Answered step by step

Verified Expert Solution

Question

1 Approved Answer

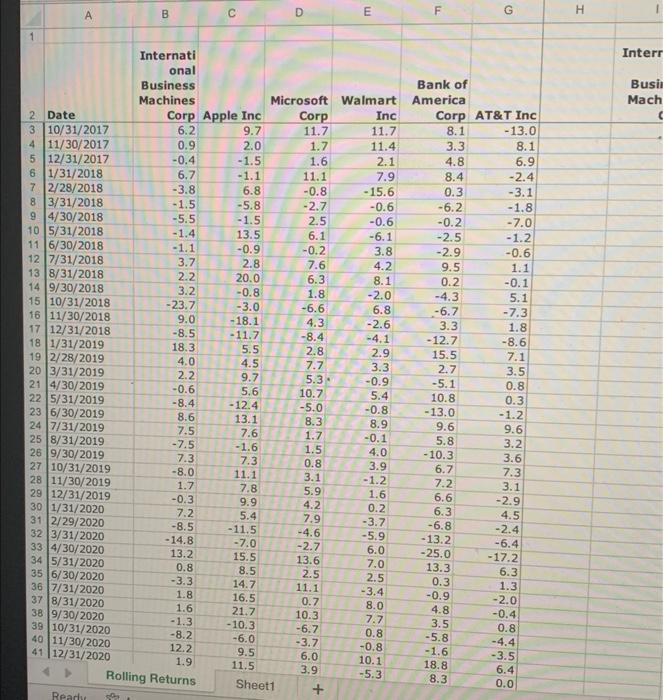

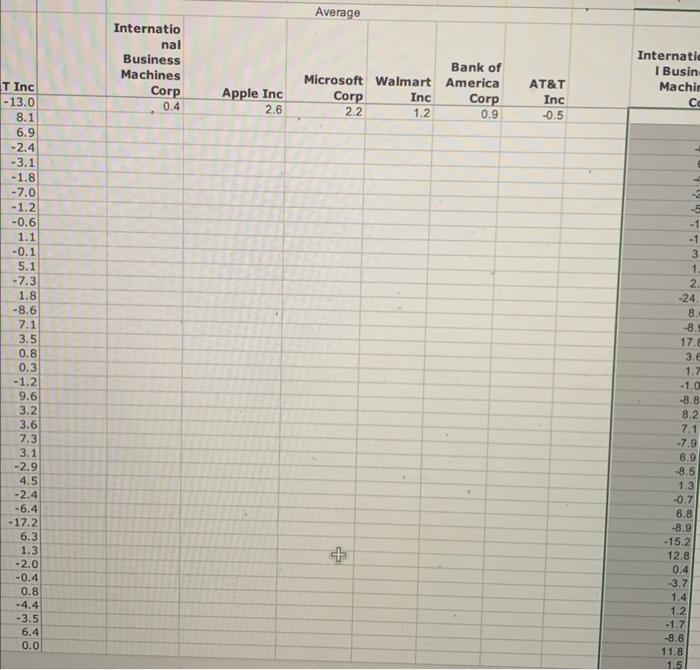

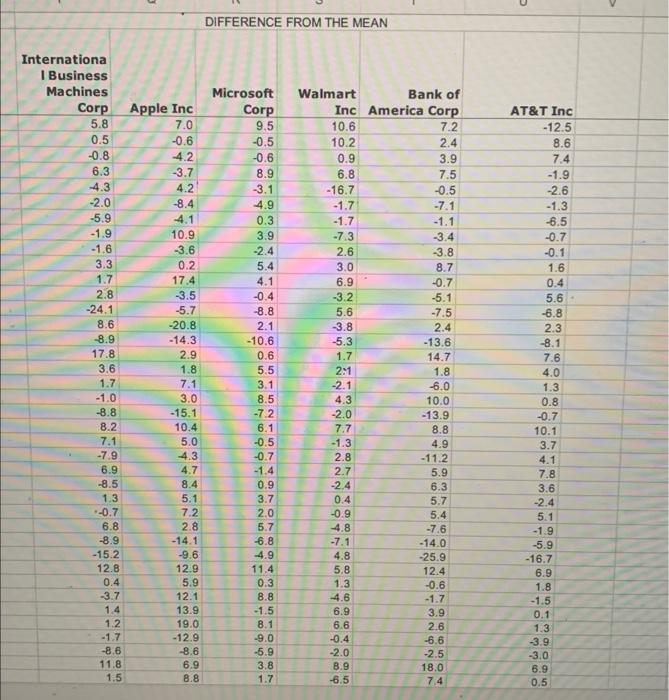

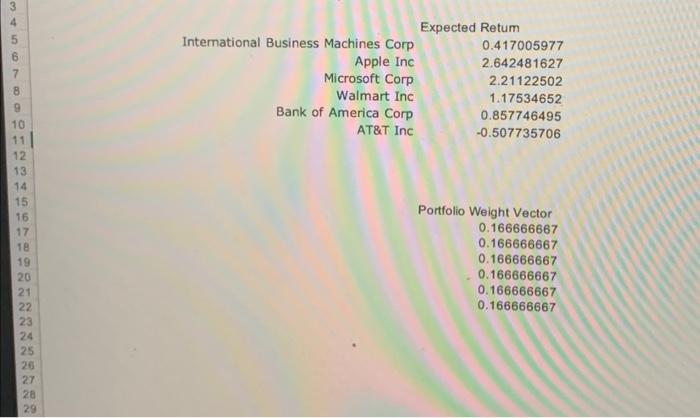

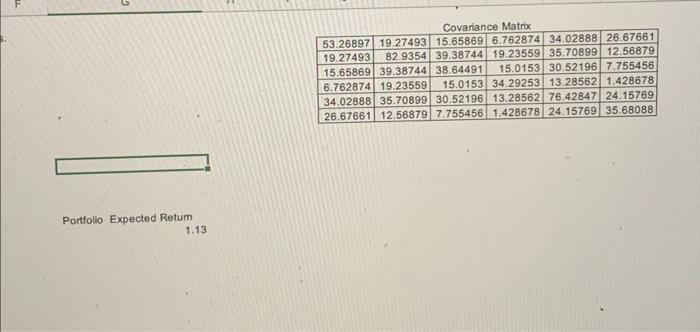

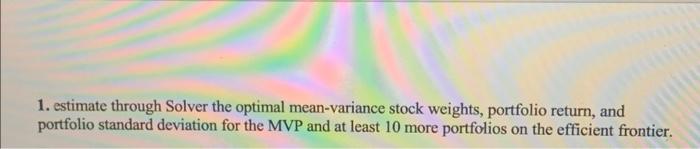

DIFFERENCE FROM THE MEAN Internationa I Business Machines Portfolio Weight Vector 0.1666666670.1666666670.1666666670.1666666670.1666666670.166666667 Portfolio Expected Retum 1.13 1. estimate through Solver the optimal mean-variance stock weights,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started