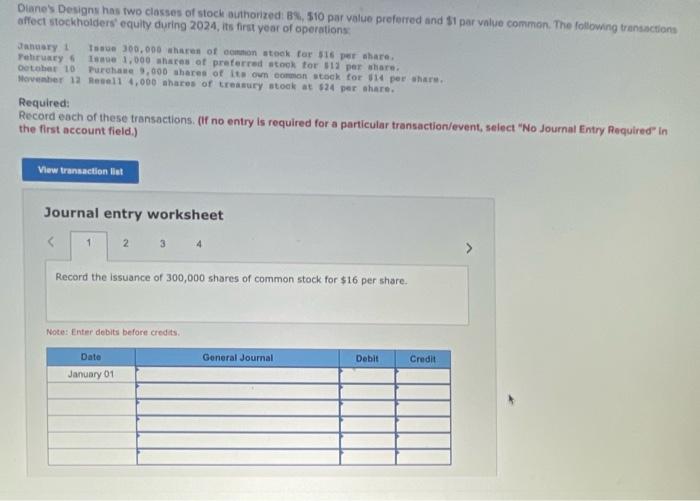

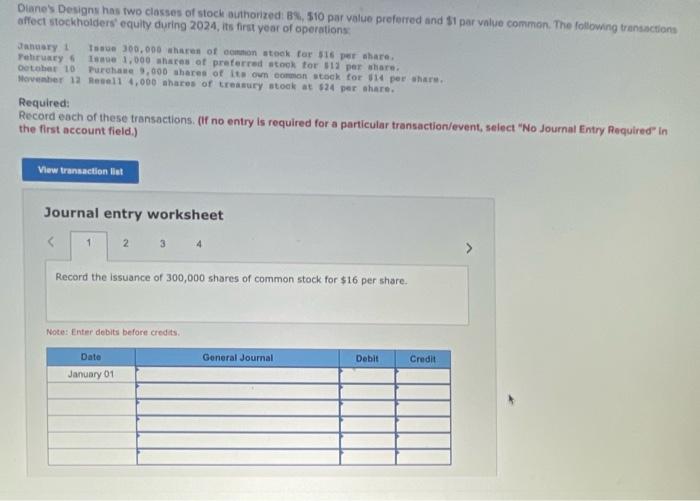

Diane's Designs has two classes of stock authorized: 8%, $10 par value preferred and $1 par value common. The following transactions affect stockholders' equity during

Diane's Designs has two classes of stock authorized: 8%, $10 par value preferred and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 1 Issue 300,000 shares of common stock for $16 per share. Issue 1,000 shares of preferred stock for $12 per share. February 6 October 10 Purchase 9,000 shares of its own common stock for $14 per share. November 12 Resell 4,000 shares of treasury stock at $24 per share, Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet

Dianes Designs has two classes of stock authonzed: 8%,$10 par value preferred and $1 par value common. The following transactiona affect stockholders' equity during 2024, its first year of operations Jahuary i tasue 300,000 wharen of ecman stoek tar s16 per share. Fehiruary o inmue 1,000 ahares of preferred atook tor 112 per nhare. ootohar 10 Purehane 3,000 ahares of its om oommon stock for 114 per ahars. Moveaber 12 Menel1 4,000 ahares of treasury stoek at 524 per ahare. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the issuance of 300,000 shares of common stock for $16 per share. Notet Enter debits before credts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started