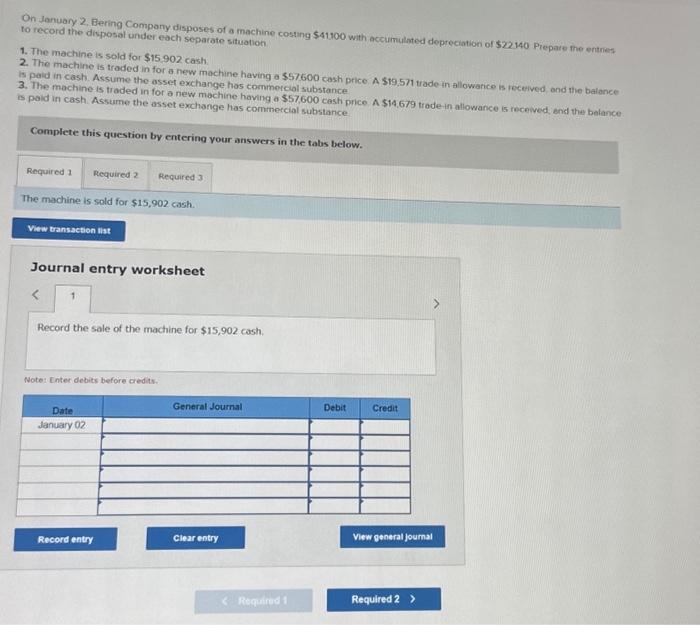

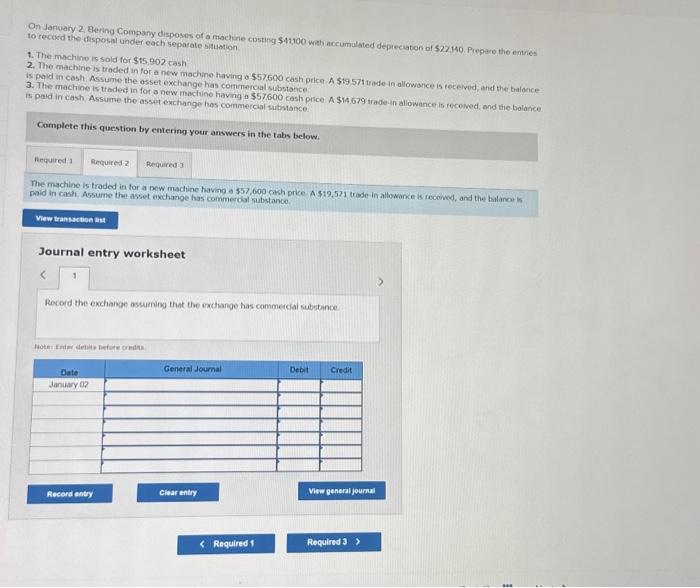

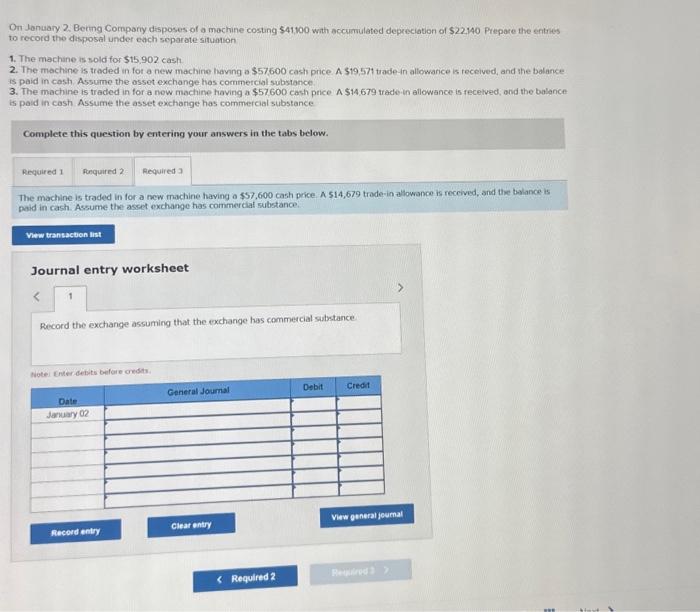

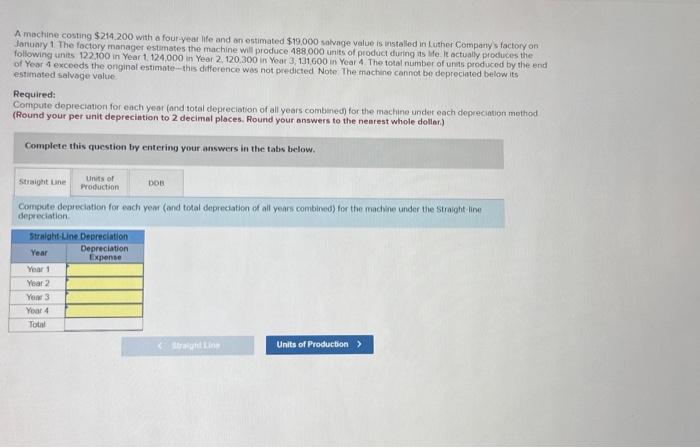

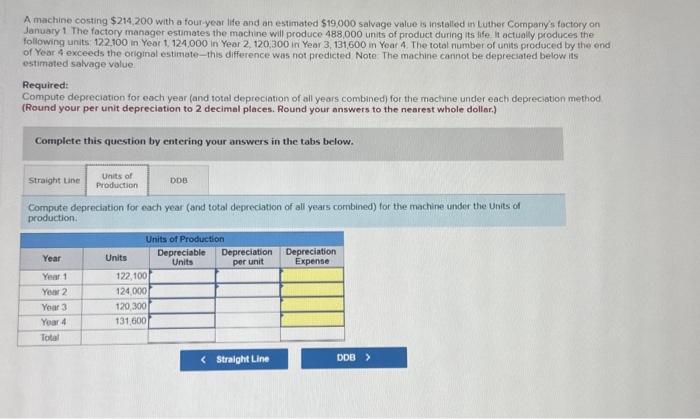

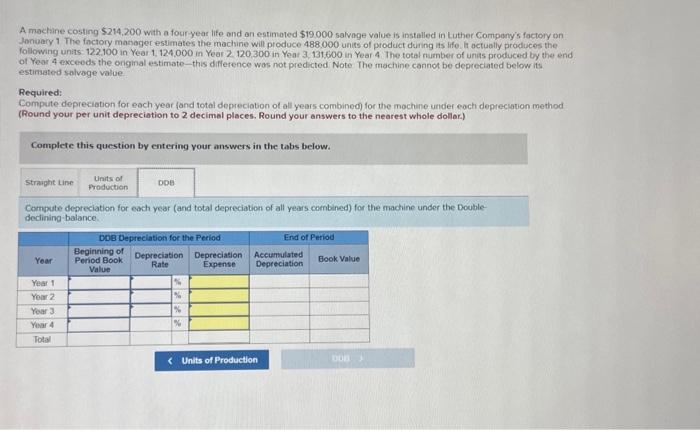

Diaz Company owns a machine that cost $125.600 and has accumulated depreciation of $91.400. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repoiring. Diaz disposed of the machine, receiving nothing in return 2. Diaz sold the machine for $15,800 cash 3. Diaz sold the machine for $34,200 cash 4. Diaz sold the machine for $40,100 cash Journal entry worksheet 2 Record the disposal of the machine receiving nothing in return. Nate: Fnter debits before credits Dioz Company owns a machine that cost $125,600 and has accumulated depreciation of $91,400 Prepare the entiy to record the disposal of the machine on January 1 in each seporate situavon 1. The machine needed extensive repairs ond was not worthrepairing. Diaz disposed of the mochine, recelving nothing in return 2. Diaz sold the machine for $15,800 cash 3. Diaz sold the machine for $34,200 cash. 4. Diaz sold the machine for $40,100 cash Journal entry worksheet Record the sale of the machine for 515,800 cash. botna loter setuin burate oredas Diaz Company owns a machine that cost $125,600 and has accumuloted depreciation of $91,400 Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repoiring. Diaz disposed of the machine, receiving nothing in return 2. Diaz sold the mochine for $15,800 cash 3. Diaz sold the machine for $34.200 cash 4. Diaz sold the machine for $40.100 cash Journal entry worksheet Record the sale of the machine for $34,200 cash. Fute- I micer debueb before croditi. Diaz Company owns a machine that cost $125,600 and has accumulated depreciation of $91.400. Prepare the entry to record the disposal of the machine on January 1 in eoch seporate situation. 1. The machine needed extensive repairs and wos not worth repoiting Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $15,800 cash 3. Diaz sold the machine for $34,200-ash 4. Dez sold the machine for $40.100 cash Journal entry worksheet Record the sale of the machine for $40,100cash. Fote Ene er debits tefore credits. On January 2, Bering Company disposes of a machine cosang $41100 with accumulated depreciation of $22140 Prepare the entries to record the disposal under each separate situation 1. The machine is sold for $15902cash 2. The machine is traded in for a new machune having a $57600 cosh price. A $19.571 trade in allowarice is received and the balance is paid in cash. Assume the asset exchange has commerciol substance 3. The machine is traded in for a new machine having a $57,600 cash price A $14.679 trade in allowance is received end tha balance. is paid in cash. Assume the asset exchange has commercial substance Complete this question by entering your answers in the tabs below. The machine is sold for $15,902cash. Journal entry worksheet Record the sale of the machine for $15,902 cash. Pote: Enter debits before credits. On Janciary 2, Bering Company disposes of a mochne costing $41400 wet nccumulated deprectaton of 52740 . Piepare the entries to recood the disposal under each separate shatuation 1. The machine is sold for $15,902 cash. 2. The machine is traded in for a new machane having o $57600 cash price A$519.571 trede in allowance is recelved, and the balance. is pold in cosh. Assume the asset exchange has commercal substasce 3. The machine is tiaded in for o new machine having a $57.600 cash pice A $14.679 irade-4n allowance is recewed, and the bolance is paid in cash Assume the asset exchange hos commercial subvance Complete this question by entering your answers in the tabs below. The machine is traded in for a mew machine having a 557,600 ckhh price. A 519,571 trode in allowance is fecowed, and the balanot is maid in cash. Assume the asset exchakge has commeroal substance. Journal entry worksheet Record the exchange assuming that the exchange has commerciat subetance Pooterifutur deilia pefue coredins On January 2. Bering Company disposes of a machine costing $41,00 with accunulated depreciation of $22.140 Prepare the entries to record the disposal under eoch separate situntion 1. The machine is sold for 515,902cash 2. The machine is traded in for a new machine having a $57600 cash price. A $19,571 trade-fn allowarice is tecelved, and the bolance is paid in cash. Assume the asset exchange has commercial substance. 3. The machine is traded in for a now machine having a $57600 cash price A $14.679 trade in allowance is recelved, and the balance is paid in cash. Assume the asset exchange has commercial substance Complete this question by entering your answers in the tabs below. The machine is traded in for a new machine having a $57,600 cash price. A 514,679 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commerclat subbtance. Journal entry worksheet Record the exchange assuming that the exchange has cammercial substance nutei dnderidebuts bifare credits. A mochine costing $214.200 with a four-year life and on estimated $19,000 salvige value is installed in Cuther Compary's factory on January 1 . The foctory manager esdmates the machine will produce 488,000 units of product during its Me. It actually pioduces the following units 122.100 in Year 1,124,000 in Year 2,120,300 in Year 3, 131,600 in Year 4 The total number of unas produced by the end of Year 4 exceeds the onginal estimate-this difference was not predicted Note. The machine cannot be depreciated belaw its estimated salvoge value Required: Compute depreciation for each year (and total depeeciatson of all years combined) for the machine under each depreciation mothod (Round your per unit deprecintion to 2 decimal places. Round your answers to the nearest whole dollar) Complete ihis question by entering your answers in the tabs below. Comprite depreciation for each year (and total deprexiatien of all years combined) for the mackine under tie Straioht-line depreciation A machine costing $214,200 with a four-year life and an estimated $19,000 salvage value is installed in Luther Compary's factory on January 1 The factory manager estumates the machine will produce 488.000 units of product during its life in actually produces the following units 122,100 in Year 1, 124,000 in Year 2, 120,300 in Year 3,131,600 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted Note. The machine cannot be depreciated below its estimated salvage value Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollor.) Complete this question by entering your answers in the tabs below. Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Units of production. A moctane costing $214,200 with a fouryear life ond an estimoted $19000 salvoge value is installed in Luther Compony's factory on Jonvary 1 The factory manager estimates the machine will produce 488.000 unils of product dunng ins life. It actually produces the following units 122.100 in Year 1, 124,000 in Year 2, 120,300 in Year 3, 131,600 in Year 4 . The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted Note The machine cannot be depreciated below its estimated salvoge value Required: Compute deprecistion for each year (and total depreciaton of all years combined) for the machine under each deprecutuon method (Round your per unit depreciotion to 2 decimal places, Round your answers to the nearest whole dollor.) Complete this question by entering vour answers in the tabs below. Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Doubledeclining-balance