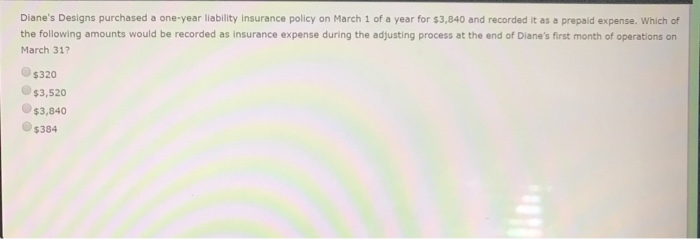

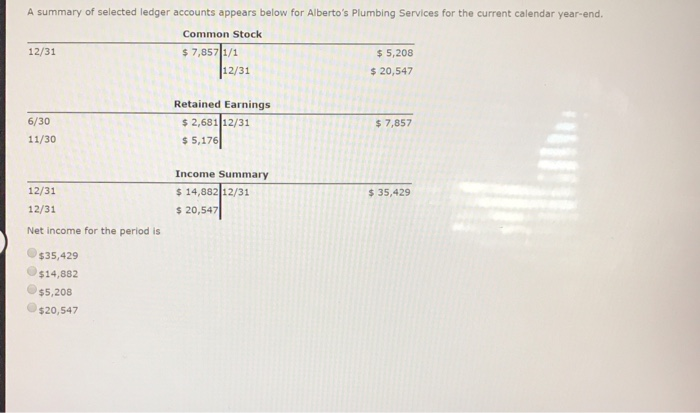

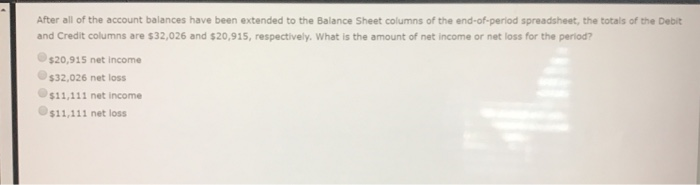

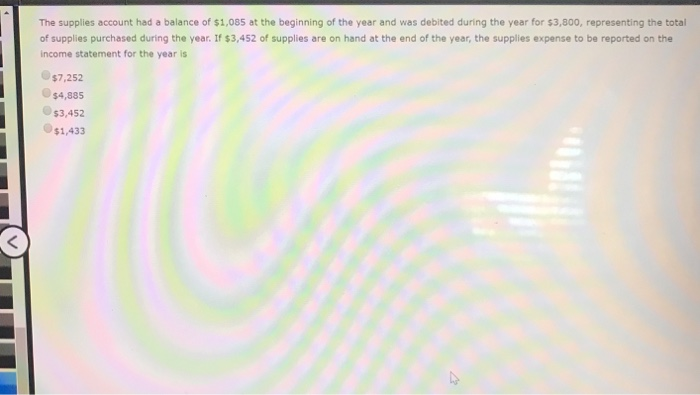

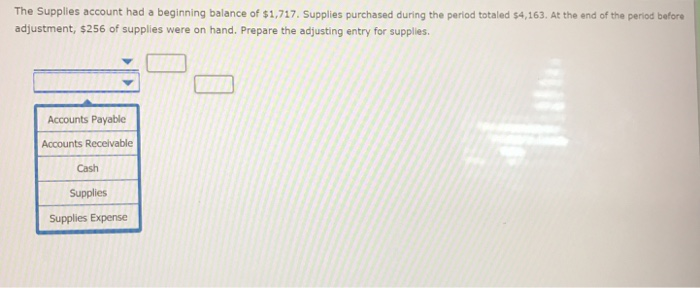

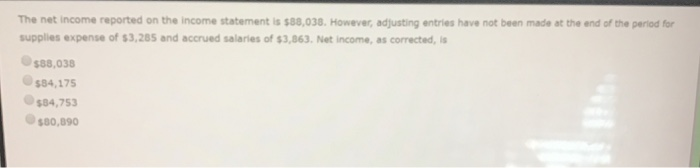

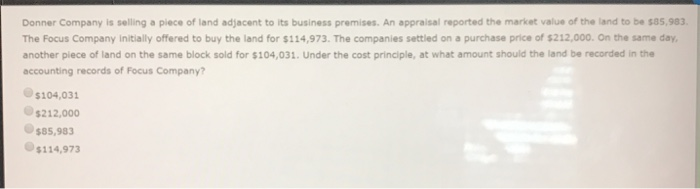

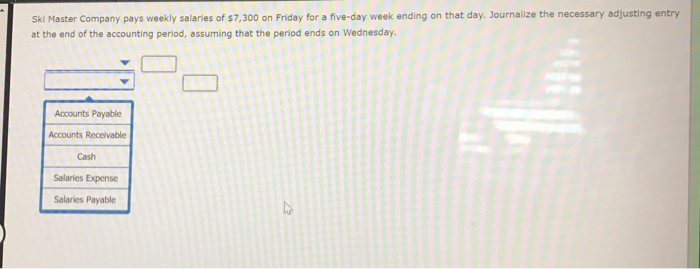

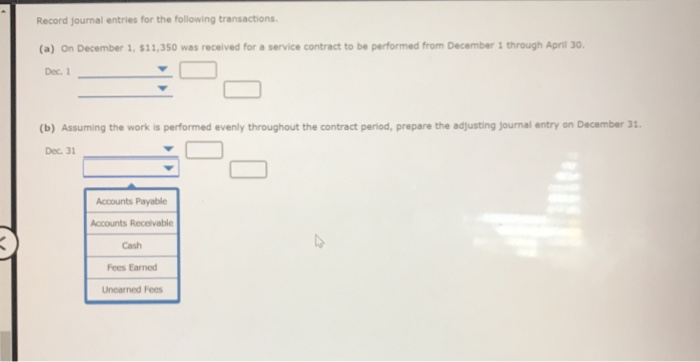

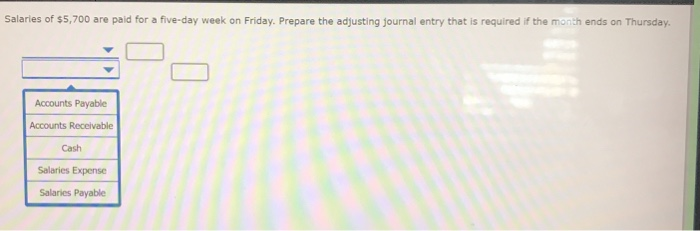

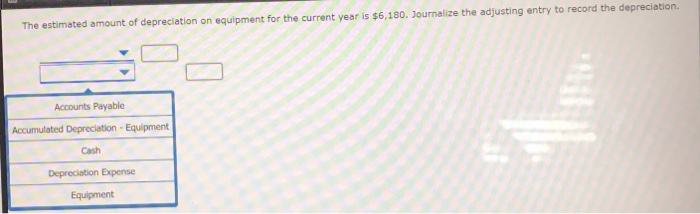

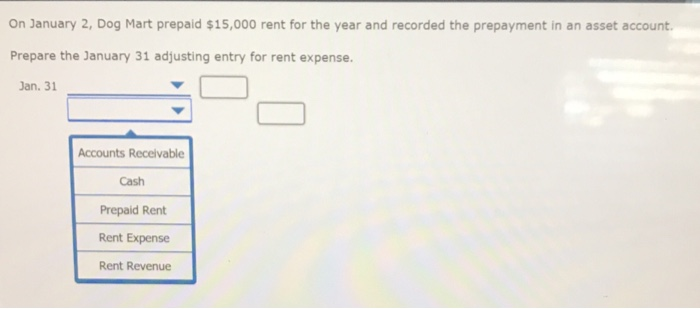

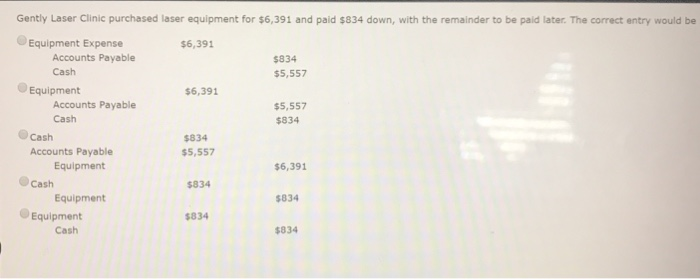

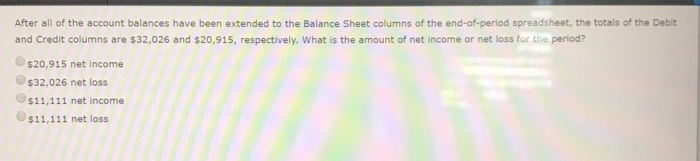

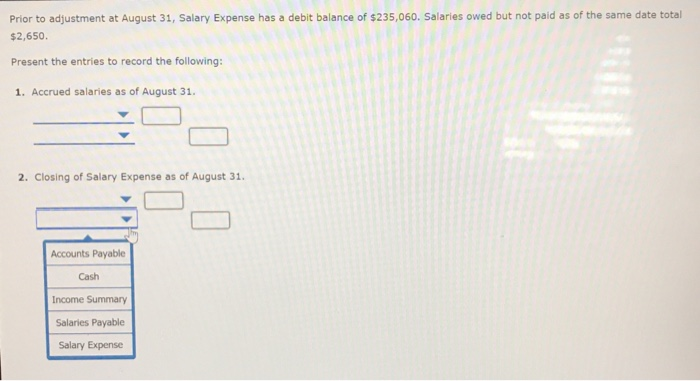

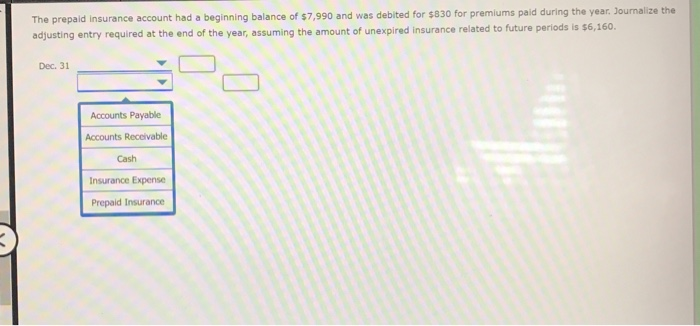

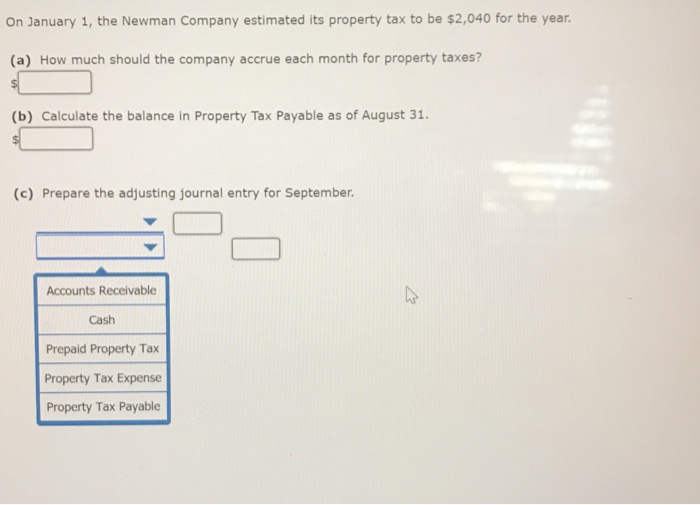

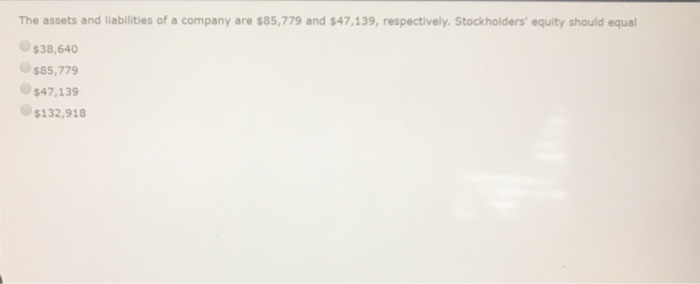

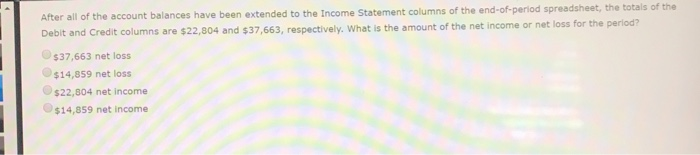

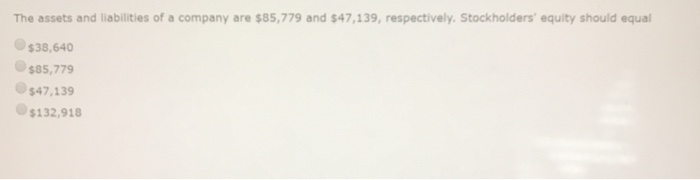

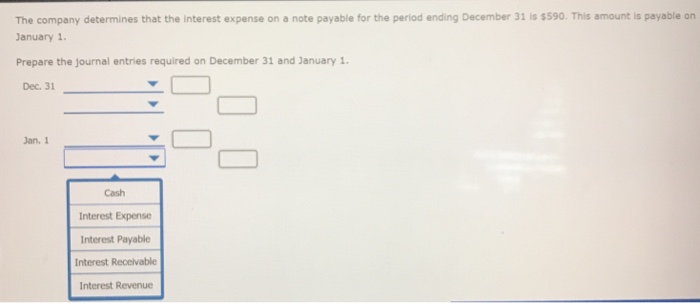

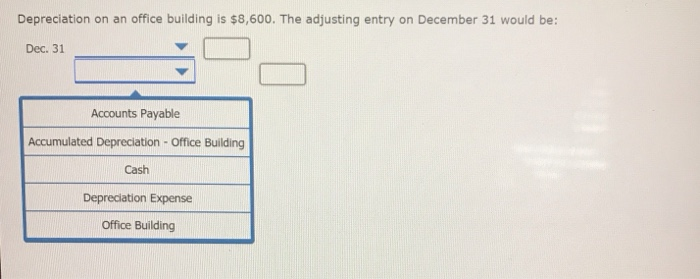

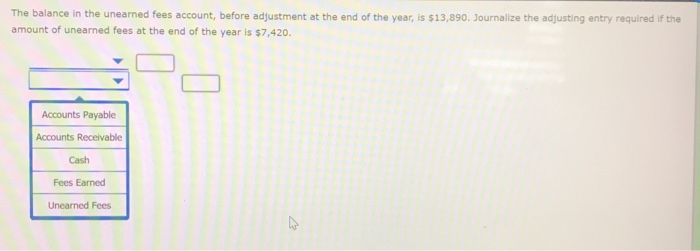

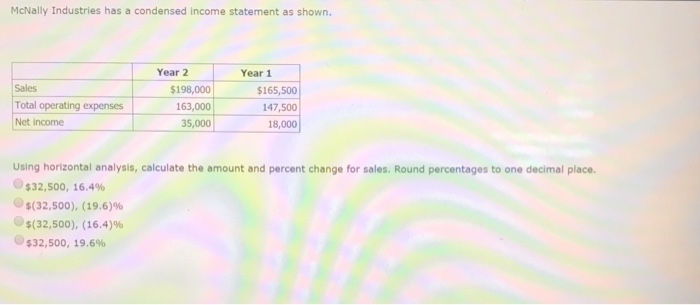

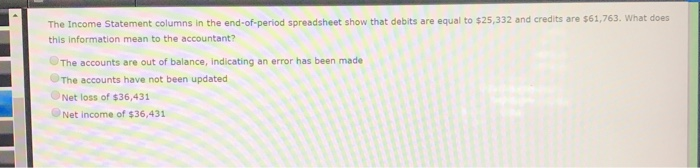

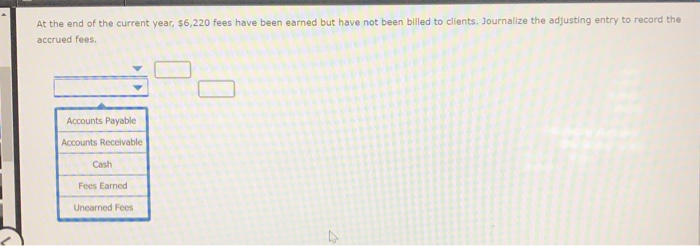

Diane's Designs purchased a one-year liability insurance policy on March 1 of a year for $3,840 and recorded it as a prepaid expense. Which of the following amounts would be recorded as insurance expense during the adjusting process at the end of Diane's first month of operations on March 31? $320 $3,520 $3,840 $384 A summary of selected ledger accounts appears below for Alberto's Plumbing Services for the current calendar year-end. Common Stock 12/31 $7,857 1/1 5,208 $20,547 12/31 Retained Earnings 6/30 11/30 s 2,63112/31 s 5,176 $7,857 Income Summary 12/31 12/31 Net income for the period is 14,882 12/31 s 20,547 35,429 $35,429 $14,882 $5,208 $20,547 After all of the account balances have been extended to the Balance Sheet columns of the end-of-period spreadsheet, the totals of the Debit and Credit columns are $32,026 and $20,915, respectively. What is the amount of net income or net loss for the period? $20,915 net income $32,026 net loss $11,111 net income $11,111 net loss The supplies account had a balance of $1,085 at the beginning of the year and was debited during the year for $3,800, representing the total of supplies purchased during the year. If $3,452 of supplies are on hand at the end of the year, the supplies expense to be reported on the income statement for the year is $7,252 $4,885 $3,452 $1,433 The Supplies account had a beginning balance of $1,717, Supplies purchased during the period totaled $4,163. At the end of the period before adjustment, $256 of supplies were on hand. Prepare the adjusting entry for supplies Accounts Payable Accounts Recelvable Cash Supplies Supplies Expense Donner Company is selling a piece of land adjacent to its business premises. An appraisal reported the market value of the land to be $85,983 The Focus Company Initially offered to buy the land for $114,973. The companies settled on a purchase price of $212,000. On the same day another piece of land on the same block sold for $104,031. Under the cost principle, at what amount should the land be recorded in the accounting records of Focus Company? $104,031 $212,000 $85,983 $114,973 Ski Master Company pays weekly salaries of $7,300 on Friday for a five-day week ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Wednesday. Accounts Payable Accounts Receivable Cash Salaries Expense Salaries Payable Record journal entries for the following transactions (a) On December 1, $11,350 was received for a service contract to be performed from December 1 through April 30 Dec. (b) Assuming the work is performed evenly throughout the contract period, prepare the adjusting journal entry on December 31 Dec. 31 Accounts Payable Accounts Receivable Cash Fees Earned Unearned Fees Salaries of s5,700 are paid for a five-day week on Friday. Prepare the adjusting journal entry that is required if the month ends on Thursday Accounts Payable Accounts Receivable Cash Salaries Expense Salaries Payable The estimated amount of depreclation on equipment for the current year is $6,180. Journalize the adjusting entry to record the depreciation Accounts Payable Accumulated Depreciation-Equipment Cash Depreciation Expense Equipment On January 2, Dog Mart prepaid $15,000 rent for the year and recorded the prepayment in an asset account Prepare the January 31 adjusting entry for rent expense Jan. 31 Accounts Recelvable Cash Prepaid Rent Rent Expense Rent Revenue Gently Laser Clinic purchased laser equipment for $6,391 and paid $834 down, with the remainder to be paid later. The correct entry would be Equipment Expense $6,391 Accounts Payable Cash $834 $5,557 Equipment $6,391 Accounts Payable Cash $5,557 $834 Cash $834 $5,557 Accounts Payable Cash Equipment Equipment $6,391 $834 Equipment $834 $834 Cash $834 After all of the account balances have been extended to the Balance Sheet columns of the end-of-period spreadsheet, the totals of the Debit and Credit columns are $32,026 and $20,915, respectively. What is the amount of net income or net loss for the period? $20,915 net income $32,026 net loss $11,111 net income $11,111 net loss Prior to adjustment at August 31, Salary Expense has a debit balance of $235,060. Salaries owed but not paid as of the same date total $2,650 Present the entries to record the following 1. Accrued salaries as of August 31. 2. Closing of Salary Expense as of August 31. Accounts Payable Cash Income Summary Salaries Payable Salary Expense The prepaid Insurance account had a beginning balance of $7,990 and was debited for $830 for premiums paid during the year, Journalize the adjusting entry required at the end of the year, assuming the amount of unexpired insurance related to future periods is $6,160 Dec. 31 Accounts Payable Accounts Reccivable Cash Insurance Expense Prepaid Insurance On January 1, the Newman Company estimated its property tax to be $2,040 for the year. (a) How much should the company accrue each month for property taxes? (b) Calculate the balance in Property Tax Payable as of August 31 (c) Prepare the adjusting journal entry for September Accounts Receivable Cash Prepaid Property Tax Property Tax Expense Property Tax Payable The assets and liabilities of a company are $85,779 and $47,139, respectively. Stockholders' equity should equa $38,640 $85,779 $47,139 $132,918 eadsheet, the totals of the After all of the account balances have been extended to the Income Statement columns of the end-of-period spr Debit and Credit columns are $22,804 and $37,663, respectively. What is the amount of the net income or net loss for the period? $37,663 net loss $14,859 net loss $22,804 net income $14,859 net income The assets and liabilities of a company are $85,779 and $47,139, respectively. Stockholders' equity should equal $38,640 $85,779 $47,139 $132,918 The company determines that the interest expense on a note payable for the period ending December 31 is $590. This amount is payable on January 1 Prepare the journal entries required on December 31 and January 1. Dec. 31 Jan. 1 Cash Interest Expense Interest Payable Interest Receivable Interest Revenue Depreciation on an office building is $8,600. The adjusting entry on December 31 would be: Dec. 31 Accounts Payable Accumulated Depreciation- Office Building Cash Depreciation Expense Office Building The balance in the unearned fees account, before adjustment at the end of the year, is $13,890. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $7,420. Accounts Payable Accounts Receivable Cash Fees Earned Unearned Fees McNally Industries has a condensed income statement as shown Year 2 Year 1 $198,000 163,000 35,000 Sales Total operating expenses Net income $165,500 147,500 18,000 Using horizontal analysis, calculate the amount and percent change for sales. Round percentages to one decimal place $32,500, 16.4% $(32,500), (19.6)% (32,500), (16.4)% @$32,500, 19.6% The Income Statement columns in the end-of-period spreadsheet show that debits are equal to $25,332 and credits are $61,763. What does this information mean to the accountant? The accounts are out of balance, indicating an error has been made The accounts have not been updated Net loss of $36,431 Net income of $36,431 At the end of the current year, $6,220 fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees. Accounts Payable Accounts Receivable Cash Fees Earned Unearned Fees