Answered step by step

Verified Expert Solution

Question

1 Approved Answer

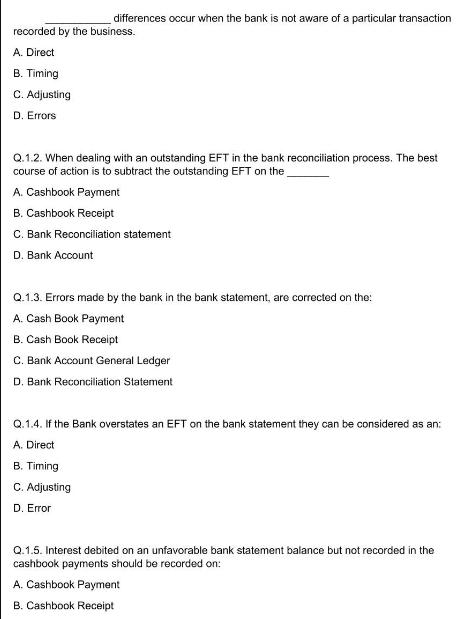

differences occur when the bank is not aware of a particular transaction recorded by the business. A. Direct B. Timing C. Adjusting D. Errors

differences occur when the bank is not aware of a particular transaction recorded by the business. A. Direct B. Timing C. Adjusting D. Errors Q.1.2. When dealing with an outstanding EFT in the bank reconciliation process. The best course of action is to subtract the outstanding EFT on the A. Cashbook Payment B. Cashbook Receipt C. Bank Reconciliation statement D. Bank Account Q.1.3. Errors made by the bank in the bank statement, are corrected on the: A. Cash Book Payment B. Cash Book Receipt C. Bank Account General Ledger D. Bank Reconciliation Statement Q.1.4. If the Bank overstates an EFT on the bank statement they can be considered as an: A. Direct B. Timing C. Adjusting D. Error Q.1.5. Interest debited on an unfavorable bank statement balance but not recorded in the cashbook payments should be recorded on: A. Cashbook Payment B. Cashbook Receipt C. Bank Reconciliation statement D. Bank Account

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Q11 When differences occur when the bank is not aware of a particular transaction recorde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started