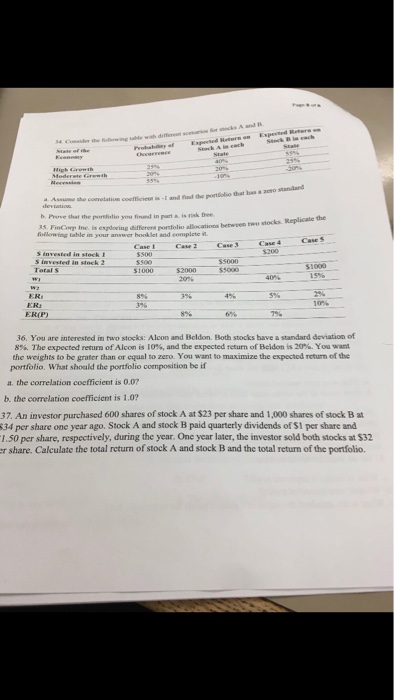

differeet coefficienn i I and find the potiolio that has a zero standand b. Phove that the porefolio you found in part a is risk thee s exloving differeproio allacations betweem two stocks Keplicate the ilowing table in your answer booklet and complete t Case I Ca $500 Case 3Cas Case $5000 ER ER ERP) 0% 36. You are interested in two stocks: Alcon and Beldon. Both stocks have a standard deviation of 8%. The expected return of Alcon is 10%, and the expected return of Belden is 20%. You wat the weights to be grater than or equal to zero. You want to maximize the expected return of the portfolio. What shoald the portfolio composition be if a the correlation coefficient is 0.07 b the correlation coefficient is 1.0? 37. An investor purchased 600 shares of stock A at $23 per share and 1,000 shares of stock B at 34 per share one year ago. Stock A and stock B paid quarterly dividends of S1 per share and 1.50 per share, respectively, during the year. One year later, the investor sold both stocks at $32 r share. Calculate the total return of stock A and stock B and the total return of the portfolio. differeet coefficienn i I and find the potiolio that has a zero standand b. Phove that the porefolio you found in part a is risk thee s exloving differeproio allacations betweem two stocks Keplicate the ilowing table in your answer booklet and complete t Case I Ca $500 Case 3Cas Case $5000 ER ER ERP) 0% 36. You are interested in two stocks: Alcon and Beldon. Both stocks have a standard deviation of 8%. The expected return of Alcon is 10%, and the expected return of Belden is 20%. You wat the weights to be grater than or equal to zero. You want to maximize the expected return of the portfolio. What shoald the portfolio composition be if a the correlation coefficient is 0.07 b the correlation coefficient is 1.0? 37. An investor purchased 600 shares of stock A at $23 per share and 1,000 shares of stock B at 34 per share one year ago. Stock A and stock B paid quarterly dividends of S1 per share and 1.50 per share, respectively, during the year. One year later, the investor sold both stocks at $32 r share. Calculate the total return of stock A and stock B and the total return of the portfolio