Answered step by step

Verified Expert Solution

Question

1 Approved Answer

did i do these 4 questions correctly? (5) Which of the following statements is correct? (A) MIRR is not affected by WACC while IRR is.

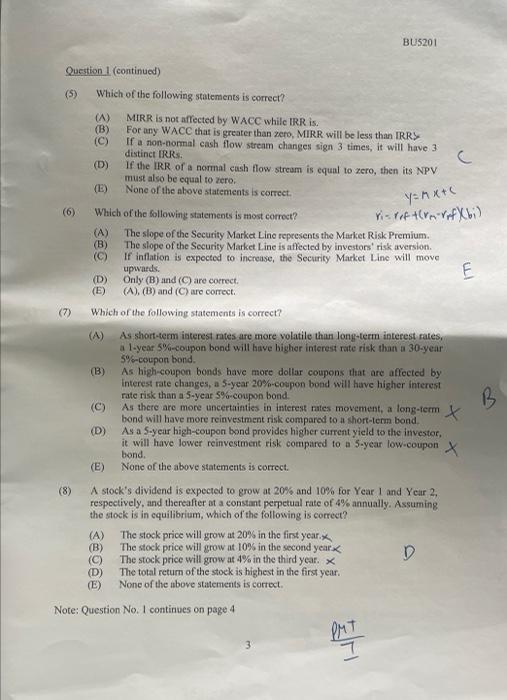

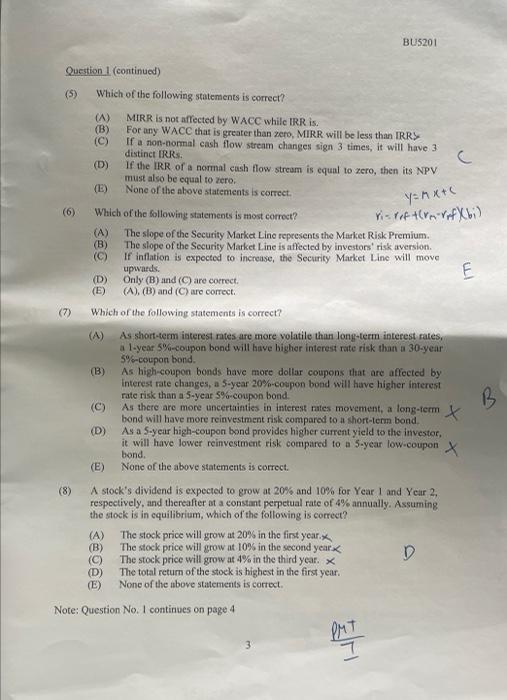

did i do these 4 questions correctly?

(5) Which of the following statements is correct? (A) MIRR is not affected by WACC while IRR is. (B) For any WACC that is greater than zero, MIRR will be less than IRR\} (C) If a non-eormal cash flow stream changes sign 3 times, it will have 3 distinct IRRs. (D) If the IRR of a nommal cash flow strearn is equal to zero, then its NPV must also be equal to zero. (E) None of the above statements is correct. (6) Which of the 6ollowing statements is most correct? ri=r1+t(rnrrf(b1) (A) The slope of the Security Market Line represents the Market Risk Premium. (B) The slope of the Security Market Line is affected by investors' risk aversion. (C) If inflation is expocted to increase, the Security Market Line will move upwards. (D) Only (B) and (C) are correct. (E) (A), (B) and (C) are correct. (7) Which of the following statements is correct? (A) As,short-term interest nates are mote volatile than long-term interest rates, a 1-year 5%-coupon bond will have higher interest rate risk than a 30year 5\%6-coupon bond. (B) As high-coupon bonds have more doltar coupons that are affected by interest rate changes, a 5 -year 20%-cospon bond will have higher interest rate risk than a 5-year 5%-coupon bond. (C) As there are more uncertainties in interest fates movement, a long-ferm bond will have more reinvestment risk compared to a short-term bond. (D) As a S-y ear high-coupon bond provides higher current yicld to the investor, it will have lower reinvestment risk compared to a 5 -year low-coupon bond. (E) Notte of the above statements is correct. (8) A stock's dividend is expected to grow at 20% and 10% for Year 1 and Year 2 , respectively, and thereafter at a constant perpetual rate of 4% annually. Assuming the stock is in cquilibrium, which of the following is correct? (A) The stock price will grow at 20% in the first year. x. (B) The stock price will grow at 10% in the second year x (C) The stock price will grow at 4% in the third year. x (D) The total return of the stock is highest in the first year. (E) None of the above statements is corroct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started