Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Differential Analysis for a Lease-or-buy Decision Moffett Industries is considering new equipment. The equipment can be purchased from an overseas supplier for $3,340. The freight

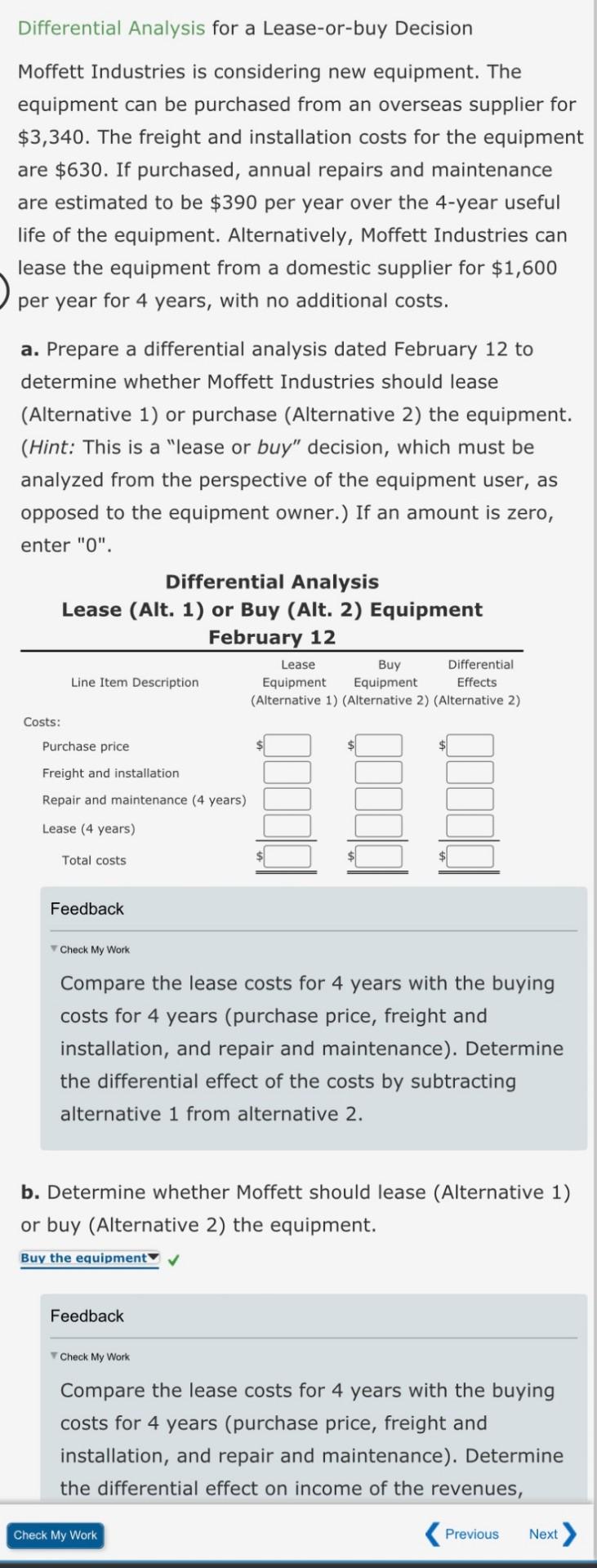

Differential Analysis for a Lease-or-buy Decision Moffett Industries is considering new equipment. The equipment can be purchased from an overseas supplier for $3,340. The freight and installation costs for the equipment are $630. If purchased, annual repairs and maintenance are estimated to be $390 per year over the 4-year useful life of the equipment. Alternatively, Moffett Industries can lease the equipment from a domestic supplier for $1,600 per year for 4 years, with no additional costs. a. Prepare a differential analysis dated February 12 to determine whether Moffett Industries should lease (Alternative 1) or purchase (Alternative 2) the equipment. (Hint: This is a "lease or buy" decision, which must be analyzed from the perspective of the equipment user, as opposed to the equipment owner.) If an amount is zero, enter " 0 ". Feedback Check My Work Compare the lease costs for 4 years with the buying costs for 4 years (purchase price, freight and installation, and repair and maintenance). Determine the differential effect of the costs by subtracting alternative 1 from alternative 2 . b. Determine whether Moffett should lease (Alternative 1) or buy (Alternative 2 ) the equipment. Feedback heck My Work Compare the lease costs for 4 years with the buying costs for 4 years (purchase price, freight and installation, and repair and maintenance). Determine the differential effect on income of the revenues

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started