Answered step by step

Verified Expert Solution

Question

1 Approved Answer

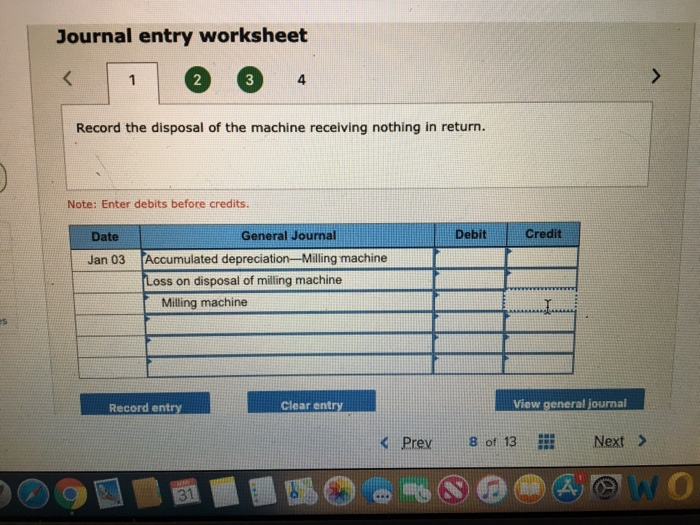

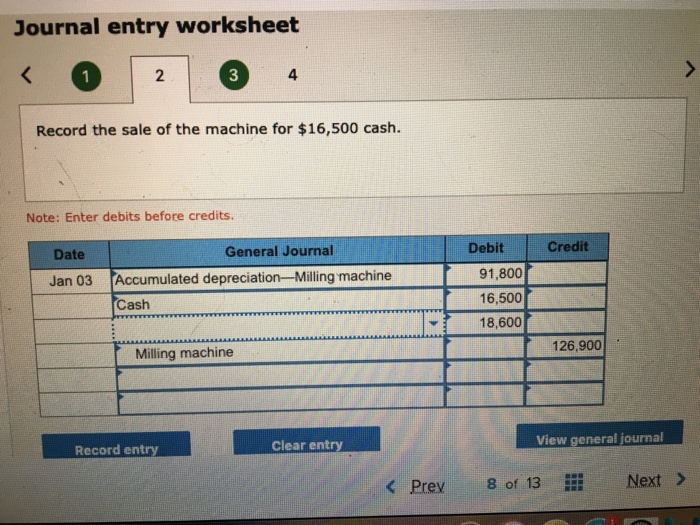

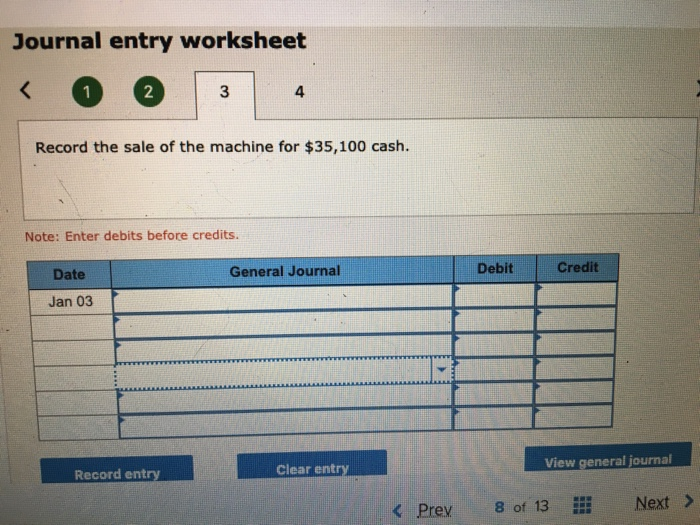

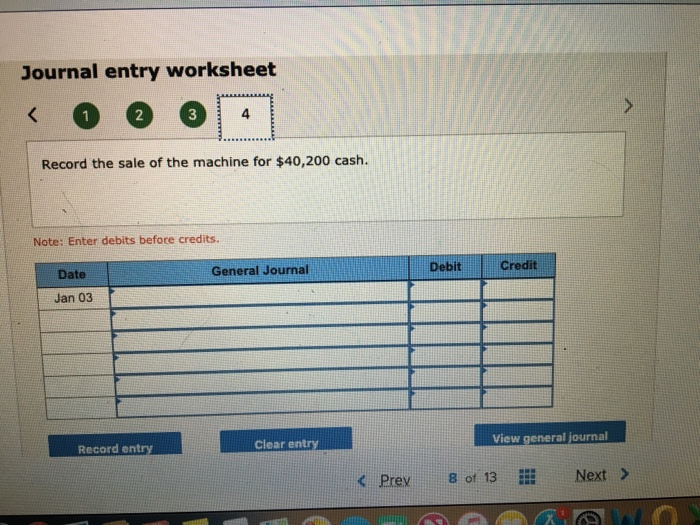

Diaz owns a milling machine that cost $126,900 and has accumalated depreciation of $91,800. Prepare the entry to record the disposal of the milling machine

Diaz owns a milling machine that cost $126,900 and has accumalated depreciation of $91,800. Prepare the entry to record the disposal of the milling machine on January 3 under each of the following situations..

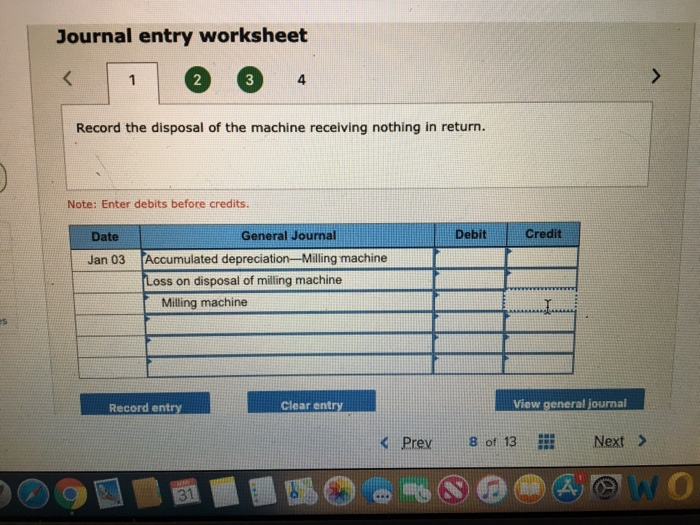

Journal entry worksheet 2 4 Record the disposal of the machine receiving nothing in return. Note: Enter debits before credits. Date General Journal Debit Credit Accumulated depreciation- Milling machine Loss on disposal of milling machine Jan 03 Milling machine Record entry Clear entry uma Prev 80f 13 : Next > Journal entry worksheet 2 3 4 Record the sale of the machine for $40,200 cash. Note: Enter debits before credits. General Journal Debit Credit Date Jan 03 View general journal Record entry Clear entry 1. the milling machine needed extensive repairs, it was not worth repairing. Diaz disposed of the machine, receiving nothing in return.

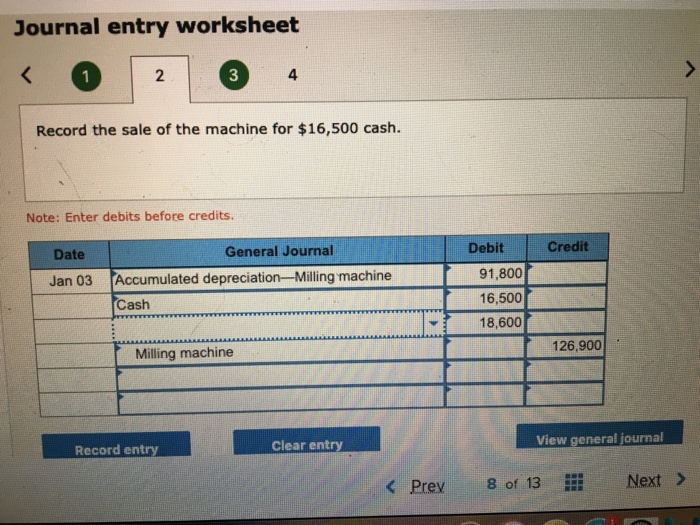

2. diaz sold the machine for $16,500 cash.

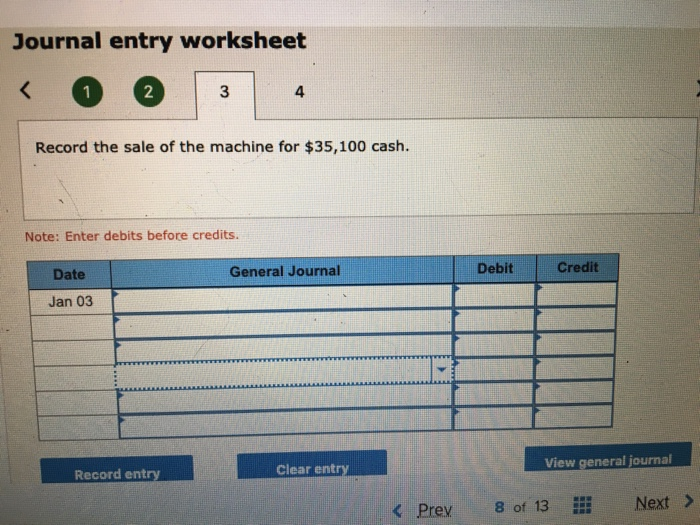

3. diaz sold the machind for $35,100 cash.

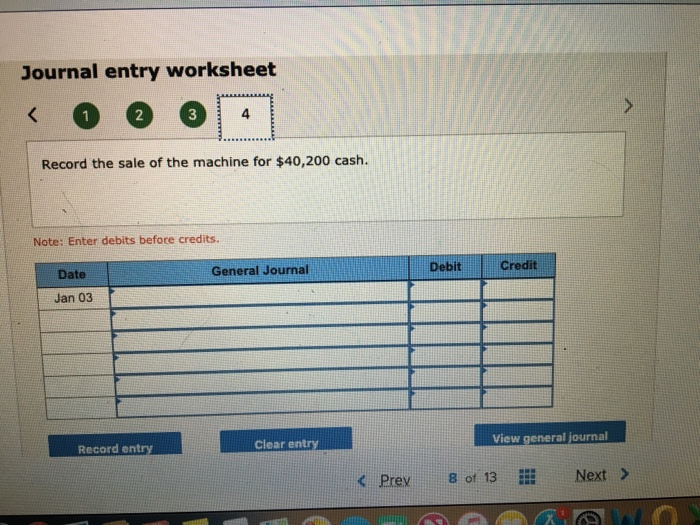

4. diaz sold the machine for $40,200 cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started