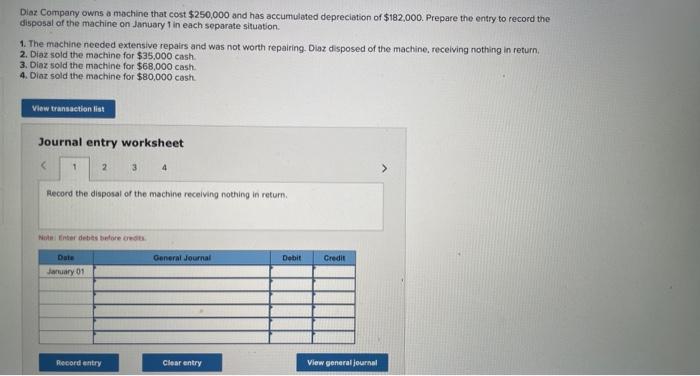

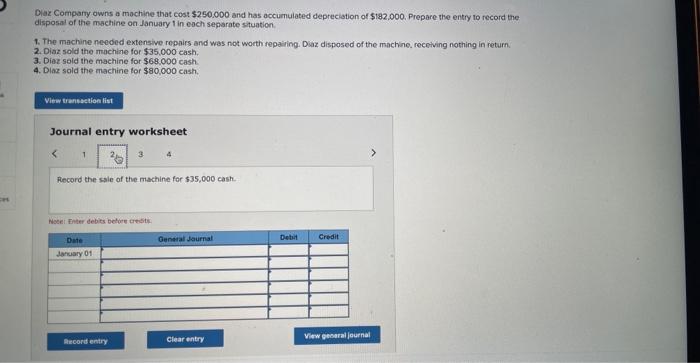

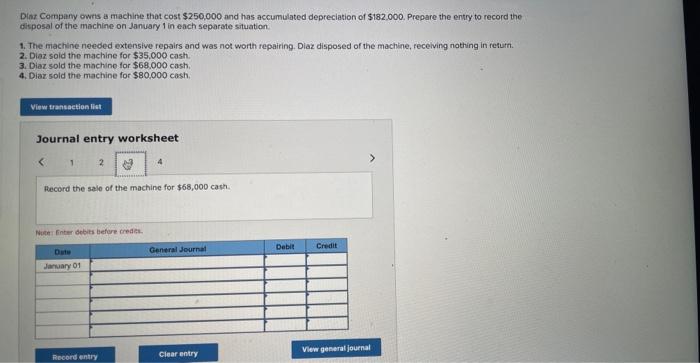

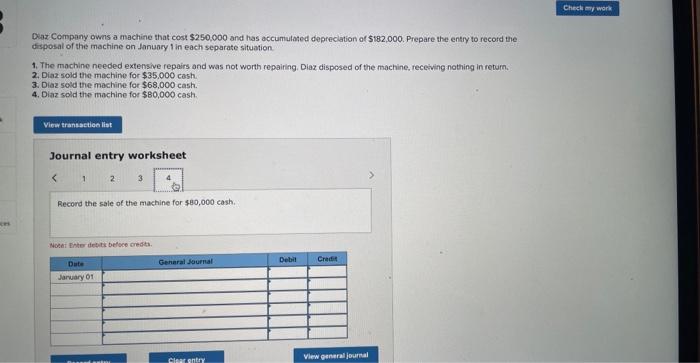

Diaz Company owns a machine that cost $250,000 and has accumblated depreciation of $182,000. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Disz disposed of the machine, recelving nothing in return. 2. Diaz sold the mochine for $35,000cash. 3. Diaz sold the machine for $68,000 cash. 4. Diaz sold the mochine for $80,000 cash. Journal entry worksheet Alecord the disposal of the machine receiving nothing in return. Nuthe finter detiet tonlore ivedit. Dlaz Compary owns a machine that cost $250.000 and has accumulated depreciation of $182.000. Prepare the entry to record the disposal of the machine on January 1 in each separate stuation. 1. The machine needed extensive repairs and was not worth repaining. Diaz disposed of the machine. receiving nothing in return. 2. Diaz sold the mechine for $35,000 cash, 3. Diez soid the machine for $69,000 cash. 4. Diaz sold the machine for $80,000 cash. Journal entry woricsheet Record the sale of the machine for $35,000 cash. Wacet Friter debits Betwer teistr. Diat Company owns a machine that cost $250.000 and has accumulated depreciation of $182.000. Prepare the entry to record the ditposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in refuth. 2. Diaz soid the machine for $35,000 cash. 3. Diaz sold the machine for $68,000 cash, 4. Diaz sold the machine for $80,000cash. Journal entry worksheet Record the sale of the machine for $68,000cash. Diaz Company owns a machine that cost $250,000 and has accumulated depreclation of $182,000. Prepare the entry to record the disposal of the mactine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, recetving nothing in return. 2. Diaz sold the mochine for $35,000 cash. 3. Diaz sold the machine for $68,000 cash. 4. Diaz sold the machine for $80,000 cash. Journal entry worksheet Record the sale of the machine for $80,000 cash. Noedi thite detiti befoce credta