Question

Different bases of accounting, such as current value accounting and historical cost-based accounting, do not affect total earnings over the life of the firm, but

Different bases of accounting, such as current value accounting and historical cost-based accounting, do not affect total earnings over the life of the firm, but only the timing of the recognition of those earnings. In effect, over the life of the firm, the firm earns what it earns, and different bases of accounting will all produce earnings that add up to this total. If this is so, then we would expect that the greater the number of time periods over which we aggregate a firms historical cost earnings, the closer the resulting total will be to economic income; that is, the earnings total that would be produced over the same periods under ideal conditions. This was studied by Easton, Harris, and Ohlson (EHO; 1992) and by Warfield and Wild (WW; 1992). EHO proxied economic income by the return on the firms shares on the securities market. When this return was aggregated over varying periods of time (up to 10 years) and compared with aggregate historical cost-based earnings returns for similar periods, the comparison improved as the time period lengthened. WW studied a similar phenomenon for shorter periods. They found, for example, that the association between economic and accounting income for quarterly time periods was on average about 1/10 of their association for an annual period, consistent with mixed measurement model-based net income lagging behind economic income in its recognition of relevant economic events.

Different bases of accounting, such as current value accounting and historical cost-based accounting, do not affect total earnings over the life of the firm, but only the timing of the recognition of those earnings. In effect, over the life of the firm, the firm earns what it earns, and different bases of accounting will all produce earnings that add up to this total. If this is so, then we would expect that the greater the number of time periods over which we aggregate a firms historical cost earnings, the closer the resulting total will be to economic income; that is, the earnings total that would be produced over the same periods under ideal conditions. This was studied by Easton, Harris, and Ohlson (EHO; 1992) and by Warfield and Wild (WW; 1992). EHO proxied economic income by the return on the firms shares on the securities market. When this return was aggregated over varying periods of time (up to 10 years) and compared with aggregate historical cost-based earnings returns for similar periods, the comparison improved as the time period lengthened. WW studied a similar phenomenon for shorter periods. They found, for example, that the association between economic and accounting income for quarterly time periods was on average about 1/10 of their association for an annual period, consistent with mixed measurement model-based net income lagging behind economic income in its recognition of relevant economic events.

Required a. In Example 2.1, calculate total net income over the two-year life of the firm, assuming that P.V. Ltd. uses historical cost accounting with straight-line amortization for its capital asset, while retaining all other assumptions. Verify that total net income over the life of P.V. Ltd. equals the total economic net income that P.V. Ltd. would report using present value amortization. b. Do the same in Example 2.2, assuming that the state realization is bad and good in years 1 and 2 respectively.

c. Use the fact that accruals reverse to explain why total net income over the two years in parts a and b above are the same under economic and straight-line amortization. Are these results consistent with the empirical results of EHO and WW outlined above?

d. If all accounting methods produce the same total net income over a sufficiently long period, why does accounting policy choice and full disclosure matter to investors?

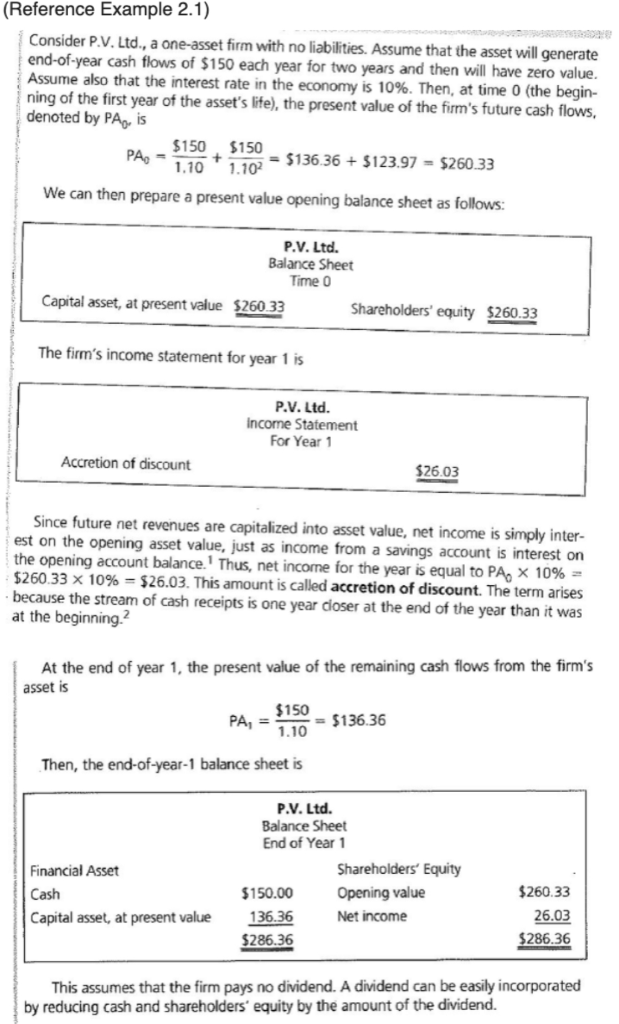

(example 2.1: in the picture)

example 2.2: Illustration of the current value model under uncertainty. If the economy is in the bad state, end-of-year cash flows will be $100 for the year. If it is in the good state, however, end-of-year cash flows will be $200 for the year.

Given these ideal conditions, we can now calculate the expected present value of P.V.s future cash flows at time 0: PA 0 = 0.5 a $100 $200 0.5 $100 $200 a1.102 + 1.102b1.10+ 1.10 b + = (0.5 * $272.73) + (0.5 * $247.93) = $136.36 + $123.97 = $260.33

We can then prepare P.V.s opening balance sheet as follows: Capital asset, at expected present value

P.V. Ltd. Balance Sheet Time 0 $260.33 . Shareholders equity $260.33

(Reference Example 2.1) Consider P.V. Ltd., a one-asset firm with no liabilities. Assume that the asset will generate end-of-year cash flows of $150 each year for two years and then will have zero value. Assume also that the interest rate in the economy is 10%. Then, at time 0 (the begin- ning of the first year of the asset's life), the present value of the firm's future cash flows, denoted by PA, is PA. - $150 $150 1.10 1.102 $136.36 + $123.97 - $260.33 We can then prepare a present value opening balance sheet as follows: P.V. Ltd. Balance Sheet Time 0 Capital asset, at present value $260.33 Shareholders' equity $260.33 The firm's income statement for year 1 is P.V. Ltd. Income Statement For Year 1 Accretion of discount $26.03 Since future net revenues are capitalized into asset value, net income is simply inter- est on the opening asset value, just as income from a savings account is interest on the opening account balance. Thus, net income for the year is equal to PA, X 10% = $260.33 X 10% = $26.03. This amount is called accretion of discount. The term arises because the stream of cash receipts is one year closer at the end of the year than it was at the beginning. At the end of year 1, the present value of the remaining cash flows from the firm's asset is PA, = 150 = $136.36 1.10 Then, the end-of-year-1 balance sheet is Financial Asset Cash Capital asset, at present value P.V. Ltd. Balance Sheet End of Year 1 Shareholders' Equity $150.00 Opening value 136.36 Net income $286.36 $260.33 26.03 $286.36 This assumes that the firm pays no dividend. A dividend can be easily incorporated by reducing cash and shareholders' equity by the amount of the dividend. (Reference Example 2.1) Consider P.V. Ltd., a one-asset firm with no liabilities. Assume that the asset will generate end-of-year cash flows of $150 each year for two years and then will have zero value. Assume also that the interest rate in the economy is 10%. Then, at time 0 (the begin- ning of the first year of the asset's life), the present value of the firm's future cash flows, denoted by PA, is PA. - $150 $150 1.10 1.102 $136.36 + $123.97 - $260.33 We can then prepare a present value opening balance sheet as follows: P.V. Ltd. Balance Sheet Time 0 Capital asset, at present value $260.33 Shareholders' equity $260.33 The firm's income statement for year 1 is P.V. Ltd. Income Statement For Year 1 Accretion of discount $26.03 Since future net revenues are capitalized into asset value, net income is simply inter- est on the opening asset value, just as income from a savings account is interest on the opening account balance. Thus, net income for the year is equal to PA, X 10% = $260.33 X 10% = $26.03. This amount is called accretion of discount. The term arises because the stream of cash receipts is one year closer at the end of the year than it was at the beginning. At the end of year 1, the present value of the remaining cash flows from the firm's asset is PA, = 150 = $136.36 1.10 Then, the end-of-year-1 balance sheet is Financial Asset Cash Capital asset, at present value P.V. Ltd. Balance Sheet End of Year 1 Shareholders' Equity $150.00 Opening value 136.36 Net income $286.36 $260.33 26.03 $286.36 This assumes that the firm pays no dividend. A dividend can be easily incorporated by reducing cash and shareholders' equity by the amount of the dividendStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started