Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Did Samsung make an acquisition by paying more than the fair value of Samsungs share of the acquired companys net identifiable assets? Explain. (Hint: Analyze

Did Samsung make an acquisition by paying more than the fair value of Samsungs share of the acquired companys net identifiable assets? Explain. (Hint: Analyze Samsungs intangible assets.)

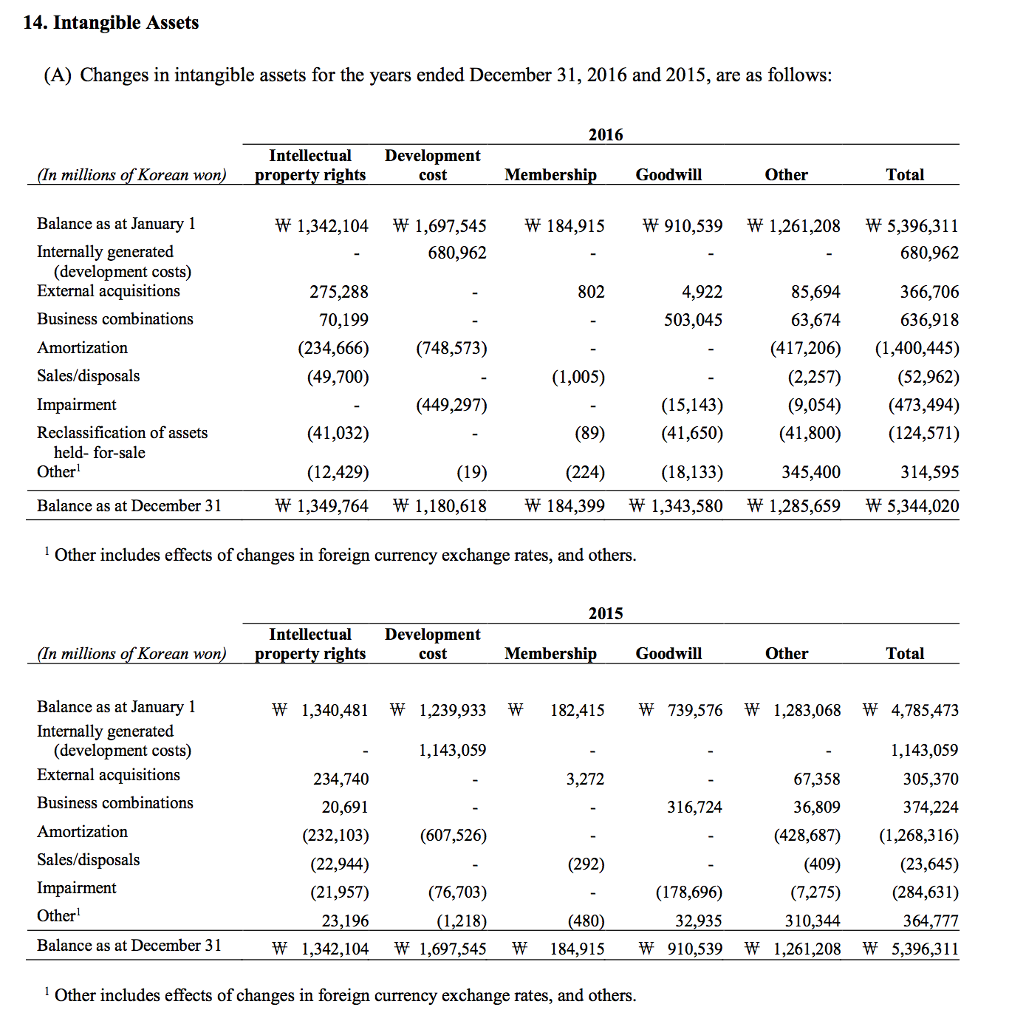

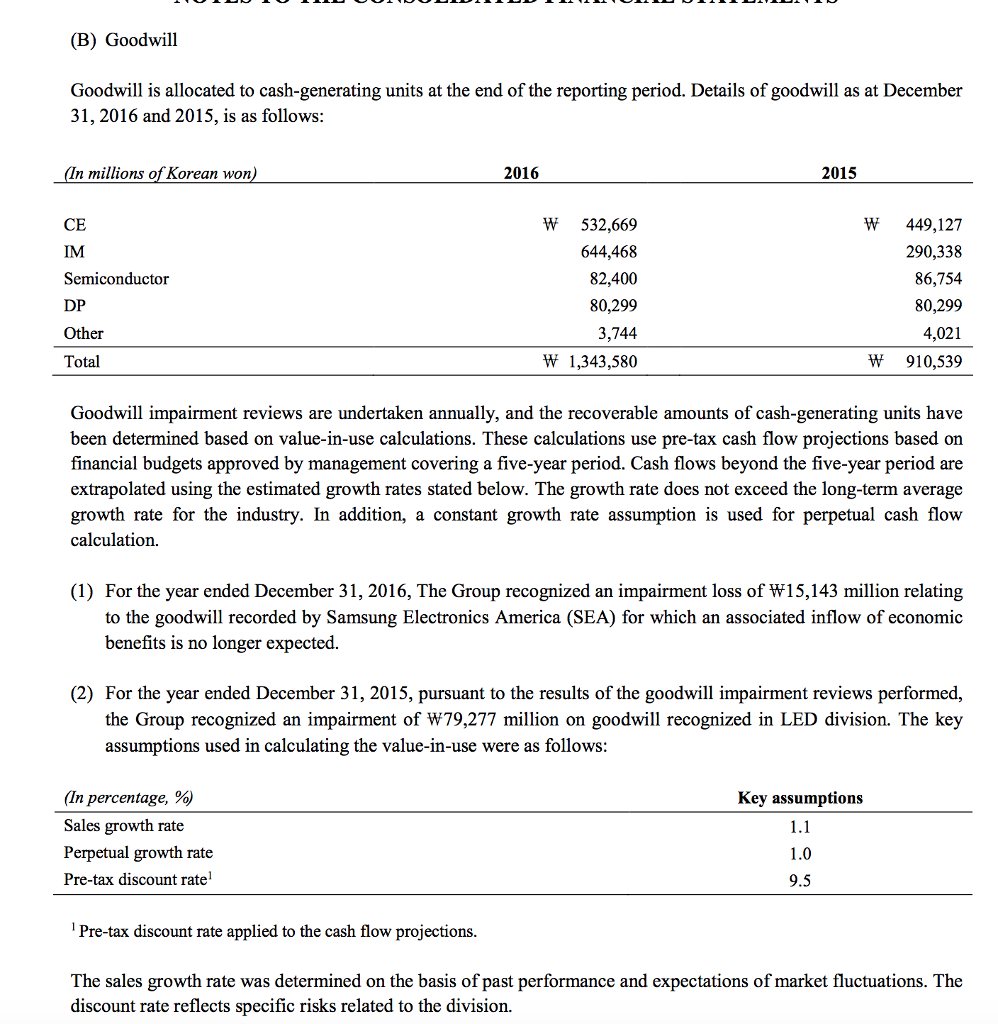

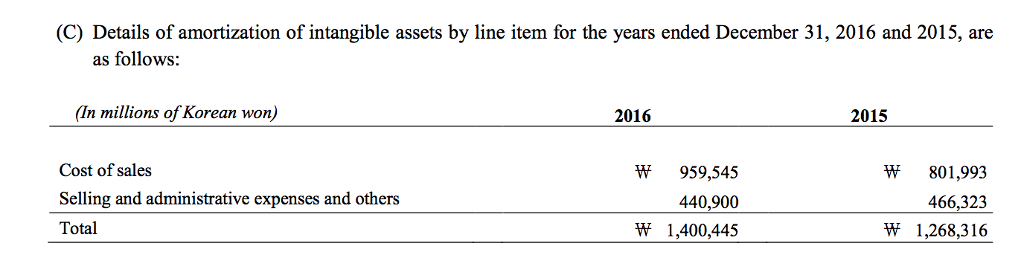

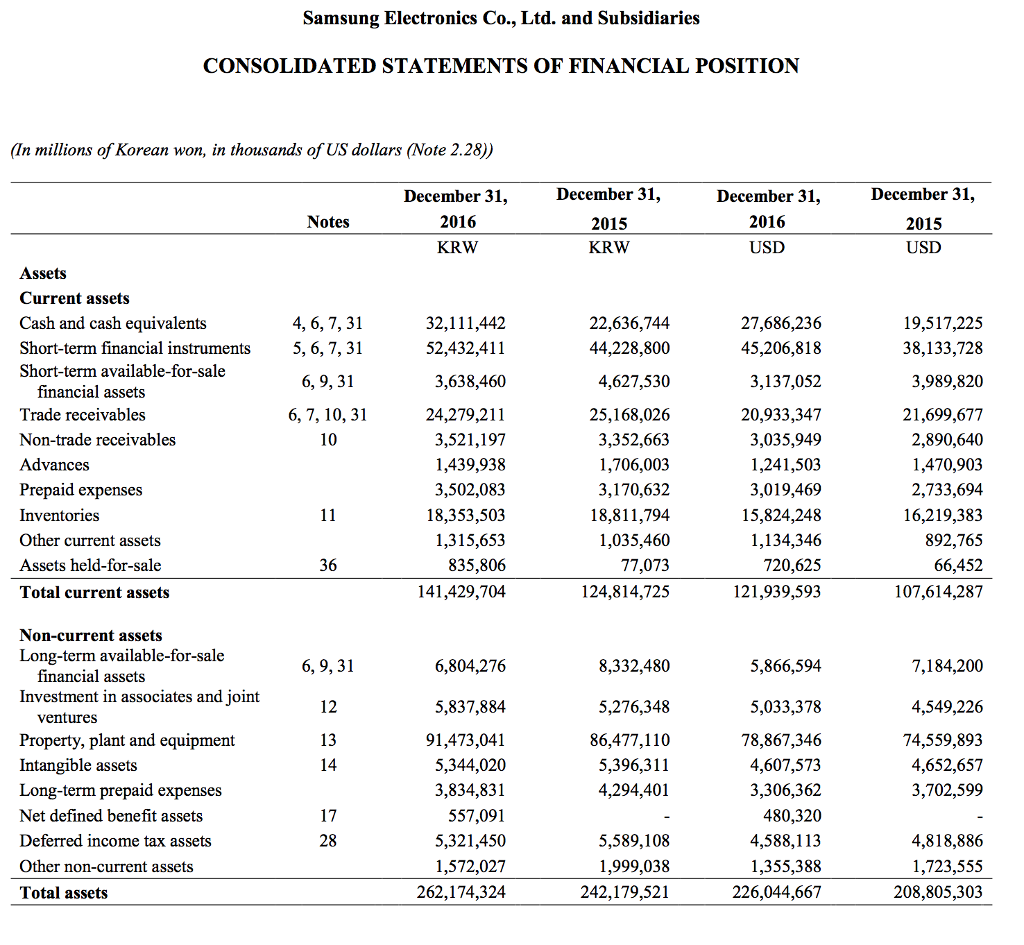

14. Intangible Assets (A) Changes in intangible assets for the years ended December 31, 2016 and 2015, are as follows: 2016 Intellectual Development cost Membershi Goodwill Other Total n millions of Korean won roperty rights Balance as at January 1 Internally generate W 1,342,104 W 1,697,545W 184,915W 910,539 W 1,261,208 W 5,396,311 680,962 366,706 636,918 (417,206) (1,400,445) (52,962) (9,054)(473,494) (41,800) (124,571) 314,595 W 1,349,764 W 1,180,618W 184,399 W 1,343,580 W 1,285,659W 5,344,020 680,962 (development costs) External acquisitions Business combinations Amortization Sales/disposals Impairment Reclassification of assets 275,288 70,199 4,922 503,045 85,694 63,674 802 (234,666)(748,573) (49,700) (41,032) (12,429) (2,257) (15,143) (41,650) (18,133) (449,297) held- for-sale er 345,400 Balance as at December 31 1Other includes effects of changes in foreign currency exchange rates, and others 2015 IntellectualDevelopment roperty rights n millions of Korean won cost Membershi Goodwill Other Total Balance as at January 1 Internally generated W 1,340,481 W 1,239,933 W182,415 W 739,576 W 1,283,068 W 4,785,473 1,143,059 305,370 374,224 (428,687) (1,268,316) (23,645) (7,275)(284,631) 364,777 W 1,342,104 W 1,697,545 W 184,915 W 910,539 W 1,261,208 W 5,396,311 1,143,059 (development costs) External acquisitions Business combinations Amortization Sales/disposals Impairment 234,740 20,691 (232,103) (22,944) 3,272 316,724 36,809 (607,526) (292) (409) (76,703) (178,696) 32,935 er 23,196 480 Balance as at December 31 Other includes effects of changes in foreign currency exchange rates, and others 14. Intangible Assets (A) Changes in intangible assets for the years ended December 31, 2016 and 2015, are as follows: 2016 Intellectual Development cost Membershi Goodwill Other Total n millions of Korean won roperty rights Balance as at January 1 Internally generate W 1,342,104 W 1,697,545W 184,915W 910,539 W 1,261,208 W 5,396,311 680,962 366,706 636,918 (417,206) (1,400,445) (52,962) (9,054)(473,494) (41,800) (124,571) 314,595 W 1,349,764 W 1,180,618W 184,399 W 1,343,580 W 1,285,659W 5,344,020 680,962 (development costs) External acquisitions Business combinations Amortization Sales/disposals Impairment Reclassification of assets 275,288 70,199 4,922 503,045 85,694 63,674 802 (234,666)(748,573) (49,700) (41,032) (12,429) (2,257) (15,143) (41,650) (18,133) (449,297) held- for-sale er 345,400 Balance as at December 31 1Other includes effects of changes in foreign currency exchange rates, and others 2015 IntellectualDevelopment roperty rights n millions of Korean won cost Membershi Goodwill Other Total Balance as at January 1 Internally generated W 1,340,481 W 1,239,933 W182,415 W 739,576 W 1,283,068 W 4,785,473 1,143,059 305,370 374,224 (428,687) (1,268,316) (23,645) (7,275)(284,631) 364,777 W 1,342,104 W 1,697,545 W 184,915 W 910,539 W 1,261,208 W 5,396,311 1,143,059 (development costs) External acquisitions Business combinations Amortization Sales/disposals Impairment 234,740 20,691 (232,103) (22,944) 3,272 316,724 36,809 (607,526) (292) (409) (76,703) (178,696) 32,935 er 23,196 480 Balance as at December 31 Other includes effects of changes in foreign currency exchange rates, and othersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started