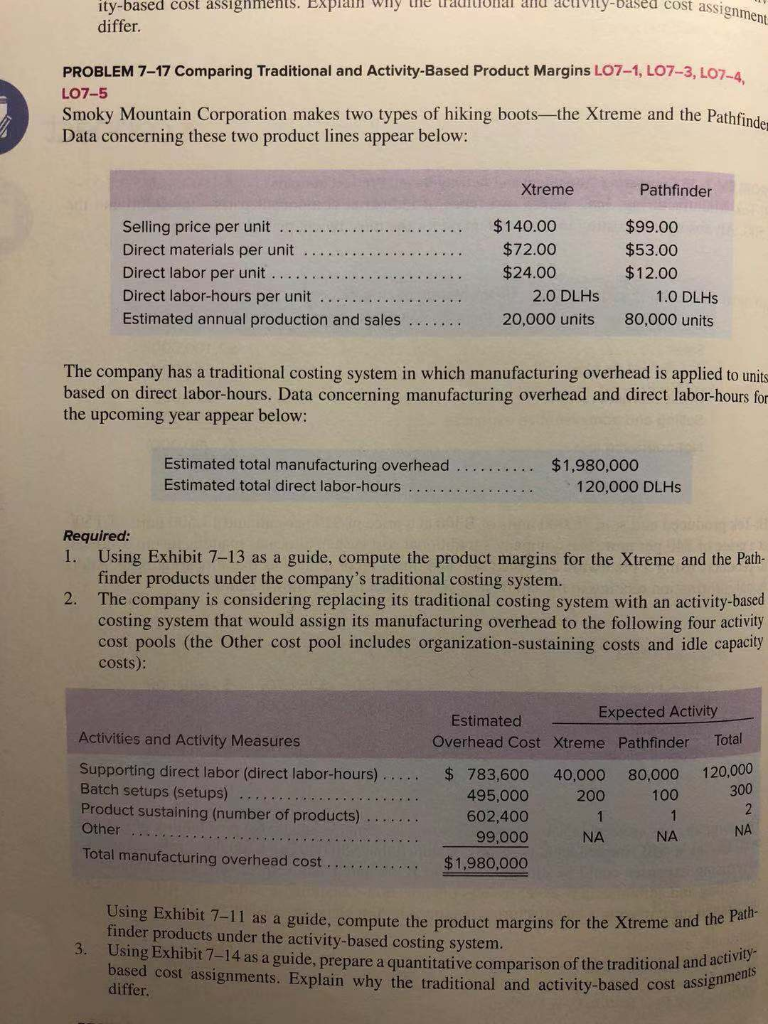

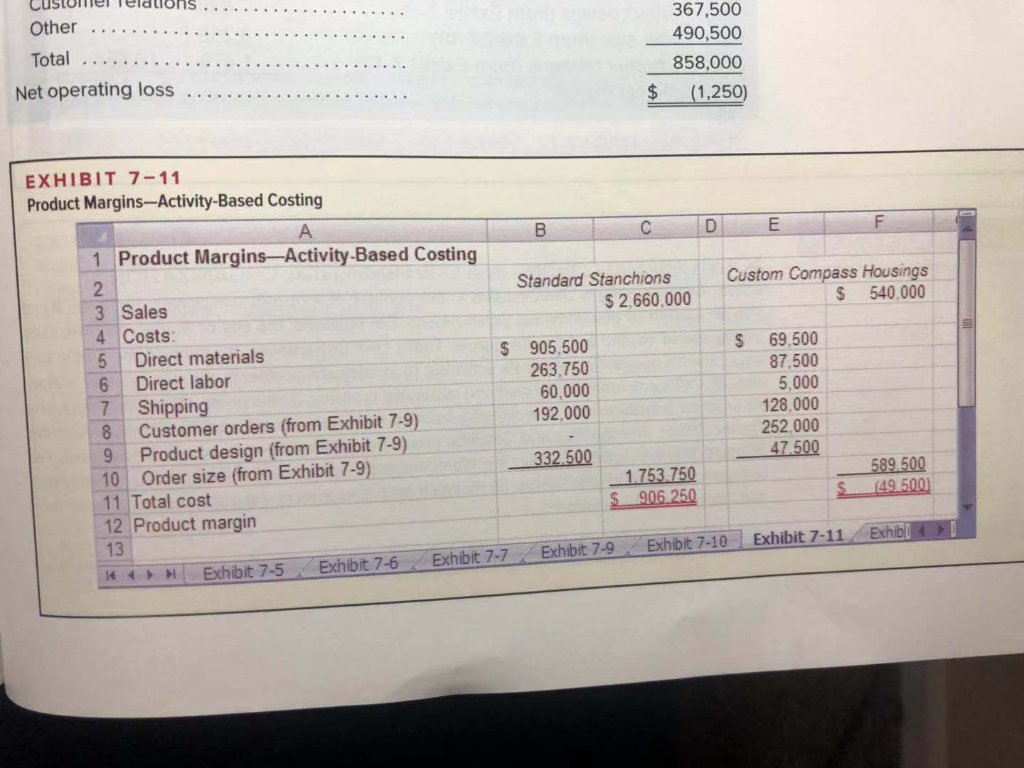

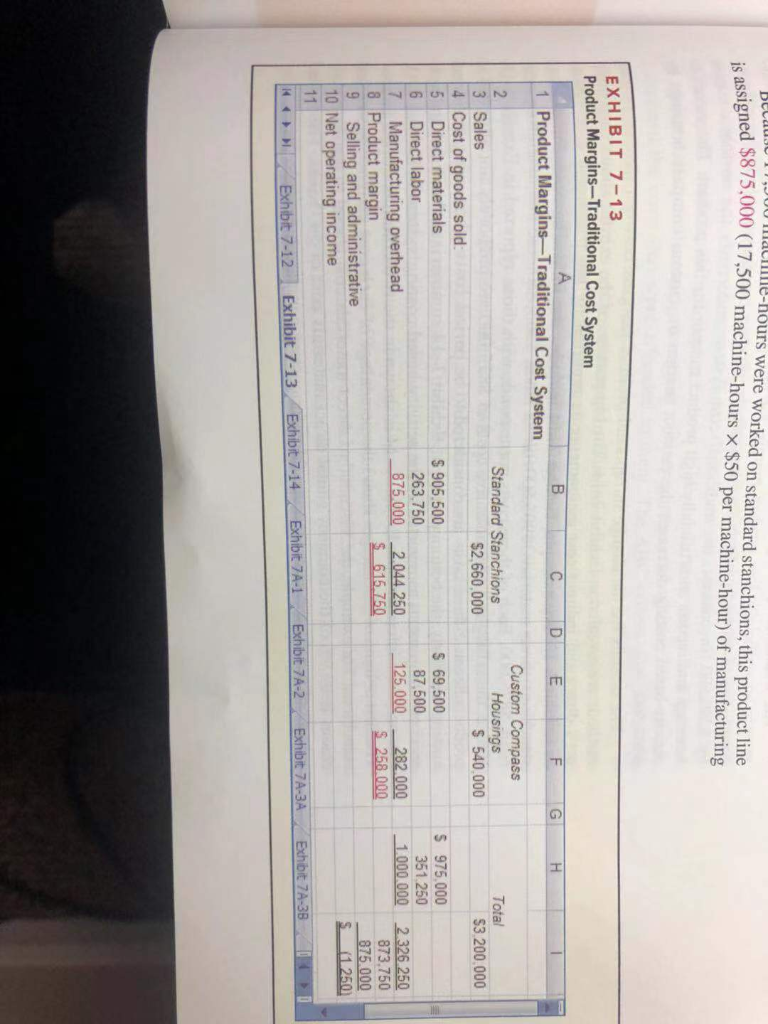

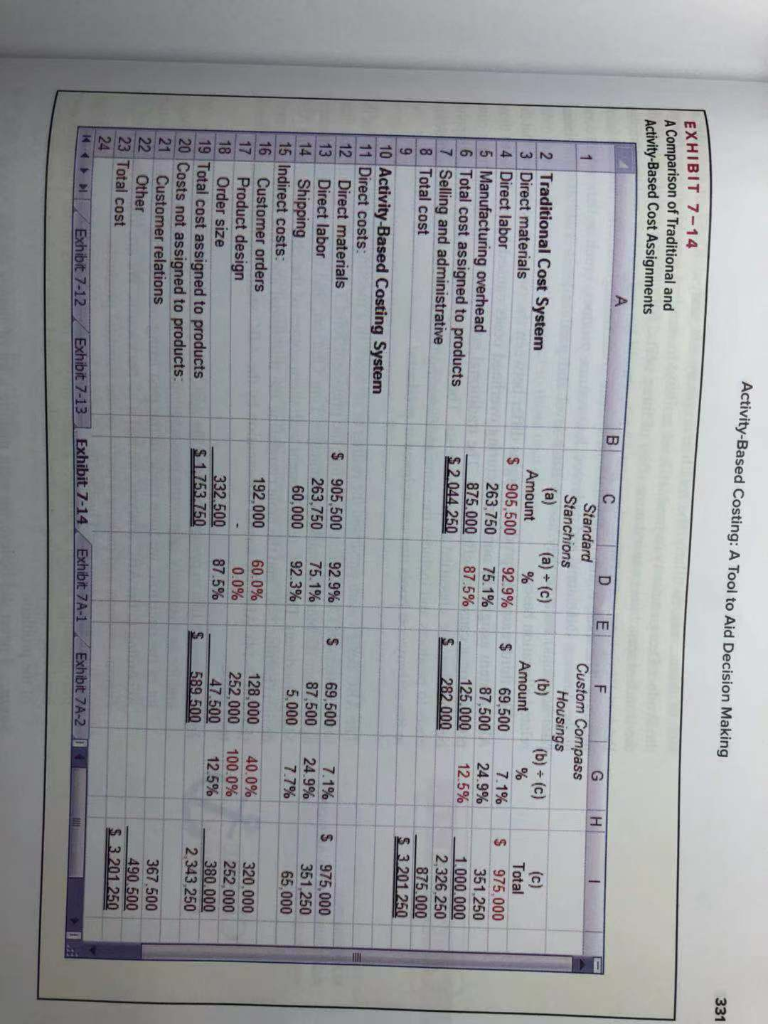

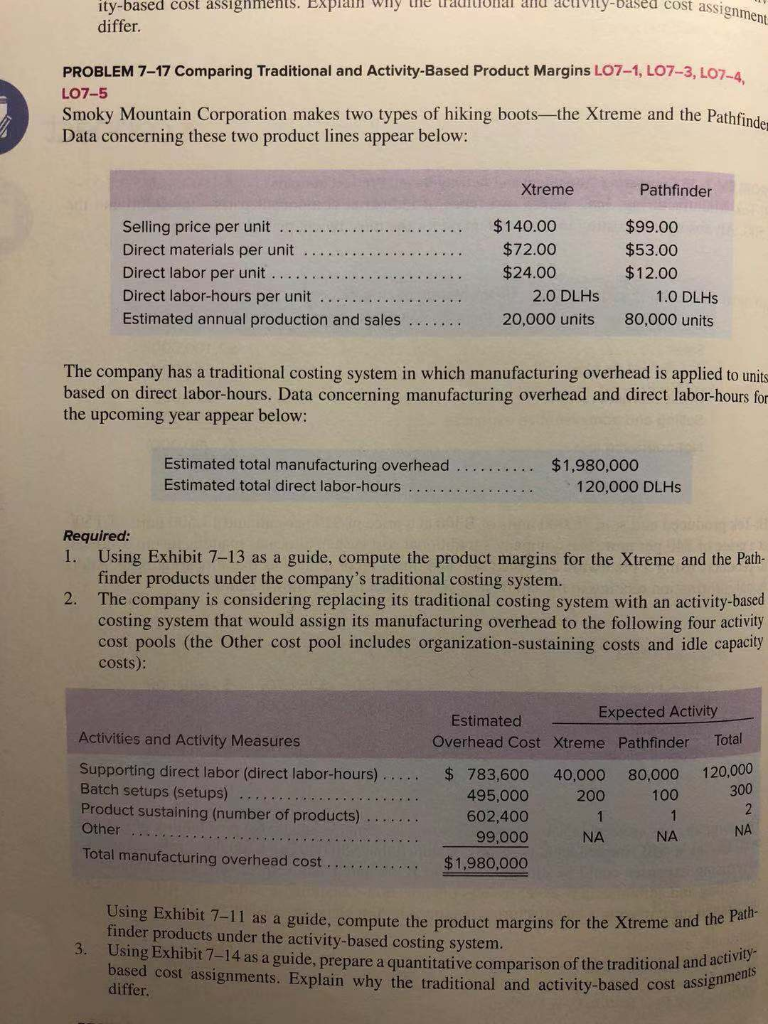

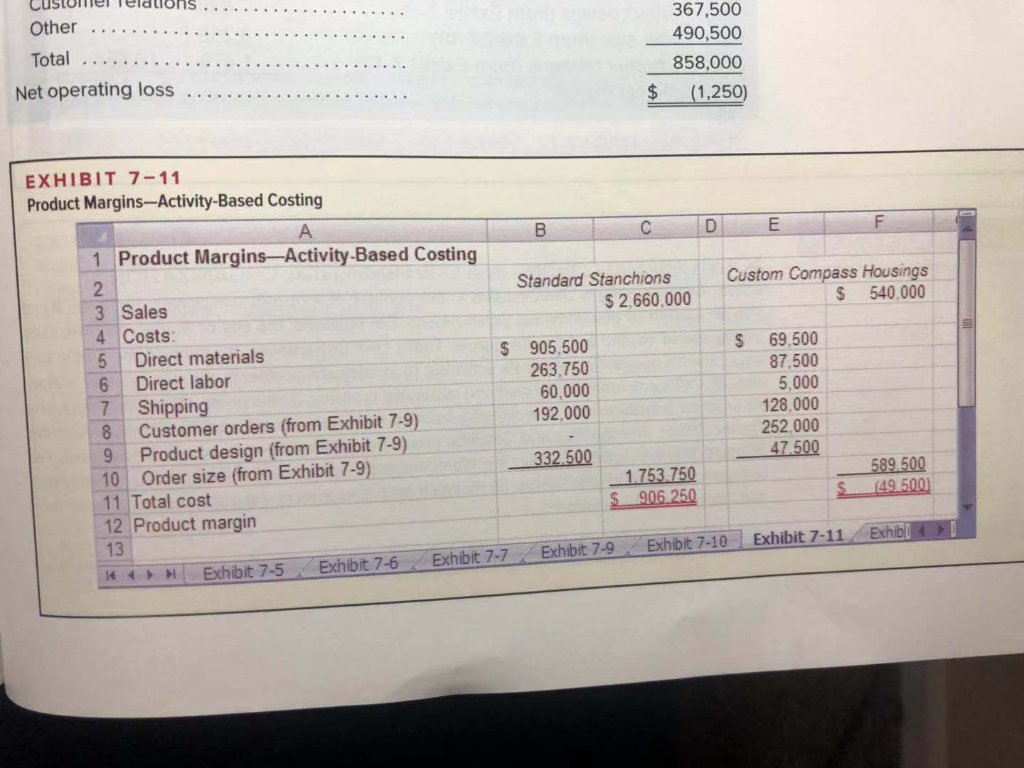

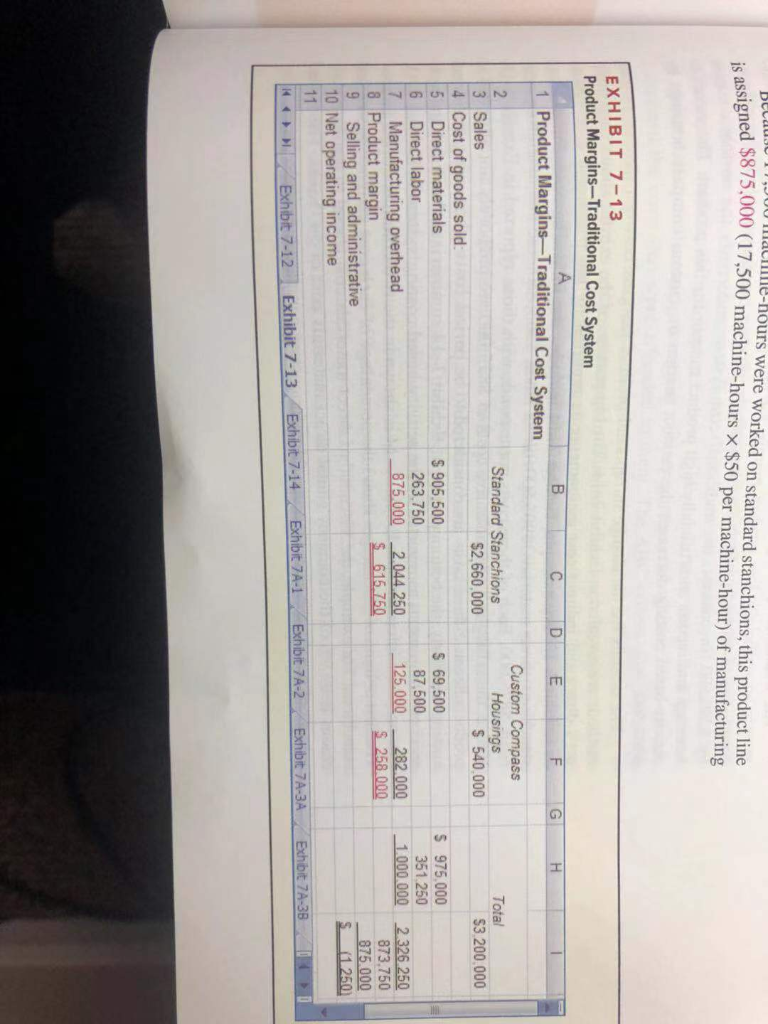

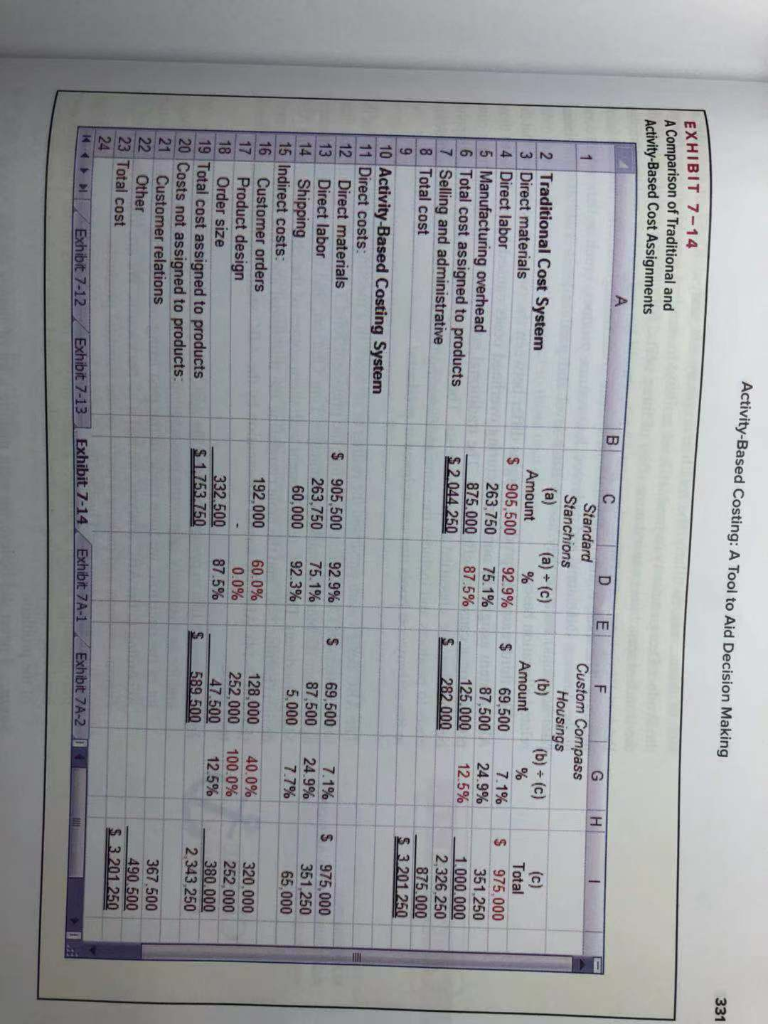

differ PROBLEM 7-17 Comparing Traditional and Activity-Based Product Margins LO7-1, LO7-3, LO7-4 LO7-5 Smoky Mountain Corporation makes two types of hiking boots-the Xtreme and the Pathfindas Data concerning these two product lines appear below: Xtreme Pathfinder $140.00 $99.00 Selling price per unit $72.00 $53.00 Direct materials per unit $24.00 $12.00 Direct labor per unit Direct labor-hours per unit 2.0 DLHS 1.0 DLHS Estimated annual production and sales 20,000 units 80,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead $1,980,000 Estimated total direct labor-hours 120,000 DLHS Required: 1. Using Exhibit 7-13 as a guide, compute the product margins for the Xtreme and the Path- finder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Expected Activity Estimated Activities and Activity Measures Total Overhead Cost Xtreme Pathfinder Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) Other .. 120,000 300 $ 783,600 80,000 40,000 495,000 602,400 99,000 100 200 2 1 1 NA NA NA Total manufacturing overhead cost $1,980,000 Using Exhibit 7-11 as a finder products under the activity-based costing system. 3. Using Exhibit 7-14 as a guide, prepare a quantitative comparison of the traditional and activity- based cost assignments. Explain why the traditional and activity-based cost assignments guide, compute the product margins for the Xtreme and the Pa differ. Other 367,500 490,500 Total 858,000 Net operating loss $ (1,250) EXHIBIT 7-11 Product Margins-Activity-Based Costing A E F 1 Product Margins-Activity-Based Costing 2 Standard Stanchions Custom Compass Housings 540,000 3 Sales $2,660,000 4 Costs: Direct materials Direct labor S 905,500 263,750 60,000 192,000 69.500 87,500 5,000 128,000 252.000 47.500 Shipping Customer orders (from Exhibit 7-9) Product design (from Exhibit 7-9) Order size (from Exhibit 7-9) 11 Total cost 12 Product margin 7 332.500 10 589 500 (49 500) 1.753.750 S 906.250 13 Exhibit 7-11 Exhib Exhibit 7-10 Exhibit 7-9 Exhibit 7-7 Exhibit 7-6 Exhibit 7-5 ,J00 acle-hours were worked on standard stanchions, this product line is assigned $875,000 (17,500 machine-hours X $50 per machine-hour) of manufacturing EXHIBIT 7-13 Product Margins-Traditional Cost System A B D F G H 1 Product Margins-Traditional Cost System Custom Compass Housings S 540,000 2 Standard Stanchions $2,660,000 Total $3.200,000 3 Sales 4 Cost of goods sold Direct materials Direct labor $905.500 263.750 S 69,500 87,500 125.000 S 975.000 351 250 1000 000 2 326 250 873.750 875.000 (1250) 2.044 250 S 615 750 282 000 $258 000 875 000 Manufacturing overhead 8 Product margin Selling and administrative 10 Net operating income 7 11 Exhibit 7A-1 Exhibit 7A-2 Exhibit 7A-3A Exhibit 7A-38 Exhibit 7-12 Exhibit 7-13 Exhibit 7-14 Activity-Based Costing: A Tool to Aid Decision Making 331 EXHIBIT 7-14 A Comparison of Traditional and Activity-Based Cost Assignments A C D Standard Stanchions E F Custom Compass Housings (b) Amount G 1 (a) (a) (c) % (b) +(c) % (c) Total 2 Traditional Cost System 3 Direct materials 4 Direct labor 5 Manufacturing overhead 6 Total cost assigned to products 7 Selling and administrative 8 Total cost Amount 905 500 263.750 875 000 $2.044 250 69,500 87,500 92.9% 7.1% 24.9% 12.5% 975 000 351 250 1.000.000 2,326,250 875.000 S3.201 250 75.1% 87.5% 125.000 282 000 10 Activity-Based Costing System 11 Direct costs: Direct materials Direct labor 14 Shipping 15 Indirect costs: 16 S 905,500 263,750 60,000 12 92.9% 75.1% S 69,500 87,500 5,000 7.1% 24.9% 975,000 351,250 65,000 13 92.3% 7.7% 60.0% 0.0% 128,000 252,000 47 500 589 500 40.0% 100.0% 12.5% 192,000 320,000 252 000 380 000 2,343 250 Customer orders 17 Product design 332.500 $ 1.753 750 87.5% Order size 19 Total cost assigned to products 20 Costs not assigned to products 21 18 Customer relations 22 367,500 490 500 $3 201 250 Other 23 Total cost 24 Exhibit 7-12 Exhibit 7-13 Exhibit 7-14 Exhibit 7A-1 Exhibit 7A-2 0